Mobile OTP verification is a security process that’s become second nature to most of us. It works by sending a unique, time-sensitive code to your registered mobile number, acting as a digital key to prove you’re really you. It’s a simple but powerful way to add a crucial layer of protection to your online accounts, essential for everything from logging in to securing transactions.

Table of Contents

Understanding Mobile OTP Verification

At its heart, a One-Time Password (OTP) is designed for a single use, which makes it far more secure than a static password that can be stolen and used over and over. The flow is straightforward: you try to log in or authorise a payment, and the system instantly generates a short code and sends it to you via SMS. You just punch in that code to finish the action.

This process is a classic example of two-factor authentication (2FA). It relies on a simple yet effective principle: verifying your identity using “something you have”—in this case, your mobile phone. When you combine this with “something you know” (your password), you build a much tougher defence against anyone trying to get in without permission. Even if a fraudster manages to steal your password, they’re stopped in their tracks because they don’t have your physical phone to receive the OTP.

The Rise of OTP in India

In India, mobile OTP verification isn’t just a feature; it’s an indispensable security tool. This has been driven by the explosive growth of digital services and smartphone ownership across the country.

With projections showing nearly 750 million smartphone users by early 2025 and internet access growing in rural areas, OTPs have become the backbone of trust for countless platforms. This digital wave, bolstered by initiatives like Digital India, has cemented the role of OTPs in everything from banking and e-commerce to government services. You can get more insights on the role of OTPs in India’s digital economy at fitinline.com.

The real value of mobile OTP verification lies in its simplicity and accessibility. It doesn’t require users to install special apps or carry extra hardware; it leverages the one device almost everyone has in their pocket.

This ubiquity has made it the default security standard for businesses big and small, helping them secure their platforms and build confidence with their users. It truly is the first line of defence in our digital world.

How the OTP Verification Process Works

The mobile OTP verification process might look like a bit of magic. One moment you tap a button, and seconds later, a code lands in your SMS inbox. But behind that speed is a carefully choreographed sequence of events, like a digital relay race where each step is crucial for getting the code securely and swiftly to your phone.

It all kicks off with a simple action from the user. When you try to log in or approve a transaction on a website or app, your click is the starting gun. It sends a signal to the application’s server, officially kicking off the verification workflow.

The Technical Relay Race

Once the application server gets this request, it doesn’t just pull a random number out of a hat. Instead, it calls on a specialised OTP generation service. This service uses a secure algorithm to create a unique, unpredictable code—usually a 6-digit number—that’s only good for a few short minutes.

Next, the server securely hands off this new OTP and the user’s mobile number to an SMS gateway. Think of this gateway as a bridge connecting the internet to the vast world of telecom networks. It’s the gateway’s job to package the message correctly and send it on its way through the complex web of mobile carriers until it reaches your device.

