Think of Know Your Customer (KYC) in India less as a bureaucratic hurdle and more like a crucial digital handshake. It’s the mandatory process financial institutions use to confirm you are who you say you are, establishing a foundation of trust. In reality, it’s the country’s first line of defence against financial crime.

Table of Contents

What KYC in India Really Means for You

At its heart, KYC is a trust-building exercise mandated by law. Whether you’re opening a bank account, investing in a mutual fund, or just getting a new SIM card, that institution needs to be certain of your identity. This isn’t just about ticking boxes on a form; it’s a fundamental security measure that holds the entire financial ecosystem together.

The main reason for this process is to clamp down on illicit activities like money laundering, terrorist financing, and identity theft. By verifying every customer’s identity and address, institutions create a transparent and accountable environment, making it incredibly difficult for criminals to exploit the system.

The Guardian of Financial Stability

The chief regulator overseeing KYC in India is the Reserve Bank of India (RBI). The RBI sets the rules of the game that all banks, non-banking financial companies (NBFCs), and digital payment systems must play by. These directives aren’t arbitrary; they are rooted in the Prevention of Money Laundering Act (PMLA), 2002, the key legislation that gives these anti-fraud measures their legal teeth.

Think of the RBI as the architect of India’s financial safety net. Its job is to ensure verification standards are robust, current, and applied consistently everywhere. This central oversight keeps the system effective and in line with global anti-money laundering standards.

The Evolution from Paper to Pixels

Not too long ago, “doing your KYC” meant dragging a thick folder of photocopies and a few passport-sized photos to a branch office. It was slow, clunky, and wide open to human error. Thankfully, that picture has changed dramatically.

The journey of KYC in India has been a remarkable shift from physical paperwork to almost instant digital verification. This was spurred on by new technology and a more forward-thinking regulatory approach. The introduction of Aadhaar-based e-KYC and, more recently, Video KYC (V-CIP) has made the entire process faster, more secure, and accessible to millions across the country.

This evolution really boils down to two key benefits:

- Enhanced Security: Digital methods slash the risk of forged documents and create a much more reliable audit trail.

- Greater Convenience: You can now get verified from the comfort of your home, often in just a few minutes.

The purpose of KYC is not to create obstacles but to build a secure financial environment. By confirming customer identities, institutions protect not only themselves but also their honest customers from the fallout of financial crime.

Understanding this ‘why’ is the first step to appreciating the system. It’s a joint effort between you, your financial institution, and the regulators to keep our financial network safe and trustworthy for everyone involved.

Navigating the Rules of KYC Compliance

The rules around KYC in India aren’t just a random set of guidelines; they’re a carefully built legal wall designed to protect the country’s financial system. The cornerstone of this structure is the Prevention of Money Laundering Act (PMLA), 2002. You can think of the PMLA as the constitution for financial security—it gives regulators like the RBI the power to create and enforce the KYC norms we see today.

So, when a bank asks you for your documents, it’s not being difficult. It’s following a direct mandate that flows from this powerful act. And these rules aren’t set in stone. They’re constantly being updated to tackle new threats, making sure India’s financial system stays secure and in step with global anti-fraud efforts.

The Logic of Risk Categorisation

A key concept that financial institutions work with is risk categorisation. It’s simple, really: not every customer carries the same level of risk, and the regulations get that. Banks generally group customers into three tiers:

- Low-Risk Customers: This is usually where salaried individuals, government employees, and people with steady, predictable financial lives fall. Their transactions don’t raise eyebrows, so they pose a minimal risk.

- Medium-Risk Customers: This group might include small business owners, traders, or anyone with a less predictable income. Their finances need a closer look, but they aren’t automatically considered suspicious.

- High-Risk Customers: This category is for individuals or businesses whose financial activities could be more easily misused. This includes Politically Exposed Persons (PEPs), clients from high-risk countries, or businesses that handle large amounts of cash.

This system is vital because it determines how often you need to update your KYC details. It’s a smart way to focus energy and resources where they’re needed most, making the whole compliance machine run more smoothly.

KYC Is Not a One-Time Event

One of the biggest myths about KYC is that it’s a one-and-done task when you open an account. The truth is, it’s an ongoing relationship of trust between you and your financial institution. This process, known as periodic updation, is mandatory to make sure the information on file is always current and correct.

How often you need to do this is tied directly to your risk category:

- High-Risk: Every 2 years

- Medium-Risk: Every 8 years

- Low-Risk: Every 10 years

KYC compliance is a continuous cycle of verification, monitoring, and updating. This ensures that the financial system can adapt to changes in a customer’s profile and respond to new security threats as they appear.

