When you hear “due diligence,” you might think of the standard checks a business runs on a new customer. That’s just the baseline. Enhanced Due Diligence (EDD) is what happens when the stakes are higher and the risks look a lot more serious.

Think of it as the next level of scrutiny, kicking in when there’s a greater chance of financial crimes like money laundering or terrorist financing. It goes way beyond a simple ID check to protect the integrity of the financial system.

Table of Contents

Deconstructing Enhanced Due Diligence

Let’s use an analogy. Standard Customer Due Diligence (CDD) is like a ticket checker at a concert, making sure everyone has a valid entry pass. It’s a routine, necessary step.

EDD, on the other hand, is the full-scale security detail assigned to a VIP. It’s an escalated, far more intense process, triggered by specific red flags that suggest a customer carries a higher risk.

This isn’t just about being cautious; it’s a legal requirement in many places. Financial institutions and other regulated businesses are mandated to apply this deeper level of investigation to certain clients. Ignoring this can lead to massive fines, a damaged reputation, and the very real risk of enabling criminal activity.

The goal here is to move beyond just confirming an identity. It’s about truly understanding who your customer is, where their money comes from, and what kind of transactions they plan to make.

Before we dive deeper into when EDD is triggered, it’s helpful to see how it compares directly with the standard process.

Standard Due Diligence vs Enhanced Due Diligence

The table below breaks down the key differences between the two levels of scrutiny, showing how EDD builds upon the foundation of CDD for high-risk scenarios.

| Aspect | Standard Customer Due Diligence (CDD) | Enhanced Due Diligence (EDD) |

|---|---|---|

| Scope | Basic identity and verification of customer information. | In-depth investigation into the customer’s background, wealth, and transaction sources. |

| Intensity | A routine, often automated, process for all customers. | A manual, investigative, and resource-intensive process. |

| Triggers | Onboarding of any new customer. | High-risk factors like PEP status, high-risk country, or suspicious activity. |

| Documentation | Standard identification documents (e.g., Aadhaar, PAN card). | Extensive documentation, including wealth statements, source of funds evidence, and media checks. |

| Monitoring | General monitoring of transaction patterns. | Continuous, intensive monitoring of all transactions and business relationships. |

| Objective | To confirm the customer is who they say they are. | To fully understand the customer’s risk profile and mitigate potential financial crime. |

As you can see, EDD isn’t just a more detailed version of CDD; it’s a fundamentally different approach designed for situations where the potential for harm is significantly greater.

When Is a Deeper Dive Necessary?

The decision to trigger EDD is guided by a risk-based approach. Not every customer needs this level of scrutiny. It’s reserved for situations where specific risk factors pop up, signalling that a more thorough assessment is needed.

These triggers often include:

- High-Risk Jurisdictions: Dealing with customers from countries known for weak anti-money laundering (AML) controls or high levels of corruption.

- Politically Exposed Persons (PEPs): These are individuals in prominent public roles, whose positions can make them targets for bribery and corruption.

- Complex Business Structures: The use of shell companies or confusing ownership chains can be a tactic to hide the true beneficial owner.

- Unusual Transaction Patterns: Large, frequent, or illogical transactions that just don’t match the customer’s known business activities.

Enhanced Due Diligence isn’t about suspicion; it’s about responsibility. It’s a proactive measure to ensure that a business relationship is legitimate and doesn’t pose an undue risk to the financial system or the organisation itself.

In India, for example, EDD is a cornerstone of the country’s anti-money laundering (AML) and counter-terrorism financing (CTF) rules. Guidelines from the Reserve Bank of India (RBI) and SEBI make it mandatory for firms to apply EDD to high-risk accounts, such as PEPs and clients from certain countries.

This helps fortify the entire financial sector. To maintain robust compliance, it’s essential to understand these requirements.

Key Triggers That Require Enhanced Due Diligence

Switching from a standard check to a full-blown Enhanced Due Diligence (EDD) investigation isn’t a gut feeling. It’s a calculated move triggered by specific red flags. Knowing when to escalate your scrutiny is half the battle in building an effective compliance program.

Think of these triggers as tripwires. Certain traits of a customer, their location, or their transactions signal that a much deeper look is needed to manage potential risks. These aren’t just arbitrary internal policies, either; they’re based on expectations from global bodies like the Financial Action Task Force (FATF). Spotting these signals early is the first step to protecting your organisation.