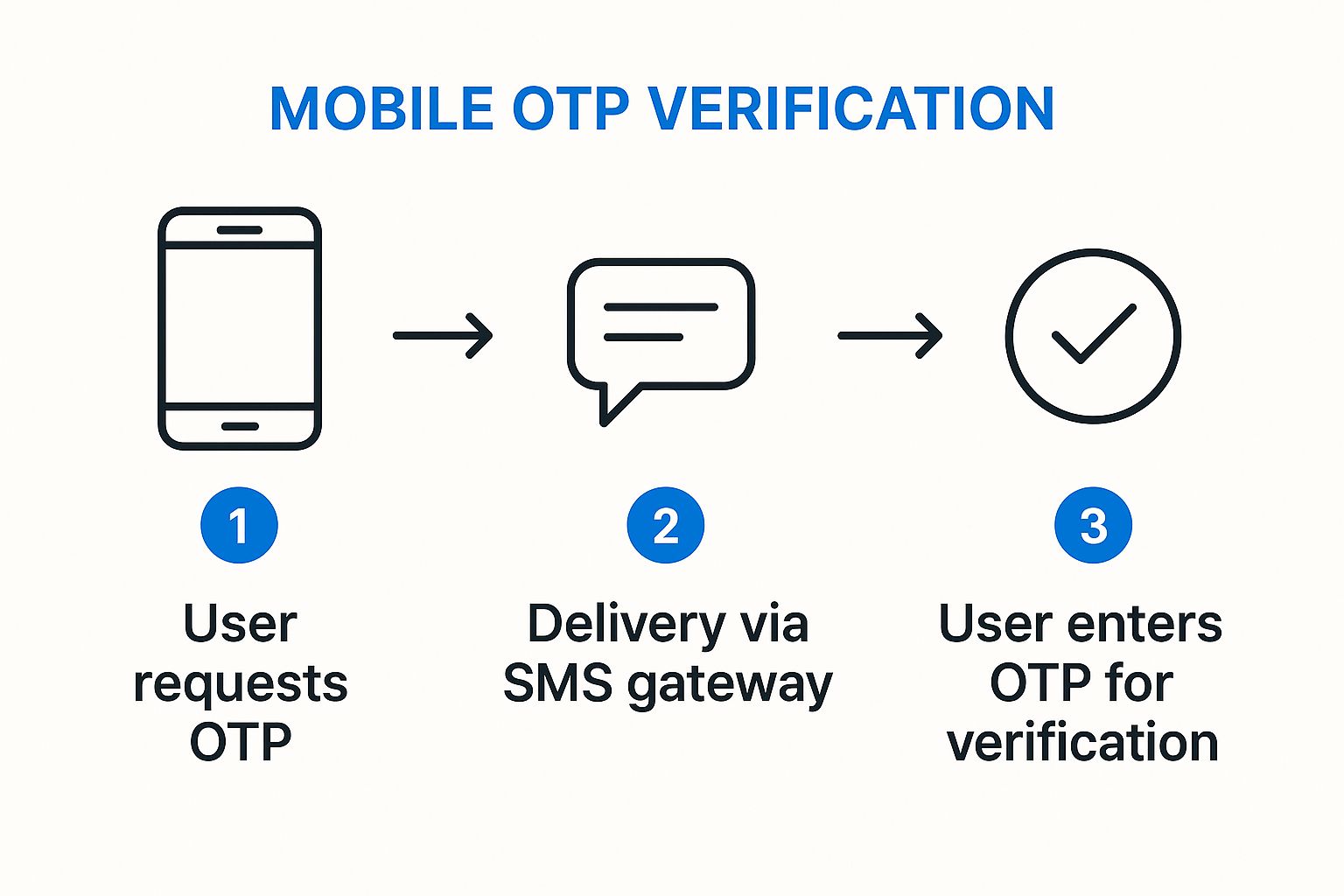

This simple but powerful three-step flow is illustrated below.

As you can see, the request, delivery, and verification steps create a closed loop. This ensures that only the person holding the physical phone can complete the action.

Final Validation and Access

The final leg of the race starts the moment you receive the SMS. You type that code into the app, and it zips back to the application server for the most critical step: validation.

The server then compares the code you entered against the original one it generated just moments earlier.

A successful match is the digital handshake that confirms the user’s identity. It proves that the person initiating the action is the same person who possesses the registered mobile phone.

If the codes line up and the OTP hasn’t expired, the server grants access. You’re in. But if they don’t match or time has run out, access is denied, and the code becomes useless, keeping the account safe from intruders. Businesses wanting to build this kind of secure process into their platforms can explore robust solutions with SpringVerify’s API integrations to set up a reliable verification system.

Why Mobile OTP Is Crucial for Your Business

Putting a mobile OTP system in place isn’t just a technical box to tick; it’s a core business strategy. It has a direct line to user trust, your financial health, and the reputation you’ve worked so hard to build. In today’s crowded markets, earning a customer’s trust right from the get-go is everything. A solid OTP system is a powerful, immediate signal that you take their security seriously.

This simple step of verifying a mobile number adds a surprisingly strong layer of confidence. It tells your customers their accounts are safe from prying eyes, which is absolutely vital when their personal or financial details are on the line. Getting this first interaction right really sets a positive tone for the entire relationship.

