Think of your PAN card as more than just a tax document. It’s the master key to your entire financial life. Because of its central role, this single card has become an incredibly valuable target for fraudsters, making PAN card misuse a significant and growing threat for every Indian citizen.

Table of Contents

Why Your PAN Card Is a Target for Fraud

Imagine your PAN card as your unique digital fingerprint in the financial world. It’s required for nearly every significant monetary activity you undertake. Whether you’re opening a simple bank account, making large investments, or securing a loan, your PAN is the primary identifier that stitches all your transactions together.

This central role is precisely what makes it so attractive to criminals. They don’t just see a ten-character alphanumeric code; they see a gateway to your financial identity.

The Power of a Single Document

Your PAN card’s power has grown exponentially over the years. Not too long ago, it was mainly a tool for the Income Tax Department. Today, its mandatory linkage with other critical documents has turned it into a central point of vulnerability.

Several key linkages dramatically increase this risk:

- Bank Accounts: All your savings, current, and investment accounts are directly tied to your PAN.

- Aadhaar Card: The government’s mandate to link PAN with Aadhaar created a powerful, interconnected identity profile that’s rich with personal data.

- Credit History: Your entire credit history, managed by bureaus like CIBIL, is tracked using your PAN.

This web of connections means that if a fraudster gets their hands on your PAN details, they don’t just have one piece of information—they have the key that can potentially unlock your entire financial life.

A compromised PAN isn’t just a minor inconvenience; it’s a full-blown identity crisis waiting to happen. Fraudsters can apply for loans, make high-value purchases, or even commit tax fraud, all in your name.

One of the biggest concerns stems from the government’s 2018 mandate to link PAN with Aadhaar and bank accounts, which drastically raised the stakes. In fact, a majority of bank fraud cases in India now show connections to the misuse of these linked IDs. You can learn more about the scale of this issue and how to report PAN card misuse to protect yourself.

Understanding these vulnerabilities is the first, most crucial step toward keeping your identity safe.

Common Ways Fraudsters Misuse Your PAN Card

Knowing how criminals get their hands on your PAN details is the first step toward building a solid defence against them. Fraudsters are always coming up with new schemes, but most of their attacks fall into a few familiar categories. The scary part? They don’t even need your physical card; your 10-digit PAN number is often more than enough to start causing serious financial and legal headaches for you.

Imagine this: you pop into a local cybercafé to print a copy of your PAN card. The operator, without your knowledge, saves a digital copy to their computer. Weeks later, they use that information to apply for a small personal loan in your name from an online lending app. You’re completely in the dark until collection agents start calling.

Let’s break down the most common ways this can happen.

Taking Out Loans in Your Name

One of the most damaging types of PAN card misuse is when criminals apply for loans and credit cards using your identity. With the explosion of instant loan apps, many of which have shockingly weak verification processes, it’s become frighteningly easy for fraudsters to use your stolen PAN details to secure credit. They take the money and disappear, leaving the unpaid loan to wreck your financial health.

The consequences for you are severe:

- Damaged Credit Score: Unpaid loans taken out in your name will cause your CIBIL score to plummet, making it almost impossible for you to get a genuine loan when you actually need one.

- Loan Rejection: When you eventually apply for a home, car, or personal loan, it will likely be rejected because of a poor credit history you didn’t even know you had.

- Harassment from Lenders: You could start getting aggressive calls and visits from banks and collection agencies for a debt that isn’t even yours.

