Regulatory compliance is all about making sure your business plays by the rules—all the applicable laws, regulations, standards, and ethical practices that govern your industry. Think of it like the traffic rules on the road. Just as drivers follow signals and speed limits to keep everyone safe, businesses have to stick to specific standards to operate legally and ethically.

Table of Contents

Decoding the Rules of the Road for Business

Picture a busy city intersection with no traffic lights, stop signs, or speed limits. It would be absolute chaos. That’s essentially what the business world would look like without regulations. Regulatory compliance is the traffic management system that creates order and keeps everyone safe.

Every single business, from a local startup in Mumbai to a global giant, works within a framework of rules laid down by government bodies and industry authorities. These rules aren’t just red tape; they serve some critical purposes:

- Protecting Consumers: Making sure products are safe, services are delivered fairly, and people’s personal data is kept secure.

- Maintaining Market Integrity: Putting a stop to fraud, corruption, and any unfair advantages in the marketplace.

- Ensuring Financial Stability: Holding up the standards that prevent economic meltdowns and protect investors’ money.

Following these rules isn’t a choice—it’s the basic ticket to entry for operating legally. A great example of this is how foundational legal structures are tied to ongoing adherence, such as when establishing a 501(c)(3) nonprofit to ensure legal and tax compliance.

At its core, regulatory compliance is about more than just dodging fines. It’s a promise to operate ethically, strive for excellence, and build real, lasting trust with your customers, partners, and the public.

Why Compliance Is a Journey, Not a Destination

The world of regulation is never static. Laws get updated, new standards pop up, and what customers expect from businesses is always changing. This means staying compliant is an ongoing job of watching, adapting, and getting better.

It demands constant vigilance, crystal-clear internal policies, and a company culture where every single employee knows the part they play in upholding the company’s legal and ethical duties.

Think of this guide as your roadmap. We’ll break down what regulatory compliance really means for businesses in India, look at its key pieces, and give you practical ways to build a strong programme that not only protects your organisation but also helps it grow.

Why Regulatory Compliance Matters

Let’s move past the textbook definitions. Understanding why regulatory compliance matters is crucial for any business, big or small. Think of it less as an administrative chore and more as a foundational pillar for stability and growth. Ignoring the rules isn’t just risky; it can have severe consequences that ripple through every single part of your company.

The most obvious hit from non-compliance is financial. Regulators can slap you with heavy fines and penalties that can easily cripple a business, especially startups and SMEs trying to find their footing. But it doesn’t stop there. The threat of lawsuits from customers or partners can lead to staggering legal fees and settlement costs, draining cash that should be fuelling your innovation or expansion plans.

But the damage often goes much deeper than just money. A public compliance failure can permanently stain your company’s reputation, wiping out the trust you’ve worked so hard to build with customers, investors, and the public. In a crowded marketplace, a damaged reputation is incredibly difficult to fix and can lead to a painful loss of market share.

From Obligation to Strategic Advantage

While the risks are very real, looking at compliance as just a burden is a massive missed opportunity. When handled proactively, effective regulatory compliance can actually become a powerful strategic advantage, setting you apart from the competition. Companies known for their strong ethical standards and commitment to the rules naturally build deeper trust with their customers.

This trust pays off in very real ways:

- Enhanced Customer Loyalty: People are far more likely to stick with businesses they believe are operating responsibly and ethically.

- Investor Confidence: Investors and banks are more willing to back companies that can show a low-risk, compliant business model.

- Operational Efficiency: Getting compliant often forces you to tighten up your processes, improve how you manage data, and create clearer internal controls. The side effect? A more efficient business overall.

Imagine two fintech startups. One runs proactive internal audits, finds a potential data privacy gap, and fixes it before anyone notices. The other overlooks the same regulation and gets hit with a public fine, leading to a storm of bad press and customers jumping ship. The first company didn’t just dodge a penalty; it made its systems stronger. The second is now dealing with both financial and reputational fires.

By reframing your approach, you can see that mastering what is regulatory compliance isn’t about avoiding punishment; it’s about building a resilient, trustworthy, and sustainable business that’s ready for long-term success. It becomes a path to growth, not a barrier.