High-Risk Jurisdictions and Geopolitical Factors

One of the most obvious triggers for EDD is geography. When a client is based in, or does a lot of business with, a high-risk jurisdiction, your standard due diligence process simply won’t cut it anymore.

These locations are often flagged by international watchdogs for having weak Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) controls, creating an environment where illegal funds can flow with alarming ease.

- FATF Grey and Blacklists: If a country lands on one of these lists, it means it has strategic gaps in its AML/CTF framework. Any connection to these places instantly bumps up a customer’s risk profile.

- High Levels of Corruption: Nations known for bribery, political instability, or a general lack of transparent governance are automatic candidates for closer inspection.

- Sanctioned Countries: This one is non-negotiable. If a client has any ties to countries under international sanctions, EDD is mandatory to make sure you aren’t breaking the law.

Engaging with clients from these areas without proper EDD is a massive compliance failure, one that can expose your organisation to some serious penalties.

Politically Exposed Persons (PEPs)

A Politically Exposed Person (PEP) is anyone holding a prominent public role. This isn’t just heads of state; it includes senior government officials, top-ranking military officers, and executives at state-owned companies. Because of their influence, PEPs are automatically considered a higher risk for potential involvement in bribery and corruption.

It’s important to remember that being a PEP doesn’t automatically mean someone is doing something wrong. However, their status means you must perform EDD to understand their source of wealth and funds. The goal is to confirm their financial activities are legitimate and not the result of corruption.

This level of scrutiny usually extends to their immediate family members and close associates, as these individuals can easily be used to move illicit money. Uncovering and verifying these connections is a fundamental part of the EDD process for any PEP-related account. A global database verification is a crucial tool for identifying these high-risk individuals and their networks.

Complex Corporate Structures and Transactions

Another huge red flag is when complexity is used to hide the truth. When a potential customer’s business structure is needlessly complicated, it’s often a sign that someone is trying to conceal something. This is a clear call for a thorough EDD investigation.

Keep an eye out for these indicators:

- Shell Companies: Businesses with no real operations, assets, or even a physical office are classic tools for laundering money.

- Opaque Ownership: The use of bearer shares, nominee directors, or tangled webs of trusts makes it nearly impossible to identify the Ultimate Beneficial Owner (UBO)—the actual person who profits from the business.

- Unusual Transactions: Large, frequent, or bizarre transactions that don’t make any economic sense or don’t fit the client’s stated business activities are deeply suspicious and demand immediate escalation.

On top of this, certain industries are just inherently riskier. Sectors like private banking, casinos, precious metal dealers, and cryptocurrency exchanges often deal with large volumes of cash or anonymous transactions. This makes them magnets for financial criminals, and as a result, EDD should be standard practice for many of their clients.

The Enhanced Due Diligence Process Step by Step

Jumping into Enhanced Due Diligence (EDD) can feel like a massive undertaking, but it’s much more manageable when you break it down into a clear, structured workflow. This isn’t about ticking boxes on a generic checklist. Think of it as a dynamic investigation, tailored specifically to the risks a particular customer brings to the table. It’s how compliance teams turn a complex regulatory burden into an actionable plan.

The main goal here is to build a risk profile that goes way beyond a simple ID check. It’s about peeling back the layers to get a real understanding of who your customer is, where their money actually comes from, and what they plan to do with it. Let’s walk through the essential stages of a proper EDD investigation.

