An ultimate beneficial owner (UBO) is the real person who actually owns, controls, or profits from a company, no matter whose name is on the official paperwork.

Think of it like a set of Russian nesting dolls. You might see a corporate name on the outside, but the UBO is the single, solid doll hidden at the very centre. This simple concept is key to peeling back the layers of corporate secrecy and finding out who’s really in charge.

Table of Contents

Lifting the Corporate Veil to Find the UBO

For a long time, having a complicated ownership structure was just seen as a clever business move. That perspective has completely flipped. Regulators and financial institutions now know that these confusing corporate veils can be used to hide all sorts of illegal activities, from money laundering to financing terrorism.

Identifying the ultimate beneficial owner is how you pierce that veil and bring transparency back into the picture. It’s all about looking past the nominee directors, the shell corporations, and the tangled legal setups to find the actual human being pulling the strings. It’s no longer enough to know the legal owner; you have to find the beneficial owner who enjoys the profits or calls the shots from behind the scenes.

The Shift from Optional to Essential

What was once a small compliance task is now a core part of doing business. The pressure to identify the UBO is coming from all sides, setting a new standard for how companies must operate.

This includes:

- Regulatory Mandates: Governments across the globe have rolled out strict laws that force businesses to identify and verify their UBOs.

- Financial Integrity: Banks and investors are demanding transparency to manage their own risk and avoid getting tangled up in financial crime.

- Public Trust: Customers and partners are becoming more suspicious of companies with hidden ownership, linking transparency directly with ethical business.

The main idea is simple: if you don’t know who you’re truly doing business with, you’re opening your organisation up to huge financial, legal, and reputational risks.

Why This Matters for Every Business

Figuring out the ultimate beneficial owner isn’t just a job for compliance teams at massive corporations. It affects everyone.

Whether you’re a startup looking for investment, a small business applying for a loan, or a large company managing its supply chain, UBO verification has a direct impact on you. It determines who you can partner with, how you get access to financial services, and how you build a brand that people trust.

This move toward radical transparency is changing the entire business landscape, making UBO identification a non-negotiable skill for any leader who wants to operate safely and successfully. Trying to ignore it is no longer an option—it’s a fast track to regulatory fines and a damaged reputation.

Why Identifying the UBO Is a Business Imperative

Ignoring who the ultimate beneficial owner (UBO) is in a business deal is like navigating a minefield blindfolded. It’s not just some box-ticking exercise; it’s a core function that shields your company from massive financial hits and reputational damage. If you don’t unmask the real person pulling the strings, you could inadvertently drag your business into some seriously illicit activities.

Understanding who truly profits from or controls a business partner, client, or supplier is your first line of defence against financial crime. Bad actors love to hide behind complex ownership structures to obscure the flow of money for things like money laundering or financing terrorism. Verifying the UBO ensures you aren’t unknowingly helping these dangerous criminal networks.

Sidestepping Crippling Fines and Legal Battles

Beyond the ethics of it all, regulators are getting much tougher on UBO transparency. Non-compliance isn’t a minor slap on the wrist anymore—it can lead to crippling fines, legal action, and even getting your business licence suspended. To really get a handle on why this is so critical, it’s worth looking at a complete guide to the due diligence process.

Here in India, the rules have become particularly strict. The Ministry of Corporate Affairs (MCA) and the Prevention of Money Laundering Act (PMLA) have tightened their grip significantly. For example, the ownership threshold for a Significant Beneficial Owner (SBO) was dropped from 25% to just 10%, which means a lot more people fall under the KYC microscope now.

This strict environment makes a deep understanding of business compliance essentials absolutely vital for survival and growth.

UBO due diligence isn’t just another task on a compliance checklist. It is a fundamental strategy for risk management and sustainable growth in a transparent global economy.

Building Trust Through Transparency

At the end of the day, identifying the ultimate beneficial owner is about building and maintaining trust. Investors, partners, and customers are savvier than ever before. They want to work with businesses that operate with integrity.