Navigating India’s Regulatory Landscape

Think of India’s compliance framework not as a single, straight highway, but as a complex web of interconnected roads. You’ve got central laws, state laws, and even local municipal rules all weaving together, and the route you need to take depends entirely on your industry and location. A business in Bengaluru will navigate a different set of local regulations than one in Delhi, even if they’re in the same sector.

This layered system means a one-size-fits-all compliance strategy just isn’t going to cut it. The rulebook for a tech startup looks wildly different from the one for a food processing plant. So, the first step is to figure out exactly which authorities are watching over your specific operations.

Key Regulators and Their Domains

At the centre of this structure are powerful, industry-specific regulatory bodies. They are the traffic controllers for their respective sectors, setting the standards and enforcing the rules of the road. For example, any company in the financial technology space has to keep a close eye on guidelines from multiple authorities. You can get a better sense of the unique hurdles in this area from our guide on compliance in the fintech industry.

With over 1500 acts and around 69,000 compliance requirements to consider as of 2025, India’s regulatory environment is undeniably vast. This intricate network is managed by several key sector-specific bodies that ensure these norms are followed.

The first step in achieving compliance is identification. You cannot follow the rules if you don’t know which rulebook applies to your business.

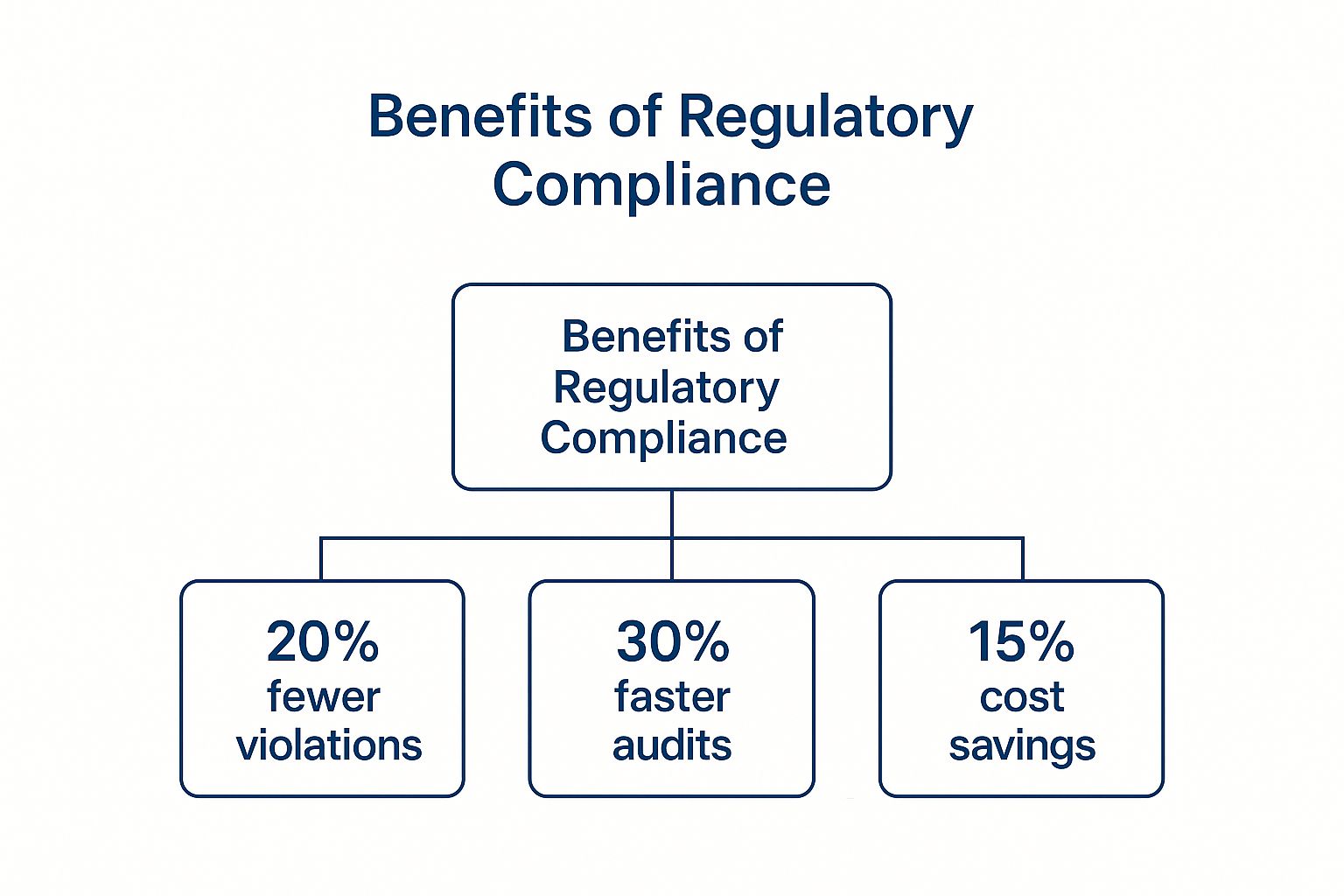

This isn’t just about avoiding penalties. As the data shows, a well-managed compliance programme delivers tangible benefits across the board.

It’s clear that getting compliance right translates directly into major operational gains, from reducing violations to saving precious time and money.

Mapping Your Regulatory Obligations

To help you get started, it’s crucial to identify which authorities govern your business. The table below gives a quick overview of India’s major regulators and their specific domains. Think of this as your initial map for navigating the landscape.

Key Regulatory Authorities in India and Their Domains

Here’s a look at some of the primary regulatory bodies in India and the industries they oversee. Knowing who’s in charge of your sector is the first step toward building a solid compliance framework.

| Regulatory Body (Abbreviation) | Full Name | Primary Industry/Domain Governed |

|---|---|---|

| RBI | Reserve Bank of India | Banking, Finance, and Payment Systems |

| SEBI | Securities and Exchange Board of India | Securities Market, Stock Exchanges, and Investors |