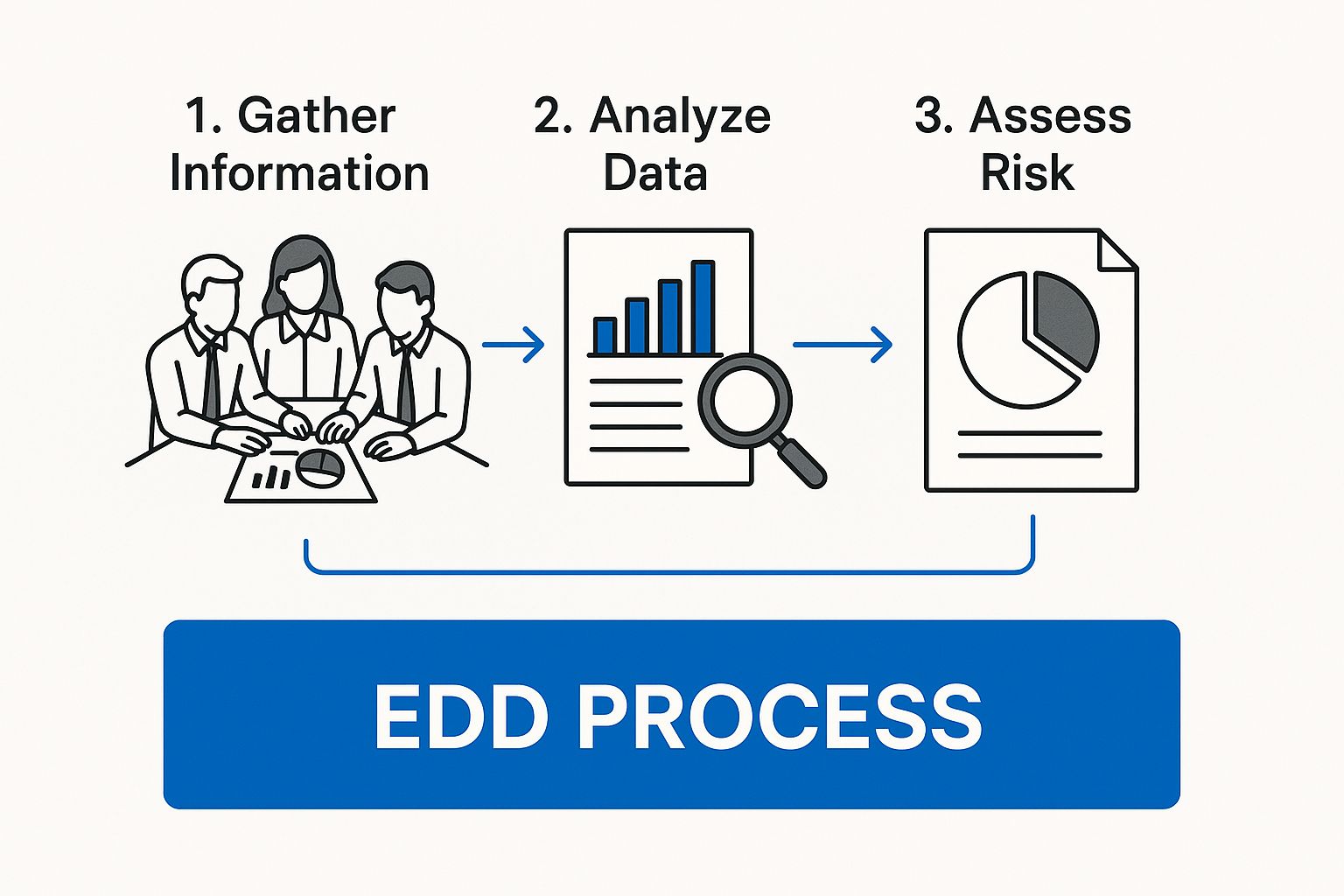

This visual breaks down how each step builds on the last, creating a solid, continuous cycle of risk management for your high-risk clients.

Step 1: Identifying the Customer and Beneficial Owners

First things first, and this is the most critical part: you need to nail down the identity of not just your customer, but also the Ultimate Beneficial Owners (UBOs). These are the real people who ultimately own or control the company. This is where EDD immediately veers off from standard checks.

It means you have to gather and verify a pile of documents to slice through complex corporate mazes like shell companies or trusts—the exact structures often used to hide true ownership.

You’ll be looking for evidence like:

- Government-Issued IDs: For every key person involved, including directors and all UBOs.

- Corporate Registration Documents: To prove the business is legally sound and see how it’s structured.

- Shareholder Registers: This helps you map out the entire ownership chain, right to the top.

- Articles of Association: To get a handle on the company’s rules and purpose.

Getting this foundation right ensures you aren’t unknowingly dealing with an anonymous or fake entity, which is a massive red flag for financial crime.

Step 2: Establishing Source of Wealth and Source of Funds

Okay, so you know who they are. The next big question is: where did their money come from? This stage is a two-pronged investigation.