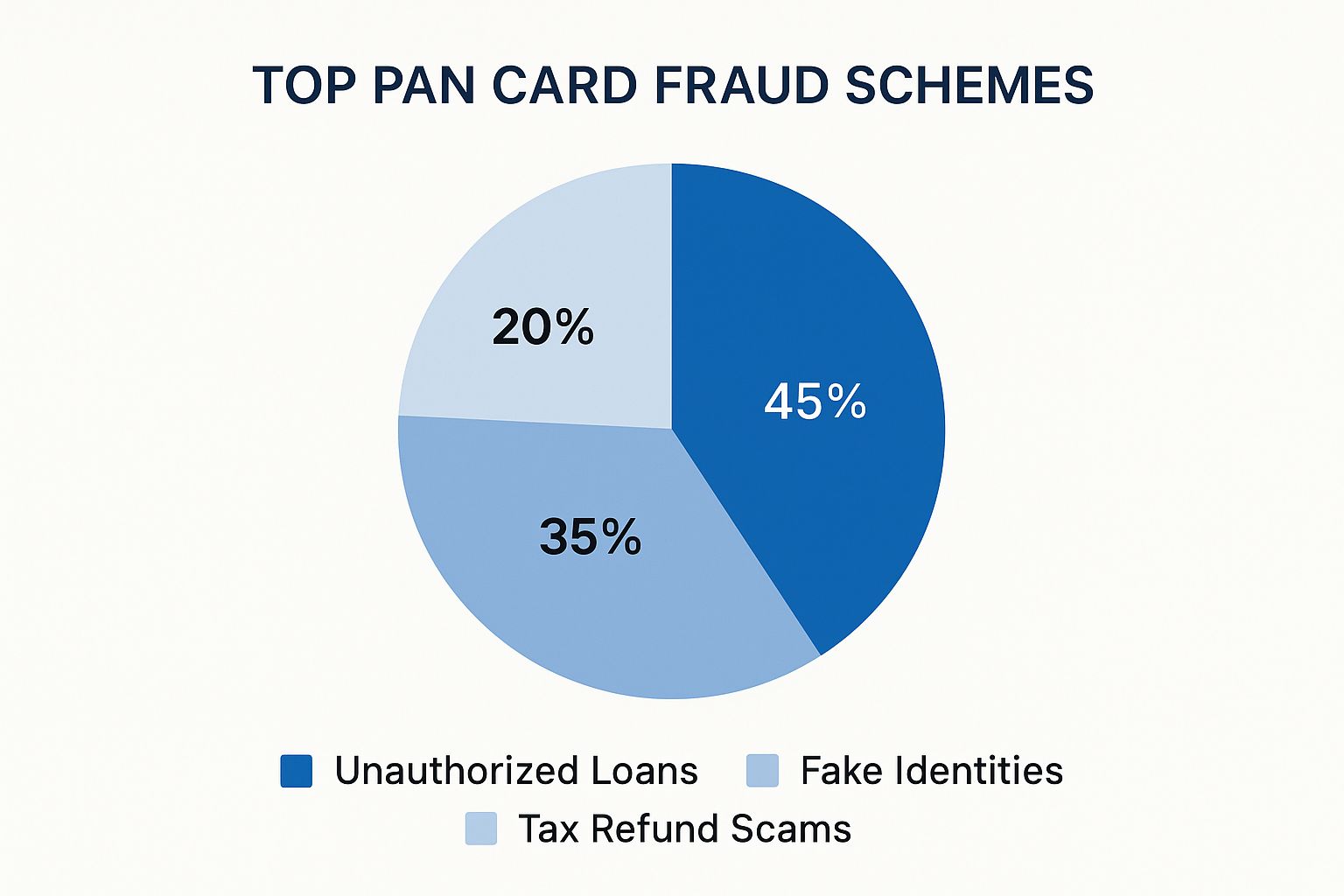

This infographic shows just how common these schemes are, with unauthorised loans making up the biggest chunk of PAN card fraud.

As the chart makes clear, nearly half of all misuse cases involve fraudulent loans. This really drives home how critical it is to check your credit report regularly for any activity that looks unfamiliar.

Creating Fake Identities for Illegal Acts

Beyond just loans, fraudsters use your PAN to build fake or synthetic identities. These false personas are then used for all sorts of illegal activities, making you an unknowing accomplice in their crimes.

A scammer could take your PAN number, slap on someone else’s photo, and add a fake address to create a seemingly legitimate ID. This new identity can then be used to open bank accounts for money laundering, buy expensive goods without paying taxes, or even book hotel rooms for criminal purposes. You won’t have a clue until a legal notice shows up at your door.

The misuse of a PAN card extends far beyond simple financial fraud. It can entangle you in complex criminal investigations, forcing you to prove your innocence for actions you never committed.

To give you a clearer picture, here’s a breakdown of the most common types of PAN card fraud and the trouble they can cause.