This constant diligence is what keeps the system strong. It closes security gaps that could be created by outdated information. For individuals, staying on top of these updates means seamless access to your accounts. For businesses, keeping a compliant framework is non-negotiable. You can learn more by exploring our detailed guide on regulatory compliance challenges.

The Evolving Nature of RBI Directives

The RBI is always tweaking its KYC directives to keep up with new challenges. For instance, recent moves show a growing pressure on financial institutions to keep their records fresh. The RBI’s KYC amendment directions, which kick in from June 12, 2025, put a major focus on better monitoring and timely updates, even for the huge base of low-risk retail customers.

Under these new rules, institutions must update KYC documents within one year of their due date or by June 30, 2026, whichever is later. This is a massive push to ensure data freshness across millions of accounts. To make it easier, the RBI has also officially allowed Business Correspondents to help with KYC updates using secure biometric e-KYC, a big help for customers in remote areas. You can dig deeper into these RBI KYC amendment directions and their impact on financial compliance.

The Essential Documents for KYC Verification

Getting your KYC in India done successfully really comes down to one thing: having the right documents ready to go. Think of it like packing for a trip; if you have your tickets and ID sorted beforehand, the whole journey is much smoother. The regulators have made this pretty straightforward by splitting the required documents into two simple categories.

These two pillars of verification are Proof of Identity (POI) and Proof of Address (POA). It’s a simple concept: one proves who you are, and the other proves where you live. Together, they build a credible profile for financial institutions, helping them meet their compliance duties under RBI guidelines.

The Core Documents You Will Need

The government has a list of what they call Officially Valid Documents (OVDs). These are the gold standard for KYC and are accepted by everyone, from banks to insurance companies.

Here’s your main checklist of OVDs:

- Aadhaar Card: This is the most common one and often lets you do an instant e-KYC.

- PAN Card: A unique 10-digit alphanumeric code that’s a must-have for almost any financial transaction.

- Indian Passport: A globally recognised document that handily works as both POI and POA.

- Voter’s ID Card: Also known as the Elector’s Photo Identity Card (EPIC).

- Driving Licence: Another popular document that can verify both your identity and address.

- NREGA Job Card: Issued by state governments, this card is also a valid OVD.