When you can confidently show who you’re doing business with, you create a culture of trust that strengthens all your professional relationships and cements your reputation in the market. This kind of transparency signals that your organisation is committed to ethical practices, making you a far more attractive and reliable partner in the long run. In short, solid UBO verification is a powerful tool for building a resilient and respected brand.

Navigating India’s UBO Regulatory Landscape

For any business operating in India, figuring out who the ultimate beneficial owner is isn’t just good practice—it’s a legal must. The country’s regulatory environment is built to cut through corporate complexity, demanding total transparency about who really controls and profits from a company.

At the heart of this framework are two major pieces of legislation: The Companies (Significant Beneficial Owners) Rules, 2018, and the powerful Prevention of Money Laundering Act (PMLA). These laws work together, leaving no wiggle room for murky ownership structures. They compel companies to look past direct shareholders and pinpoint the actual people at the very end of the ownership chain.

Defining the Significant Beneficial Owner

In India, the official term you’ll encounter is Significant Beneficial Owner (SBO). This isn’t just about who owns shares; it’s a much broader definition. An individual gets classified as an SBO if they meet certain criteria, whether directly or indirectly.

The main trigger is ownership. Anyone holding 10% or more of the shares or voting rights in a company is automatically flagged as an SBO. This is a big deal because the old threshold was 25%, so this change pulls a lot more people into the disclosure net.

This shift has a direct impact on the fintech industry, where complex funding rounds and diverse investor stakes are the norm. But ownership is only part of the story.

The concept of ‘significant influence’ is just as critical. This means someone who has the power to shape a company’s financial and operating decisions—even without a large shareholding—can also be considered an SBO.

This clever rule ensures that people who pull the strings through contractual agreements or board influence can’t hide in the shadows.

A Closer Look at UBO Thresholds in India

To get a clear picture, it helps to see how different regulations define beneficial ownership. The thresholds vary depending on the governing body and the specific context, from company law to anti-money laundering rules.

Here’s a quick summary of the key UBO and SBO thresholds you need to know.

Key UBO Thresholds in India at a Glance

| Regulation/Act | Governing Body | Ownership Threshold | Key Focus Area |

|---|---|---|---|

| Companies Act, 2013 | Ministry of Corporate Affairs (MCA) | 10% shareholding or voting rights (SBO) | Corporate transparency and governance |

| PMLA, 2002 | Financial Intelligence Unit (FIU) | 25% shareholding or capital (UBO) | Preventing money laundering & financial crime |

| SEBI (FPI) Regulations | SEBI | 10% for companies; 25% for trusts | Foreign Portfolio Investor (FPI) disclosures |

As you can see, there’s no single number that applies across the board. Companies must be aware of which rules apply to them and ensure they are compliant with each specific requirement.

Tightening the Screws on Foreign Investment

Regulators are also zeroing in on loopholes related to foreign money coming into India. The Securities and Exchange Board of India (SEBI) has rolled out strict disclosure rules for Foreign Portfolio Investors (FPIs).

As of early 2024, SEBI is using a “look-through” approach. This means FPIs with 50% or more of their Indian equity assets under management (AUM) in a single corporate group must now reveal their ultimate beneficial owners all the way down to the individual level.

Deadlines were set for January and March 2024, giving these FPIs a choice: either rebalance their investments or provide full disclosure. Those who didn’t comply faced the risk of having their registration cancelled.

This regulatory landscape gives businesses a clear, if challenging, path forward. Compliance isn’t a choice, and the rules demand a proactive and detailed approach to identifying every single ultimate beneficial owner. Getting it wrong can lead to heavy penalties, making a solid grasp of India’s specific rules a cornerstone of good corporate governance.

A Practical Guide to Identifying an Ultimate Beneficial Owner

Alright, let’s move from the what to the how. Figuring out who the UBO really is takes a methodical approach. Think of it like being a detective; you’re following a trail of documents and complex corporate structures to find the actual person calling the shots at the end.