Types of PAN Card Misuse and Their Impact

| Type of Fraud | How It Works | Potential Impact on the Victim |

|---|---|---|

| Fraudulent Loans & Credit Cards | Criminals use your PAN to apply for credit from lenders with weak verification, then default on payments. | Drastically lowered CIBIL score, rejection of future loan applications, and harassment from collection agents. |

| Identity Theft | Your PAN is combined with fake details (photo, address) to create a new, fraudulent identity. | You could be unknowingly linked to money laundering, tax evasion, or other criminal activities. |

| Tax Evasion | Scammers use your PAN to file false tax returns and claim refunds in their own bank accounts. | You face scrutiny, penalties, and legal action from the Income Tax Department for fraud you didn’t commit. |

| Unauthorised High-Value Transactions | Your PAN is quoted for large purchases (like jewellery or property) to avoid flagging the fraudster’s own identity. | The transactions appear on your financial record (Form 26AS), potentially triggering a tax notice for undeclared income. |

Understanding these schemes is the first step toward protecting yourself from becoming another statistic.

Committing Tax Evasion and Fraud

Another favourite tactic for criminals is using stolen PAN details to commit tax-related fraud. They might use your PAN to file fake tax returns, claiming fraudulent refunds from the Income Tax Department. While they pocket the cash, you’re the one left to deal with the official investigation and potential penalties.

In fact, one detailed investigation found that counterfeit PAN cards were involved in over 27% of all identity fraud cases reported nationwide. This makes PAN misuse the single largest category of identity theft, used for everything from opening illegal bank accounts to claiming bogus tax refunds. You can find more insights into how fraudsters are stealing money using your identity at The News Minute. The more you know about these schemes, the better you’ll be at spotting the red flags.

The Financial and Legal Damage of PAN Card Fraud

When your PAN card is misused, it sets off a destructive chain reaction that goes way beyond a single dodgy transaction. This isn’t just about losing some money. It’s about your financial identity being hijacked, leaving you to face legal problems you never saw coming. Often, the damage builds quietly in the background until it blows up into a full-blown crisis.

Think of your financial reputation as something you’ve built brick by brick over years. A fraudulent loan taken out in your name is like a wrecking ball to that structure, capable of demolishing your credit score overnight. This one act can lock you out of getting genuine credit for years to come.

So when you eventually need that home loan or a car loan, you’ll likely be met with a flat-out rejection. All because of a debt you didn’t even know existed. For most victims, this immediate financial paralysis is the first and most painful hit.

The Hidden Legal Entanglements

The financial mess is just the beginning. The real danger lies in the hidden legal traps that PAN card misuse can spring on you. Fraudsters love using stolen PAN details as a cover for serious criminal activities, turning you into an unintentional accomplice in their schemes.

Suddenly, you could find yourself linked to:

- Money Laundering: Criminals might open bank accounts with your PAN to funnel illegal funds, putting your name and face on the whole operation.

- Tax Evasion: Your PAN could be used for high-value transactions or to claim fake tax refunds, landing you squarely in the sights of the Income Tax Department.

- Creating Synthetic Identities: Fraudsters can stitch your PAN together with other fake details to create a brand-new identity. This new persona can then be used for all sorts of crimes, from renting properties for illegal activities to taking out multiple loans.

Just like that, the burden of proof is on you. You’re left to navigate a confusing maze of banks, credit bureaus, and police departments to prove you’re innocent. It’s a process that doesn’t just drain your bank account, but your time and emotional energy as well.

A compromised PAN number can quickly spiral into a legal nightmare, forcing you to untangle yourself from criminal investigations for actions you had no part in. The path to clearing your name is often long and arduous.

The Long Road to Recovery

Clawing your way back from PAN card fraud is a marathon, not a sprint. The initial shock wears off and is replaced by the long grind of filing police reports, fighting fraudulent transactions with lenders, and constantly chasing up credit agencies to fix your records. Every single step demands patience and perfect documentation.

For businesses, this is a huge red flag. Ensuring a person’s PAN is legitimate is a non-negotiable step for maintaining security and compliance with Indian regulations. Verifying identity documents right at the source is the best way to stop fraudsters from getting into your system in the first place, protecting both your company and your genuine customers from the fallout of identity theft. The consequences make it clear: robust verification isn’t a “nice-to-have” anymore—it’s a core part of managing risk.