Source of Wealth (SoW) looks at the big picture. It’s about understanding how the person or company built up their total net worth. Was it through business profits, an inheritance, savvy investments, or something else entirely?

Source of Funds (SoF) gets more specific. It zeroes in on the origin of the actual money being used in the transaction or business relationship you’re starting.

Verifying SoW and SoF is completely non-negotiable in EDD. It’s the only way to prove a customer’s capital is legitimate and not laundered from criminal activity. Without this proof, you’re building a business relationship on a foundation of pure risk.

For instance, if a client says they got rich selling a tech start-up, you can’t just take their word for it. You need to see the proof: sale agreements, company valuation reports, and bank statements showing the money hitting their account.

Step 3: Understanding the Business Relationship

With identity and wealth verified, it’s time to understand why they’re here. Why does this customer want your services? What transactions do they plan on making? Getting a clear picture of their intentions helps you establish a baseline of what “normal” activity looks like for them.

This means documenting:

- The Nature of Business: What industry are they in? What do they sell or do?

- Expected Transaction Patterns: What’s the typical volume, value, and frequency of their transactions going to be?

- Geographic Connections: Which countries will they be sending money to or receiving it from?

If a client says they run a local textile import business but suddenly wires a huge sum to a high-risk country that has nothing to do with textiles, your alarm bells should be ringing. That’s a major deviation from the baseline you established and demands a closer look.

Step 4: Screening for Adverse Media and Sanctions

No EDD investigation is complete without scrubbing the customer’s name against global watchlists and news archives. This proactive search is fantastic for uncovering hidden risks that won’t show up in their official paperwork.

Sanctions and Watchlist Screening is about checking the customer and UBOs against lists from governments and international bodies like the UN or OFAC. Finding a match on a sanctions list is a showstopper—it usually means you can’t do business with them, period.

Adverse Media Screening involves digging through credible news sources, legal databases, and public records for any bad press. You’re looking for reports of financial crime, bribery, corruption, or other shady dealings. As part of a holistic EDD process, it’s crucial to consider all operational risks, including digital vulnerabilities by conducting a comprehensive website security audit.

Step 5: Ongoing Monitoring and Review

Finally, remember that EDD isn’t a one-and-done task. High-risk customers need to be watched closely and continuously for the entire duration of your relationship. Their risk profile can change in a heartbeat, and new red flags can pop up at any time.

This final stage is all about:

- Transaction Monitoring: Keeping a constant eye on their transactions to spot any activity that doesn’t fit the profile you built.

- Periodic Reviews: Regularly re-evaluating the customer’s risk level, re-verifying their documents, and running fresh adverse media checks. How often you do this depends on just how high-risk they are.

Effective ongoing monitoring is your safety net. It allows you to spot and react to suspicious behaviour in real-time, protecting your organisation from being used as a pawn in financial crime.

Why a Strong EDD Framework Is a Strategic Asset

It’s easy to view Enhanced Due Diligence (EDD) as just another regulatory hoop to jump through, a box-ticking exercise that slows things down. But seeing it that way is a massive strategic mistake. A solid EDD framework is much more than a defensive play; it’s a powerful tool that actively protects and strengthens your entire organisation.

When you shift your perspective from chore to strategic advantage, you unlock its real value. A well-run EDD programme goes beyond checklists. It becomes a proactive shield against serious financial, reputational, and operational risks, helping you make smarter decisions for long-term stability.

Mitigating Financial and Reputational Harm

The most obvious win from a strong EDD framework is preventing financial loss. By digging deeper into high-risk clients, you can identify and steer clear of illicit actors, ensuring you don’t become a channel for money laundering or terrorist financing. This directly protects you from handling criminal funds and avoids the eye-watering costs that come with a compliance breach.

But the damage isn’t just financial. The hit to your reputation after a compliance failure can be catastrophic. News of being involved in a money laundering scandal—even accidentally—can shatter customer trust, scare off investors, and stain your brand for years.

A strong EDD process acts as your organisation’s reputational guardian. It demonstrates a commitment to ethical operations and corporate integrity, building a foundation of trust that is invaluable in the marketplace.

Think of it this way: effective EDD is a public statement that your company is a responsible player. This commitment doesn’t just keep your current customers happy; it also attracts new ones who value security and ethical partners.