The goal here is to create a crystal-clear map of ownership, one that can hold up under the intense glare of regulatory scrutiny. This isn’t just about skimming a shareholder list. It demands a deep dive into the company’s entire framework to uncover any individual with significant control, whether it’s direct or buried under layers of corporate entities.

Mapping the Ownership Chain

First things first: you need to map out the company’s entire ownership structure. This means identifying every single shareholder and director. But don’t stop at that first layer. If a shareholder turns out to be another company, your investigation has to continue into that parent company, and so on, until you finally land on a natural person.

It’s a process of meticulously tracing ownership through what can often be a bewildering maze of multi-layered corporate arrangements. The key is simple: keep digging until you can’t find another corporate entity and you’ve arrived at an individual.

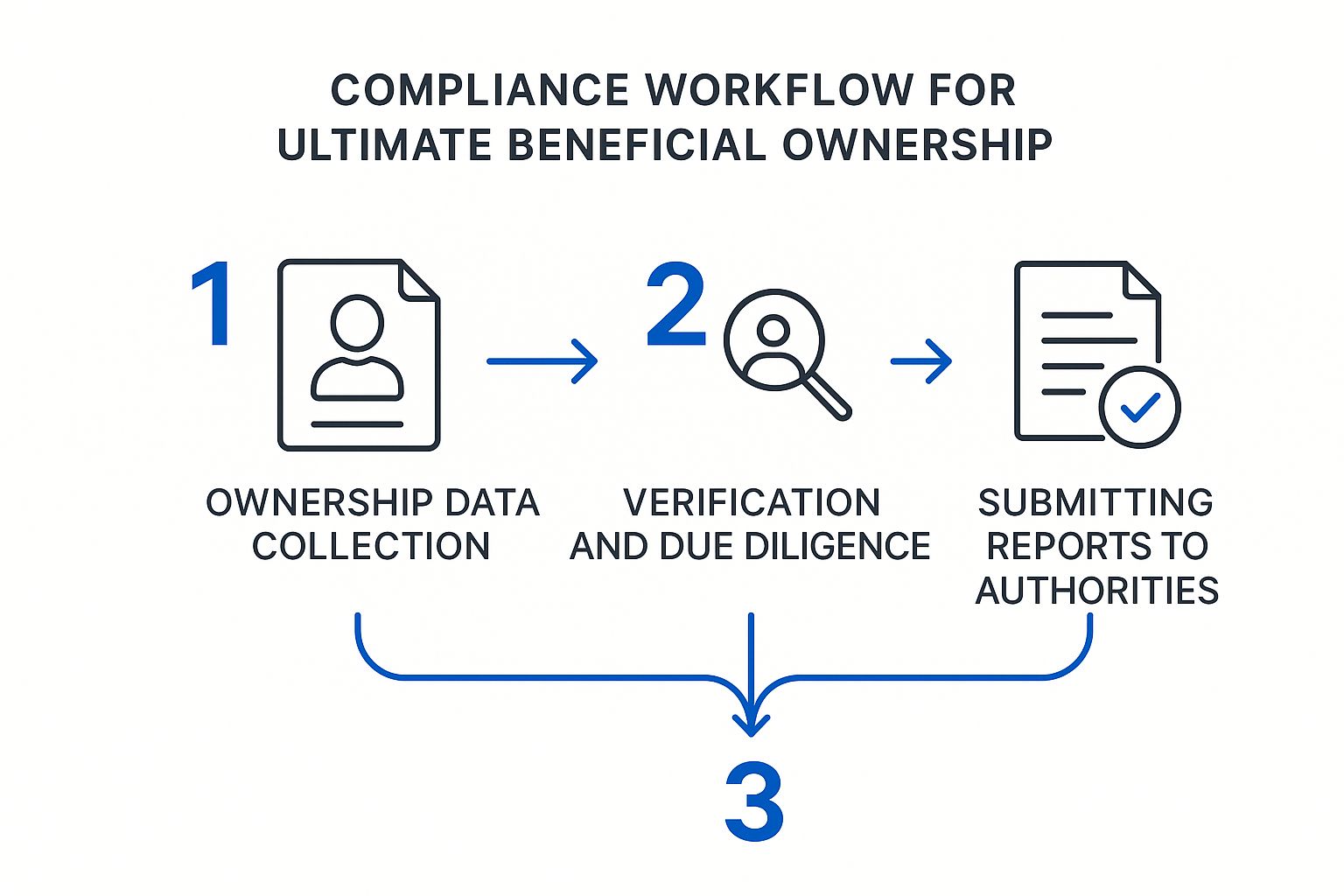

The visual below lays out the standard compliance workflow for uncovering and reporting the ultimate beneficial owner.

As the flow shows, this is a cycle of collecting data, verifying it, and then formally reporting it. This cycle forms the backbone of any solid compliance programme.

Overcoming Common Roadblocks

As you trace this ownership chain, you’ll almost certainly hit roadblocks. Many are deliberately set up to hide the true UBO. Two of the most common tricks in the book are shell companies and nominee directors.

- Shell Companies: These are companies that exist only on paper. They have no real office, no operations, nothing. They’re often just a legal entity used to create another layer in the corporate structure, making it harder to see who’s really in charge.

- Nominee Directors: These are people put in place to act as a company’s director, but they’re just following orders from someone else. They hold no real power; they are just a name on a piece of paper, a front to obscure the person actually pulling the strings.

Getting past these obstacles requires persistence and a sharp eye for red flags. Be wary of things like companies registered in known tax havens or directors who have zero relevant industry experience.

Identifying the ultimate beneficial owner is not a one-time check but a continuous process of due diligence. It requires a combination of thorough documentation review, structural analysis, and an awareness of the tactics used to hide beneficial ownership.

Essential Documentation for Verification

Once you think you’ve identified a potential UBO, the final—and most critical—step is verification. You can’t just take the information at face value. You must confirm it with official documentation to get the hard evidence you need for your compliance records.