How to Check for Unauthorized PAN Card Activity

Staying on top of your financial footprint is the single best way to catch PAN card misuse before it blows up into a real crisis. Think of it as a regular health check-up for your finances. If you know where to look, you can spot suspicious activity early on and shut it down.

And you don’t need to be a financial wizard to play detective. The two most powerful tools you have are your credit report and your Form 26AS. These documents are like a detailed logbook of your financial life, recording every transaction tied to your PAN.

Uncover Clues in Your Credit Report

Your credit report is the first place you should look for signs of fraud. It’s a comprehensive list of every single loan and credit card account opened with your PAN. A sudden, unexplained dip in your score is a massive red flag that something’s wrong.

You can get a free credit report from bureaus like CIBIL, Experian, or Equifax. When you get it, scan for these tell-tale signs:

- Unknown Loans or Credit Cards: Are there accounts listed that you have absolutely no memory of opening? This is the clearest, most direct sign of fraud.

- Suspicious Credit Inquiries: Lenders run a “hard inquiry” whenever you apply for credit. If you see a bunch of inquiries from banks or lenders you’ve never even spoken to, it means someone is trying to take out loans in your name.

Running a personal credit check regularly is essential for catching these issues. For employers, understanding a candidate’s financial standing through a professional credit history check can also be a vital part of the verification process, showing just how important this document is.

A clean credit report is a sign of good financial health. Any unfamiliar entry, no matter how small, should be treated as a potential threat and investigated immediately.

Scrutinise Your Form 26AS

Your second key tool is your Form 26AS, which is your annual consolidated tax statement. You can find this document on the Income Tax Department’s e-filing portal, and it shows all the tax deducted at source (TDS) on your behalf throughout the year.

Here’s what the official portal where you can access your tax information looks like.

Logging in here gives you direct access to the financial records the tax authorities have on you.

Since TDS is directly linked to your PAN, this form can uncover financial activities you might otherwise miss. For example, if a crook used your PAN for a high-value transaction where tax was cut, it will show up here. Look for TDS entries from unfamiliar sources or for income you know you didn’t earn. This trick can help you spot PAN card misuse long before it ever hits your credit score.

Actionable Steps to Safeguard Your PAN Details

While keeping an eye out for fraud is a good start, the best defence against PAN card misuse is a proactive one. By building a few simple yet powerful habits, you can wrap multiple layers of security around your financial identity, making it much tougher for criminals to get through.

Think of your PAN details as the keys to your financial home—you wouldn’t just leave them lying around. The same logic applies here. You need to treat your PAN information with care, both in the physical world and online.

Smart Habits for Physical Documents

Your physical PAN card and any photocopies are just as vulnerable as your digital data. A copy carelessly thrown away or an unsecured card can easily end up in the wrong hands.

Here are a few practices that should be non-negotiable:

- Annotate Your Photocopies: This is a simple but incredibly effective trick. Before you hand over a PAN card copy, write the specific purpose and date right on it. For example, “For Car Loan Application with [Bank Name] Only – 15 October 2024” written across the copy makes it almost impossible to reuse for another scam.

- Never Leave Copies Behind: If you’re at a print shop or a cybercafé, always double-check that you’ve collected every single copy. Just as important, make sure no digital version was left saved on the public computer.

- Limit Who You Share With: If another ID like a driver’s licence or voter card will do, use that instead. The fewer places your PAN is floating around, the lower your risk of it being exposed.

These small steps can make a massive difference in preventing your physical documents from being turned against you.

Strengthening Your Digital Defences

In our connected world, protecting your PAN information online is more critical than ever. Fraudsters are always coming up with new tricks, from phishing emails to malware, to fool you into giving up sensitive data.

Stay vigilant by learning to recognise common online threats:

- Spot Phishing Scams: Be extremely suspicious of any unsolicited email or SMS asking you to “update your KYC” or “verify your PAN details.” Real banks and financial institutions will never ask for your PAN number, password, or an OTP through a random link.

- Avoid Public Wi-Fi for Transactions: Never, ever access your bank accounts, file taxes, or handle any financial business on public or unsecured Wi-Fi. These networks are a playground for data thieves.