| FSSAI | Food Safety and Standards Authority of India | Food Products, Manufacturing, and Distribution |

| TRAI | Telecom Regulatory Authority of India | Telecommunications and Broadcasting Services |

| IRDAI | Insurance Regulatory and Development Authority | Insurance and Reinsurance Sector |

This list isn’t exhaustive, but it covers the main players you’re likely to encounter. Pinpointing your specific regulator is a critical foundation for your entire compliance strategy.

Building a Compliance Management System

Knowing the “what” and “why” of regulatory compliance is a great start, but the real work begins when you actually build a system to manage it all. This is where a Compliance Management System (CMS) comes in. Think of it as your company’s operational blueprint for staying on the right side of the law.

A CMS isn’t just a single document or policy. It’s a living, breathing framework of interconnected processes, controls, and day-to-day actions.

Imagine building a house. You wouldn’t just start laying bricks without an architect’s plan, would you? A CMS is that plan. It provides the structure to ensure your compliance efforts are organised, effective, and sustainable, turning abstract rules into concrete actions for your team.

The first, and most critical, step is figuring out exactly which regulations apply to your business. This means taking a deep dive into central, state, and industry-specific laws. Once you know the rules of the game, the next move is a thorough risk assessment to pinpoint where your company is most vulnerable to slipping up.

Core Components of a Robust CMS

A strong CMS is built on several key pillars. Each one has a distinct job, but they all work together to create a solid defence against regulatory risks.

- Policies and Procedures: This is your internal rulebook. The goal is to draft clear, concise policies that translate complex legal jargon into easy-to-follow guidelines for your employees. These documents should spell out exactly what’s expected in different situations.

- Employee Training: Policies are pretty useless if your team doesn’t know they exist or why they matter. You need ongoing training programmes that teach employees about the specific compliance duties relevant to their roles, constantly reinforcing why these rules are so important for the business.

- Monitoring and Auditing: You have to check that your system is actually working. This involves keeping a close eye on key activities and scheduling regular internal or external audits to find weaknesses before they snowball into major problems. For instance, integrating with systems that streamline verification can be a huge help; you can learn more about how powerful API integrations can simplify such workflows.