Your verification toolkit should include a range of documents:

- Identity Proofs: This is non-negotiable. You need official government-issued identification for the UBO, like a passport or Aadhaar card, to confirm they are who they say they are.

- Shareholder Agreements: These legal documents spell out the rights and responsibilities of shareholders. They are goldmines for revealing who holds the real voting power or control.

- Articles of Association: This document defines a company’s purpose and internal rules, often detailing shareholder rights and rules around directorships.

- Trust Deeds: If a trust is involved in the ownership structure—a common tactic—the trust deed is essential. It identifies the trustees and beneficiaries who actually hold the control.

Gathering and carefully verifying these documents gives your team a complete and, most importantly, defensible record. It ensures you can confidently prove that you know who you’re really doing business with.

Using Technology to Streamline UBO Verification

Let’s be honest, manually verifying an ultimate beneficial owner is a nightmare. It’s slow, riddled with potential errors, and nearly impossible to do at scale. Imagine your team trying to trace ownership through tangled corporate layers, digging through global records, and then constantly monitoring for any changes. It’s a massive drain on your resources.

This is where modern technology completely changes the game.

Specialised platforms can automate the whole process—data collection, verification, and monitoring—turning a resource-heavy chore into a smooth, manageable workflow. Instead of painful manual searches, these tools tap into global databases to instantly pull and cross-reference ownership information. They can flag discrepancies and complex structures that would take a human analyst weeks to unravel.

The Power of Automated Verification

The real beauty of technology here is its ability to act as a force multiplier for your compliance team. By automating all the tedious legwork, you free up your experts to focus on what they do best: analysis and decision-making, not data entry.

Here are a few key advantages:

- Enhanced Accuracy: Automated systems connect to countless official registries and data sources around the world. This drastically reduces the risk of human error and gives you a much more complete picture of the ownership chain.

- Major Efficiency Gains: What used to take days of painstaking research can now be done in minutes. This speed allows your organisation to onboard new partners and clients much faster without ever cutting corners on due diligence.

- Stronger Compliance: Technology ensures a consistent, repeatable verification process. This creates a solid, auditable trail that clearly demonstrates your commitment to regulatory requirements.