Protecting Your Bottom Line from Fraud

One of the clearest wins from using OTP verification is how effectively it cuts down on fraud-related losses. Account takeover (ATO) attacks are a constant headache, where criminals hijack user accounts to make bogus purchases or drain funds. Mobile OTPs are a formidable roadblock against these threats.

By demanding a code sent to a person’s physical device, you make a fraudster’s job incredibly difficult. Even if they’ve managed to steal a password, they’re stopped dead in their tracks without the user’s phone. This protection is a game-changer across several industries:

- E-commerce: Stops fraudulent orders in their tracks and keeps stored payment details safe.

- Fintech: Secures every transaction and blocks unauthorised money transfers.

- Healthcare: Protects sensitive patient information and helps maintain regulatory compliance.

For sectors like financial technology, top-notch security isn’t just nice to have—it’s essential. You can get a deeper look into how verification builds trust by exploring security must-haves for the fintech industry. At the end of the day, preventing fraud isn’t just about saving money; it’s about maintaining the integrity of your entire platform.

Streamlining Onboarding and Enhancing User Experience

Security is paramount, but it should never create a frustrating experience for your users. A slow, clunky, or unreliable verification process will cause people to give up and leave during that all-important sign-up stage. A smooth mobile OTP verification flow does the exact opposite—it makes the process fast and frictionless.

When a new user gets their OTP instantly and can sign up in seconds, it leaves a great first impression. That kind of efficiency is what turns a potential sign-up into an active, happy customer.

A fast and dependable OTP system is a direct investment in your user acquisition funnel. It reduces abandonment rates and starts the customer journey on a positive, hassle-free note.

So, when you look at it, OTP verification does a lot of heavy lifting. It strengthens your security, builds real customer trust, stops costly fraud, and makes for a better user experience. By making a strong verification system a priority, you’re not just protecting your assets—you are actively investing in the long-term growth and reputation of your business.

Navigating Common Security Risks and Challenges

While mobile OTP verification is a fantastic security layer, it’s not a silver bullet. You have to understand its weak spots to build a truly solid system. The path an OTP takes from your server to a user’s phone is surprisingly full of potential traps, from clever fraud schemes to basic network issues.

The Big Security Threats

One of the sneakiest threats out there is SIM swap fraud. This is where a scammer convinces a mobile operator to switch a user’s phone number over to a new SIM card they control. Just like that, they can intercept all incoming SMS messages—including your OTPs—and waltz right into sensitive accounts.

Then there’s smishing (SMS phishing), a classic trick where attackers send convincing but fake text messages. These messages are designed to create panic, urging users to reveal their OTPs directly before they have a chance to think twice.

Comparing OTP Delivery Methods and Risks

Not all OTPs are created equal. The way you send the code can significantly change its security profile. Here’s a quick breakdown of the common delivery channels and the risks that come with each.

| Delivery Method | Pros | Cons | Key Security Risk |

|---|---|---|---|

| SMS | Universal reach, no app needed | Unencrypted, prone to delivery delays, carrier-dependent | SIM swap fraud, smishing, interception over weak mobile networks |

| Cost-effective, good for desktop users | Email accounts are a primary target for hacking, slower than SMS | Account takeover (if the email is compromised), phishing attacks | |

| Voice Call | Accessible for users without smartphones or with visual impairments | Can be intrusive, automated voice can be hard to understand | Eavesdropping, can be forwarded to another number |

| Push Notification | Highly secure, encrypted, better user experience | Requires a dedicated mobile app to be installed | Relies on the user having a stable internet connection and notifications enabled |

| Authenticator App | Works offline, very secure (Time-based OTP) | Requires users to install and set up a separate app | Device theft (if the app isn’t secured with a PIN or biometrics) |

As you can see, relying solely on SMS opens you up to some serious vulnerabilities. While it’s the most common method, considering alternatives like push notifications or authenticator apps for higher-security actions is a smart move.

Beyond Fraud: The Operational Hurdles

Security threats aren’t the only headaches. Operational problems can be just as harmful to your user experience and, ultimately, your business. The reliability of SMS delivery is a huge factor that can make or break your mobile OTP verification process.