Avoiding Crippling Regulatory Penalties

Regulators don’t mess around when it comes to compliance failures. The penalties for weak AML/CTF controls can be staggering, often running into millions of dollars, not to mention the strict and expensive oversight that follows. A solid EDD framework is your best defence.

It gives you a clear, documented audit trail of your risk-based decisions and diligent investigations. This meticulous record-keeping is your lifeline when regulators come knocking, proving you’ve taken robust, reasonable steps to manage high-risk relationships.

The numbers in India tell the story. Between 2017 and 2022, organisations that properly implemented EDD saw a nearly 18% drop in harmful financial crime incidents. On top of that, a survey by the Indian Banks’ Association revealed that 72% of member banks agree that EDD processes are far better at spotting suspicious activity than basic checks.

Fostering a Resilient Compliance Culture

A strong EDD framework does more than just catch criminals; it has a ripple effect inside your organisation. It helps build a culture of vigilance and accountability, where every employee becomes a line of defence against financial crime.

When your team is trained to recognise high-risk triggers and understands the “why” behind EDD, compliance stops being one department’s problem. It becomes a shared mission. This encourages critical thinking and gives people the confidence to raise concerns.

This kind of culture is non-negotiable for fintech companies aiming to build secure systems and grow sustainably. Ultimately, a well-defined EDD programme is an investment in your company’s long-term health and integrity, paying dividends far beyond just staying on the right side of the law.

Navigating Common EDD Challenges and Best Practices

Putting an effective Enhanced Due Diligence (EDD) programme into practice is rarely a straightforward journey. In the real world, compliance teams hit all sorts of obstacles that can make a thorough investigation feel like navigating a maze. From deliberately confusing corporate structures to the sheer cost of a deep-dive analysis, these challenges can test even the most seasoned professionals.

But for every common hurdle, there’s a proven best practice to get over it. Understanding these challenges and adopting smart, practical solutions is what separates a reactive, overwhelmed compliance team from a proactive, efficient one. Think of this as the toolkit for building a more resilient and effective EDD framework.

Untangling Complex Ownership Structures

One of the biggest headaches in EDD is figuring out who really owns and controls a company. It’s common for high-risk entities to use a confusing mix of shell companies, offshore trusts, and nominee directors to deliberately hide the Ultimate Beneficial Owner (UBO). This creates a messy web of ownership that’s tough and time-consuming to unravel.

The real challenge is piercing this corporate veil to identify the individuals actually pulling the strings. Simply relying on the information they give you isn’t good enough—it can be misleading or an outright lie.

To get around this, the best practice is to use a multi-pronged verification approach. Don’t just take the customer’s word for it; independently confirm the information using reliable, third-party data sources. This means:

- Accessing Corporate Registries: Use official government and commercial databases to verify shareholder details and directorships.

- Leveraging Technology: Employ specialised software that can map out complex ownership chains and flag connections to high-risk people or places.

- Demanding Documentation: Insist on getting and verifying official documents like shareholder agreements, trust deeds, and articles of association.

Managing High Costs and Resource Drain

Let’s be honest: a proper EDD investigation isn’t cheap. The process demands significant resources, from skilled analysts and expensive database subscriptions to a whole lot of time. For many organisations, especially smaller ones, the cost can feel overwhelming, creating a temptation to cut corners on high-risk cases.

This resource drain can lead to EDD being applied inconsistently. Only the most obviously risky customers get the full treatment, leaving dangerous gaps in your compliance defences.

The most effective solution here is a risk-based approach. This simple principle allows you to direct your most intensive resources to your highest-risk customers. Instead of treating every EDD case the same, you can categorise them and apply proportionate measures, which keeps things efficient without compromising on safety.

By focusing your efforts where the danger is greatest, you get the most out of your resources. Your team can conduct serious deep-dive investigations on critical cases rather than spreading themselves too thin across the board.

Overcoming Incomplete or Suspicious Information

Another classic problem is when a high-risk customer provides documentation that’s incomplete, inconsistent, or just doesn’t feel right. Maybe they’re slow to respond to requests or give vague answers about where their money came from. This is a massive red flag that needs to be handled carefully.

Pushing back without a clear policy can damage the client relationship, but accepting suspicious information is a huge compliance risk.