A solid rule of thumb is to treat every unexpected request for your PAN with suspicion. Always go back to the official source to verify before you share anything.

Personal vigilance is key, but it works best when paired with strong digital defences. It’s wise to adopt essential security best practices to shield all your devices from malware and prying eyes.

Finally, think twice before you share a picture of your PAN card on messaging apps like WhatsApp. The moment you hit send, you lose all control over where that image goes. It only takes one screenshot for your data to be compromised. By combining these physical and digital safety measures, you can build a formidable shield against the growing threat of PAN card misuse.

The Role of Verification in Fighting Modern Fraud

While being careful with your own PAN card is a great first step, the real fight against misuse happens on a much bigger scale. It comes down to robust verification systems. In a world where digital documents can be faked with a few clicks, businesses simply can’t afford to take an ID at face value anymore. The game has shifted from cleaning up the mess after fraud to stopping it before it even starts.

And a simple check of a PAN number against a database just doesn’t cut it these days. Modern fraud is way more sophisticated. Criminals are now using synthetic identities—a dangerous cocktail of real information (like a stolen PAN) mixed with made-up details (a fake name or address). These doctored profiles are slippery and can often sneak past basic security checks, which is why a multi-layered approach to verification is no longer optional.

Moving Beyond Simple Checks

So, what does effective fraud prevention look like now? It’s all about connecting the dots.

Real security comes from cross-referencing data across multiple government-issued IDs. By checking a PAN against an Aadhaar card, a driver’s licence, or a voter ID, companies can spot the tiny inconsistencies that give away a fake identity. Think of it as creating a security net with much smaller holes, making it significantly harder for criminals to slip through.

This is exactly where professional identity verification services come into play. They provide the tools and technology for organisations to confirm that a person is exactly who they claim to be, nipping fraud in the bud.

By catching synthetic identities before they ever get into the system, businesses don’t just protect themselves from financial loss. They also protect the entire ecosystem from the ripple effects of PAN card misuse.

A recent case out of Bengaluru paints a stark picture of why this is so critical. A fraud ring cooked up over 200 synthetic identities using AI to generate fake PAN and Aadhaar details. These fakes were good enough to pass basic e-KYC checks, allowing them to secure microloans. The scheme swindled at least five lenders out of nearly ₹4 crores before it was finally uncovered—a disaster that better cross-verification could have easily prevented.

To truly strengthen our defences, we need to embrace more advanced technological tools and frameworks. Explore how global standards like ISO 27001 and AI-powered risk detection contribute to fraud prevention. By adopting these stronger methods, we can work together to build a much safer financial environment for everyone.

Frequently Asked Questions

Can someone take money from my bank with just my PAN card?

Not directly, no. A fraudster can’t just walk up to a bank or an ATM with your PAN card number and pull money out of your account. Think of your PAN as a financial identifier, not a key to your bank vault.

However, the real danger is what they can do with it. Armed with your PAN, they could apply for credit cards or personal loans in your name. If they succeed, you’re left with the debt, and your credit score takes a massive hit.

What is the penalty for misuse of a PAN card?

The consequences can be quite severe. Under Section 272B of the Income Tax Act, there’s a straightforward penalty of ₹10,000 for each instance where incorrect PAN details are provided or where the PAN isn’t quoted when required.

But that’s just the starting point. If the misuse is part of a larger scheme like identity theft or deliberate tax evasion, it can escalate into a criminal matter, leading to much bigger legal troubles.

How can I know if my PAN card is being misused?

The best way is to keep a close eye on your financial footprint. Make it a habit to check your credit report regularly from bureaus like CIBIL. Look for any loans, credit card applications, or inquiries that you don’t recognise—these are major red flags.

Another critical document to review is your Form 26AS, which is available on the income tax portal. This form is a consolidated statement of all tax-related transactions linked to your PAN. If you see any financial entries or TDS deductions that look unfamiliar, it’s a sign that someone might be using your PAN without your knowledge.

At SpringVerify, we understand that building trust starts with knowing who you’re hiring. Our advanced screening solutions help businesses confirm identities securely, stopping fraud before it can start and protecting both your organisation and your customers. Make hiring decisions with confidence by visiting our website.