Even though it’s everywhere, SMS technology has its limits. Globally, 98% of OTPs are read within three minutes, which sounds great. But in India, the story can be very different. During peak hours, network congestion can cause SMS failure rates to shoot up as high as 15-20%. This means frustrating delays or, worse, OTPs that never arrive. You can find more data on different delivery channels at dexatel.com.

When an OTP fails to arrive, it breaks the user’s journey. This friction can lead directly to abandoned sign-ups, incomplete transactions, and a loss of customer trust.

A single failed SMS might seem like a small issue, but if it happens repeatedly, it can seriously tarnish your brand’s reputation. These challenges highlight why you need a strategy that plans for both security risks and operational flaws. By facing these issues head-on, you can implement stronger safeguards and create a verification system that’s both secure and dependable for every user, every time.

Best Practices for Implementing OTP Verification

Putting a mobile OTP verification system in place is about more than just generating a code and hitting send. It’s a delicate balance between robust security and a smooth user experience. Nail this, and you protect user accounts without driving them away in frustration. It’s these details that separate a genuinely secure platform from one that just has the appearance of being safe.

A solid implementation is built on a few non-negotiable security measures. Think of them as layers of defence, each one making it significantly harder for attackers to find a crack in your verification process.

Fortifying Your OTP Workflow

Your first line of defence is all about managing the OTP’s lifecycle. A code that sticks around for too long is just a security hole waiting to be discovered.

- Set Short Expiry Times: An OTP should be a fleeting secret. Keep its valid window incredibly short—ideally between 2 to 5 minutes—to give attackers as little time as possible to exploit it.

- Implement Rate Limiting: This is crucial for stopping brute-force attacks. You need to limit how many times a user can request an OTP or try to enter one in a short period. A good rule of thumb? Allow only three attempts every 15 minutes for a single phone number.

- Use Secure Generation Algorithms: Never, ever use predictable number sequences. Your system must use a cryptographically secure random number generator to create OTPs that are truly random and impossible to guess.

The goal is to make each OTP a unique, time-sensitive key that becomes useless moments after its purpose is served. This principle of transience is fundamental to the security of the entire process.

Ensuring Reliable Delivery and Compliance

Beyond the technical security, the practical side of things—like delivery and regulations—is just as important for a successful mobile OTP verification system, especially in the Indian context.

First off, choosing a dependable SMS gateway is paramount. A provider with a spotty delivery record can directly lead to lost users and lost revenue. You need a partner with a proven track record across all major Indian telecom operators. They should also offer fallback options, like voice calls, for those rare times an SMS just doesn’t make it through.

On top of that, you have to navigate the local rules. In India, for instance, there are strict regulations around using virtual mobile numbers for verification. To combat fraud, many banks and other secure services block OTPs sent to these numbers, which can lead to failed transactions if your system isn’t ready for it. Getting a handle on these nuances is a key part of maintaining regulatory compliance and ensuring a hiccup-free experience for your users. You can learn more about the challenges of using virtual numbers in India on callerdesk.io.

Choosing the Right OTP Service Provider

Picking an OTP service provider isn’t just another vendor selection; it’s like choosing a critical business partner. Their performance has a direct line to your security, the user’s experience, and ultimately, your bottom line. A cheap but flaky provider can end up costing you far more in frustrated customers and fraud than you ever save on fees. This is why making a smart, informed choice is so vital for a dependable mobile otp verification system.

Your first port of call should be the provider’s core infrastructure. Technical reliability is completely non-negotiable. Look for vendors who are open about their API performance and can show you a clear history of their uptime. A solid service-level agreement (SLA) that guarantees 99.9% uptime or higher is a great sign you’re dealing with a robust and trustworthy platform.

Evaluating Delivery Speed and Scalability

In India’s diverse and sometimes patchy network landscape, delivery speed is everything. An OTP that shows up a minute late is totally useless and a major source of frustration for your users. You need to ask potential providers for hard data on their average delivery times across the big Indian carriers like Jio, Airtel, and Vodafone Idea. Any top-tier provider should be hitting that sweet spot of under 10 seconds, consistently.