The best practice here is to establish clear and firm EDD policies and procedures that everyone on your team understands. They need to know exactly what to do when faced with uncooperative clients. This includes:

- Standardised Escalation Paths: Create a clear process for analysts to escalate suspicious cases to senior management or the compliance officer. No guesswork involved.

- Defined Red Flags: Document specific examples of suspicious behaviour or documentation that automatically trigger a deeper look or an escalation.

- Exit Strategy: Have a clear policy on when to stop the onboarding process or end an existing relationship if the customer refuses to provide the necessary information.

This structured approach takes the uncertainty out of the equation and empowers your team to act decisively, all while maintaining a consistent and defensible audit trail. Continuous staff training on these procedures is crucial to make sure they’re followed correctly every time, turning your EDD framework from a set of rules into a powerful, practical defence against financial crime.

EDD Questions We Hear All the Time

Even when you’ve got a handle on the Enhanced Due Diligence process, putting it into practice throws up a few curveballs. Here are the most common questions that pop up, with straightforward answers to help you manage high-risk customers and keep your compliance sharp.

What’s the Real Difference Between CDD, EDD, and SDD?

Think of your due diligence efforts as a dial you turn up or down depending on the risk.

- Simplified Due Diligence (SDD): This is the lowest setting. It’s for your very low-risk customers where the chance of any funny business is next to zero. The identity checks are usually less intense.

- Customer Due Diligence (CDD): This is your default, standard setting for the average customer. You’ll verify their identity, get a sense of why they need your services, and do a basic risk check.

- Enhanced Due Diligence (EDD): This is when you crank the dial all the way up. It’s strictly for high-risk customers and involves a much deeper dive into where their money and wealth come from, plus keeping a closer eye on their transactions.

The main difference is simply the depth of the investigation—the higher the perceived risk, the deeper you dig.

Can a Customer’s Risk Level Actually Change?

Absolutely. A customer’s risk profile isn’t set in stone; it can change for all sorts of reasons. That’s precisely why ongoing monitoring is so non-negotiable for any solid due diligence programme. A customer who seemed low-risk at first could easily end up needing Enhanced Due Diligence down the line.

For instance, a client might suddenly start doing business in a newly sanctioned country. Or maybe a key person in their company becomes a Politically Exposed Person (PEP). On the flip side, a high-risk customer could be downgraded if you manage to clear up the initial concerns. Regular reviews are the only way to make sure your level of scrutiny matches the current risk.

How Does Technology Fit into the EDD Process?

Honestly, modern EDD would be nearly impossible without technology. Trying to do these deep dives manually is incredibly slow and a recipe for human error, especially when you’re sifting through mountains of data.

Today’s compliance tools are a game-changer. They help by:

- Automating Screening: Instantly checking names against global sanctions lists, PEP databases, and news articles from around the world.

- Mapping Ownership Structures: Using smart tools to untangle complicated company structures and pinpoint the real person in charge (the Ultimate Beneficial Owner, or UBO).

- Monitoring Transactions: Deploying AI to watch transaction patterns in real-time, flagging any weird activity that doesn’t fit what you’d expect from the customer.

Technology doesn’t take the place of a sharp compliance professional, but it gives them the powerful tools needed to do a proper investigation without getting buried in paperwork.

The point of using tech in EDD isn’t to replace the human expert. It’s to arm them with faster, more reliable data so they can focus on the important stuff: analysing the risk and making the final call.

How Often Should We Be Doing EDD Reviews?

There’s no magic number here; it all comes back to your risk-based approach. The rule of thumb is simple: the higher the customer’s risk, the more often you need to check in on them.

As a general guide, you could follow something like this:

- Very High-Risk Customers: You might want to review their file every 6 to 12 months.

- Standard High-Risk Customers: An annual review is a widely accepted best practice.

But don’t just stick to a schedule. A review should also be triggered by certain events—like a massive, out-of-the-blue transaction, a splash of bad press, or a change in who owns the company. A good monitoring strategy has to be flexible. The answer to “what is enhanced due diligence edd?” is that it’s a living process, not a check-it-once-and-forget-it task.

Making informed hiring decisions quickly and confidently is crucial for growth. SpringVerify offers comprehensive, fast, and accurate background verification services designed for Indian companies, from startups to large enterprises. Ensure your team is built on trust and integrity.

Learn more about how SpringVerify can secure your hiring process