A well-structured CMS moves your organisation from a reactive “fire-fighting” mode to a proactive state of control. It empowers your team to identify and address potential issues before they escalate into costly violations.

Establishing Clear Reporting and Resolution Channels

Finally, a crucial piece of the puzzle is creating a transparent process for reporting and resolving potential compliance issues. Employees have to feel safe flagging concerns without any fear of retaliation.

This opens up a vital feedback loop, allowing leadership to investigate potential breaches and roll out corrective actions quickly.

This whole framework acts as your practical roadmap. For specific, complex regulations like the GDPR, a structured approach is non-negotiable. Using a practical tool like a GDPR compliance checklist can be invaluable here, ensuring you cover all your bases methodically. By systematically building out each of these components, you create a resilient programme that doesn’t just cut down on risk—it strengthens your entire organisation.

Overcoming Common Compliance Challenges

Knowing the path to regulatory compliance and actually walking it are two very different things. For many Indian businesses, the journey is filled with real-world hurdles that can feel overwhelming. If you’re feeling the pressure, you’re certainly not alone—it’s an experience shared by many.

One of the biggest headaches is data security and management. In sectors like fintech, healthcare, and e-commerce, protecting sensitive information isn’t just good practice; it’s a strict legal requirement. Companies have to guard data against a constant barrage of cyber threats while trying to keep up with complex IT rules. In fact, data security is one of the most critical compliance challenges for Indian businesses in 2025, and it’s deeply tied to regulatory adherence. You can discover more insights about data security compliance challenges on alp.consulting.

But data is just one piece of the puzzle. Several other persistent obstacles often stand in the way of a smooth compliance programme.

Navigating Constant Regulatory Changes

The rulebook for businesses is in a constant state of flux. New laws get passed, old ones are tweaked, and official interpretations can shift overnight. Just keeping up with this relentless pace requires dedicated resources to monitor, analyse, and implement changes quickly. Fall behind, and you could find yourself non-compliant without even realising it.

This gets exponentially harder for businesses operating across state lines or internationally, where the complexity multiplies.

Managing High Implementation Costs

Let’s be honest: building and maintaining a solid compliance programme isn’t cheap. The costs can pile up fast, from investing in specialised software and technology to hiring legal experts and training your staff. For small and medium-sized enterprises (SMEs) working with tighter budgets, these expenses can feel like a massive barrier.

The key is to view compliance spending not as a cost, but as an investment. The potential fines and reputational damage from a compliance failure almost always outweigh the upfront costs of getting it right.

Addressing Practical Hurdles Head-On

Even with the best intentions, several other challenges frequently pop up. Tackling them proactively can make all the difference.

- Employee Training and Engagement: It’s not enough to just have policies on paper; your team has to understand and live by them. This means ongoing training and finding creative ways to make compliance part of the company culture, not just a once-a-year seminar.

- Cross-Border Compliance: For companies with global ambitions, navigating the different legal landscapes of multiple countries is a major undertaking. What’s perfectly fine in India might be a violation in Europe or the US, demanding careful coordination.

- Segmenting Risks: A smart strategy is to prioritise. Figure out the highest-risk areas for your specific industry and pour your initial efforts there. This lets you tackle the most critical threats first.

- Leveraging External Expertise: You don’t have to figure it all out by yourself. Partnering with compliance consultants or legal experts can provide invaluable guidance and help you navigate the tricky requirements much more efficiently.

Leveraging Compliance Technology and Automation

Trying to manage compliance manually is a bit like trying to bail out a boat with a teaspoon. It’s becoming a thing of the past, and for good reason. Today, technology is stepping in to make the complex world of regulatory compliance much more manageable.

Fields like Regulatory Technology (RegTech), Artificial Intelligence (AI), and Machine Learning (ML) aren’t just buzzwords anymore. They are actively reshaping how businesses handle their legal duties.

Think of these modern tools as a vigilant co-pilot for your company. They automate the repetitive but critical tasks, scanning thousands of regulatory updates in minutes or tracking internal policy adherence in real-time. More importantly, they can flag potential risks long before they escalate into serious problems. This shift frees up compliance teams from being buried in spreadsheets, allowing them to focus on high-level strategy.