This screenshot from SpringVerify shows just how a simple interface can make even complex verification processes feel manageable.

The clear layout and focused functions are a perfect example of how technology can cut through the clutter of detailed compliance checks.

Building a Scalable Compliance Programme

As your business grows, so does your compliance burden. A manual process that works for ten clients will completely fall apart when you hit a hundred. Technology provides the scalability you need to grow with confidence, ensuring your UBO checks stay robust no matter how large your operations become.

By integrating verification technology, you aren’t just buying a tool; you’re building a resilient and defensible compliance framework that protects your organisation from financial crime and regulatory penalties.

These systems also offer continuous monitoring, automatically flagging any changes in a company’s ownership structure. This proactive approach is vital for ongoing compliance, alerting you to potential risks the moment they appear. For businesses looking to embed these capabilities directly into their existing HR platforms, exploring powerful API integrations is the logical next step.

Ultimately, using technology for UBO verification is no longer a luxury—it’s an essential strategy for any modern, compliant organisation.

Answering Your Key Questions About UBOs

As the idea of the ultimate beneficial owner becomes more central to how we do business, plenty of practical questions pop up. Getting your head around the finer points of UBO identification can be a real challenge, but a few clear answers can make all the difference for your compliance teams and leadership.

This section gets straight to the point, tackling the most common areas of confusion. Let’s demystify some of the most critical parts of UBO compliance so you can handle real-world situations with confidence.

Legal Owner vs. Beneficial Owner: What Is the Difference?

This is probably the most fundamental concept to get right. A legal owner is the person or company whose name is on the official paperwork—the registered shareholder, for instance. Simple enough.

The ultimate beneficial owner, on the other hand, is the actual person who gets to enjoy the perks of ownership or pulls the strings, even if their name isn’t on a single share certificate.

Think of it like this: a flat is legally registered to a management company. That company is the legal owner. But if a private individual collects all the rent and has the final say on selling the property, they are the ultimate beneficial owner. That’s the person regulators are trying to find.

What Should We Do if a UBO Cannot Be Identified?

Sometimes, even after you’ve turned over every stone, you just can’t find an actual person who meets the ownership threshold. This can happen with companies that have a huge number of small shareholders or are owned by complex trusts.

In these cases, regulations usually have a backup plan: you need to identify a senior managing official (SMO). This could be the CEO, CFO, Managing Director, or someone else with major responsibility for running the company.

Crucially, you must be able to prove you did your homework first. You’ll need to document all the steps you took to find the UBO to show you performed thorough due diligence before falling back on the SMO.

When a true ultimate beneficial owner cannot be found after a diligent search, the focus shifts to identifying the person with the highest level of managerial control over the entity. This ensures there is always a natural person accountable.

How Often Must UBO Information Be Reviewed?

UBO verification is definitely not a one-and-done job. Ownership structures can shift all the time because of new investments, mergers, or people simply transferring shares. Because of this, most regulations require you to keep your UBO information accurate and up-to-date.

A good rule of thumb is to review UBO details annually. However, you should also have a process ready for when a “trigger event” happens, such as:

- A big change in the ownership or control structure.

- Bringing the company on as a new client or partner.

- Renewing a contract or business relationship.

- During your regular risk assessments.

This proactive mindset makes sure your records stay compliant and accurate as things change.

Are Directors Automatically Considered UBOs?

Nope. Just being a director doesn’t automatically make someone a UBO. The definition of a UBO is all about ownership or control, usually through holding shares or having a massive influence over financial and operational decisions.

A director’s role is about management. While a director can also be a UBO if they own enough shares or have that level of overriding control, their job title alone doesn’t qualify them. You always have to look at their actual power and financial stake, not just what it says on their business card.

Ready to build a faster, more reliable UBO verification process? SpringVerify offers comprehensive background and identity checks that integrate seamlessly with your existing workflows, ensuring you remain compliant without slowing down your business. Discover how SpringVerify can fortify your due diligence process.