Just as important is how they handle the pressure when things get busy.

- Peak Load Capacity: Can their system actually manage your traffic during a massive sale, a big promotional event, or a viral marketing campaign without grinding to a halt?

- Scalability Proof: Don’t just take their word for it. Ask for case studies or real data that proves they can scale up smoothly without sacrificing speed or reliability.

A provider’s inability to scale during your busiest hours can bring user onboarding and transactions to a dead stop. This doesn’t just hit your revenue; it can seriously damage your brand’s reputation.

Analysing Security, Support, and Pricing

Beyond sheer speed, you need to get into the weeds of the provider’s security features and support system. Look for things like intelligent traffic routing, real-time delivery reports, and solid protection against common threats. Developer support is another piece of the puzzle you can’t ignore. A provider with clear documentation, a responsive tech support team, and APIs that are easy to work with will save your developers a world of pain and time.

Finally, make sure the pricing model is crystal clear and fits your business. Steer clear of providers with sneaky hidden fees or confusing pricing tiers. Often, a straightforward, pay-as-you-go model gives you the best value and flexibility, letting you scale your mobile OTP verification services as your business grows.

Frequently Asked Questions About Mobile OTP

As mobile OTP becomes a standard part of our digital lives, plenty of questions pop up. It makes sense—when you’re dealing with security, you want to be sure you’re making the right calls. Let’s clear up some of the most common queries to give you a better handle on how this all works.

How Secure Is SMS OTP Compared to Other Methods?

SMS OTP is incredibly popular because almost everyone has a phone that can receive texts, but it’s not the Fort Knox of security. Its main weaknesses are SIM swap fraud (where a scammer convinces your mobile provider to switch your number to their SIM card) and the chance of a message being intercepted on an insecure network. It’s a solid upgrade from just a password, but there are tougher options out there.

So, how does it stack up against the alternatives?

- Authenticator Apps (like Google Authenticator): These are a big step up in security. The codes are generated right on your device and work offline, which means they can’t be nabbed through network snooping or SIM swapping.

- Push Notifications: When an app sends a notification to your phone for you to approve, that message travels through a secure, encrypted channel. This method is not only highly secure but also much smoother for the user.

- Biometrics (Fingerprint/Face ID): This is the top tier. Verification is tied directly to you—your unique physical self. It’s tough to beat that.

The bottom line? SMS OTP is a great foundational layer of security and much better than relying on passwords alone. But if you’re protecting highly sensitive data, it’s wise to layer it with more advanced methods for real peace of mind.

What Factors Determine OTP Service Costs?

The price tag on a mobile OTP service isn’t a simple flat rate; it’s a mix of a few key things. Getting to grips with these helps you budget properly and pick a provider that fits your scale and needs.

The biggest factor is volume. Most providers charge per OTP sent, and just like buying in bulk, the more you send, the lower your cost per message usually gets. The delivery route is another huge piece of the puzzle. Premium routes cost more but give you better reliability and faster delivery, especially across India’s complex web of telecom networks. Standard routes are cheaper but can sometimes face delays.

Finally, extra features like voice OTPs as a fallback, detailed performance analytics, and dedicated tech support will also shape the final cost.

What Is the Ideal Validity Period for an OTP?

The lifespan of an OTP is a tightrope walk between user convenience and security. If a code lasts too long, it gives attackers a bigger window to potentially intercept and use it. The industry consensus is to keep that window as brief as practically possible.

A sweet spot for an OTP’s validity is somewhere between 2 and 5 minutes. This gives a genuine user enough time to receive the text and type in the code without feeling the pressure, but it’s short enough to drastically shrink the risk of it being compromised. Anything over 10 minutes is generally seen as leaving the door open for too long and is best avoided.

Ready to implement a fast, reliable, and secure OTP verification system for your business? SpringVerify offers robust API integrations that ensure your users are verified quickly and your platform remains protected. Discover how our seamless verification solutions can help you build trust and scale with confidence. Explore our services at https://in.springverify.com.