For leadership, the benefits are crystal clear. Instead of waiting for stuffy quarterly reports, modern platforms offer real-time dashboards that visualise risk levels, training completion rates, and policy updates at a glance.

The Rise of Digital Oversight

This tech-driven shift isn’t just happening inside companies; Indian regulators are also going digital. Authorities are increasingly using AI and ML to monitor businesses more efficiently, identify risks, and automate their own processes.

As a result, many Indian firms are expected to boost their tech budgets to keep up. EY’s analysis of India’s regulatory challenges highlights this trend, showing that automating tactical compliance tasks is becoming a priority.

When the referees start using advanced replay technology, your team needs it too. Adopting similar innovations is no longer just an advantage—it’s essential for keeping pace.

This means that companies must mirror this evolution. Technology is no longer an optional extra but a fundamental part of a modern compliance framework.

The Impact of Automation in Practice

The real-world impact of this technology is huge. We’ve seen financial firms cut their audit preparation time in half by using automated systems that gather and organise the necessary documents around the clock.

Other organisations have drastically reduced non-compliance incidents by using AI-powered tools that instantly detect suspicious activities or deviations from procedure. Secure automation is especially vital in areas like identity verification, where accuracy and compliance are non-negotiable. You can learn more in our guide on effective identity verification.

The message from these examples is clear: investing in compliance technology delivers a powerful return. It doesn’t just improve accuracy and efficiency—it builds a more resilient, proactive compliance culture, making it an indispensable asset for any forward-thinking Indian business.

Of course. Here is the rewritten section, designed to sound completely human-written, following the provided style guide and examples.

Your Regulatory Compliance Questions, Answered

As you start to get your head around the big picture of compliance, some very specific questions usually pop up. Let’s tackle a few of the common ones we see from Indian businesses trying to figure out what this all means for their day-to-day operations.

What’s the Difference Between Regulatory Compliance and Corporate Governance?

It’s easy to get these two mixed up, but the distinction is quite simple. Think of it like this: regulatory compliance is about following the law of the land, while corporate governance is about the laws you set for your own house.

Regulatory compliance is all about sticking to the rules and regulations laid down by government bodies. It’s not optional—it’s mandatory and enforced by external authorities. Corporate governance, on the other hand, is a much broader concept. It’s the internal framework of practices, ethics, and controls that steers how a company is managed. Good governance helps you stay compliant, but it also covers things like shareholder rights, ethical standards, and internal accountability that go way beyond the legal bare minimum.

How Can a Small Business Handle Compliance Without a Huge Budget?

Look, managing compliance doesn’t have to drain your bank account. For smaller businesses, it’s all about being smart and resourceful.

- Tackle the biggest risks first: You can’t do everything at once. Pinpoint the regulations that pose the highest risk to your specific industry and pour your initial energy and funds there.

- Use budget-friendly tools: Instead of splurging on custom-built solutions, look for affordable compliance software or even ready-made templates to get started.

- Give someone ownership: You don’t need a massive department. Just assign one person or a small, dedicated team to be in charge of compliance. This creates clear accountability.

- Lean on free advice: Tap into resources from industry associations, local chambers of commerce, and government helplines. They often provide fantastic, low-cost guidance and share best practices.

The goal isn’t perfection from day one. It’s about building a compliance framework that can grow with you, starting with what matters most. A few smart, focused steps can drastically lower your risk without needing a massive budget. Steady progress is the name of the game.

What Are the First Steps to Setting Up a Compliance Programme?

Just getting started can feel like the toughest part, but breaking it down into clear steps makes it far less daunting. Your first move should always be a thorough risk assessment to map out every single regulation that applies to your business.

Once you have that map, document all these requirements in a clear, straightforward way. This documentation then becomes the foundation for your internal policies and procedures—make them easy enough for anyone in the company to understand. The final piece of the puzzle is communication. Roll out these new policies to the entire organisation and provide training so every single employee knows exactly what their role is in keeping the company compliant.

Making informed hiring decisions is a critical part of staying compliant and building a team you can trust. SpringVerify provides reliable, fast background verification services to help you hire with confidence. Find out how we can help.