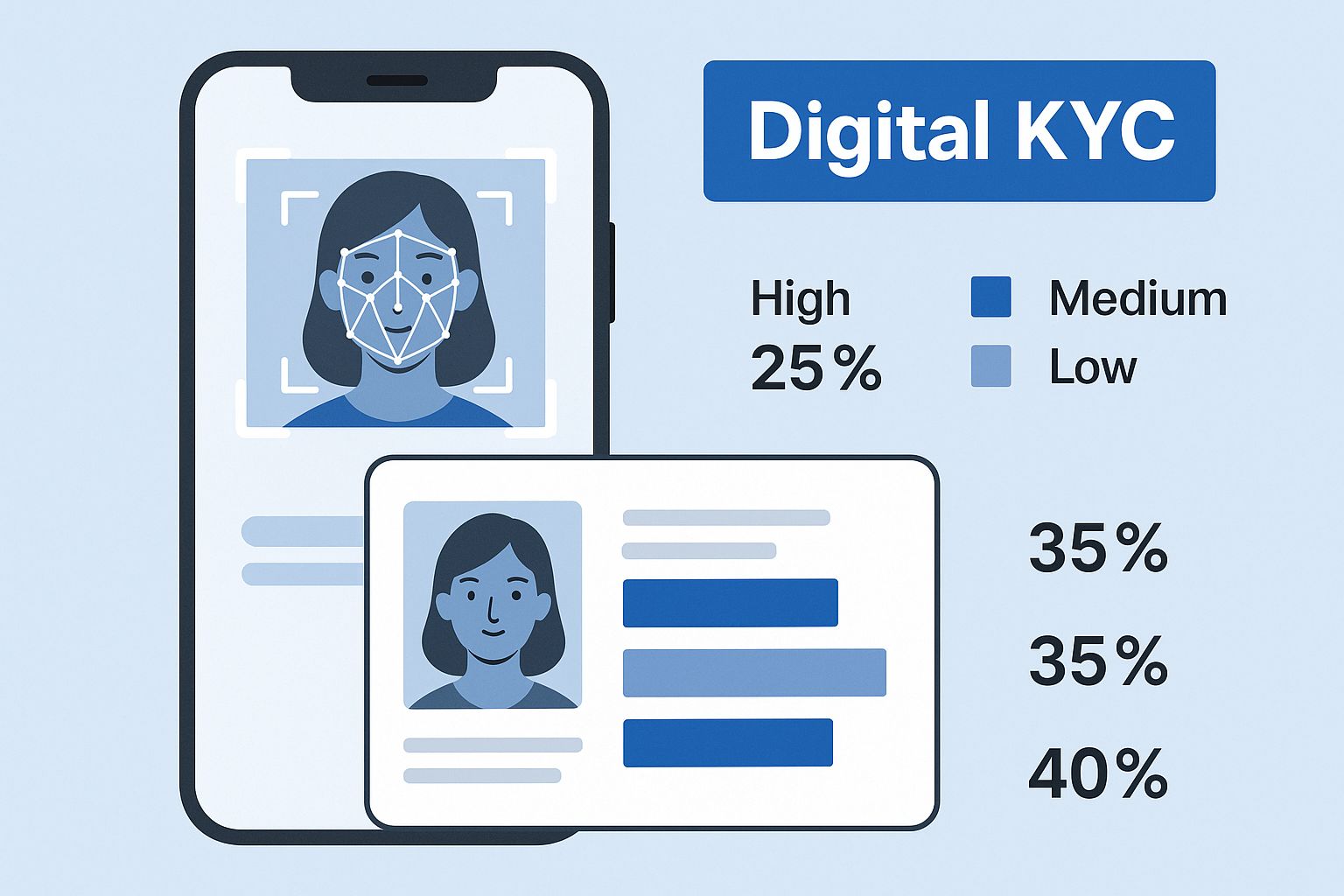

This image shows just how much technology, like digital KYC, has changed the game, using these very documents for lightning-fast verification.

The image really drives home the shift to mobile-first verification. Instead of piles of paper, documents are now scanned and verified on the spot, making the entire KYC process far more convenient for everyone involved.

Proof Of Identity vs. Proof Of Address: What’s The Difference?

One of the most common hiccups people run into is figuring out which document works for what. It’s a fair question. While some OVDs are multitaskers, serving as both POI and POA, others are more specialised. For example, your PAN card is solid proof of who you are, but since it doesn’t have your address on it, you can’t use it as a POA.

To make this clearer, here’s a quick breakdown of which OVDs are accepted for each purpose.

Officially Valid Documents for KYC in India

A clear guide to the documents accepted as Proof of Identity (POI) and Proof of Address (POA) for KYC verification.

| Document Type | Accepted as Proof of Identity (POI) | Accepted as Proof of Address (POA) |

|---|---|---|

| Aadhaar Card | Yes | Yes |

| Indian Passport | Yes | Yes |

| Driving Licence | Yes | Yes |

| Voter’s ID Card | Yes | Yes |

| PAN Card | Yes | No |

| NREGA Job Card | Yes | Yes |

As you can see, documents like a Passport or Aadhaar Card pull double duty because they typically have both your photo and current address. Getting this right from the start is the secret to a hassle-free experience.

Understanding the distinction between POI and POA is key to avoiding delays. Always check if your chosen document satisfies the specific requirement—identity, address, or both—before submitting your application. This simple step can prevent back-and-forth communication and speed up your verification.

For businesses that want to build these verification checks right into their own apps or websites, understanding the tech side of things is crucial. A great way to simplify this is by exploring KYC API integrations that automate document validation and cut down on manual work. At the end of the day, a clear, organised approach to document collection is the best way to ensure a smooth KYC journey for everyone.

How Digital KYC is Changing the Game

The days of lugging photocopies to a bank branch are fading fast. India has jumped headfirst into using technology to make identity verification quicker, safer, and something everyone can access. This isn’t just a minor tweak for convenience; it’s a huge shift that’s unlocking financial services for millions of people.

This whole digital revolution stands on two massive pillars that are completely reshaping KYC in India: Aadhaar-based e-KYC and the Video-based Customer Identification Process (V-CIP). These two together are making remote verification a secure, everyday reality.

The Instant Handshake of Aadhaar e-KYC

What if you could get your entire identity verified in the time it takes to get a text message? That’s exactly what e-KYC, or Electronic Know Your Customer, delivers. It leans on the powerful Aadhaar ecosystem to make verification happen almost instantly.

The process itself is beautifully straightforward:

- You share your 12-digit Aadhaar number with a service provider.

- You give them the green light to pull your details from the UIDAI database.

- You confirm it’s really you by entering a one-time password (OTP) sent to your linked mobile number.

In a matter of seconds, the system fetches your name, address, date of birth, and photo directly from the official Aadhaar source. This completely does away with physical paperwork and manual data entry, cutting down on both mistakes and waiting time.

A Face-to-Face Meeting from Anywhere with V-CIP

While e-KYC is fantastic for quick, data-driven checks, some scenarios just need a more human touch. That’s where the Video-based Customer Identification Process (V-CIP) steps in. Introduced by the RBI, V-CIP is basically a digital, live video call version of the old-school, in-person verification.

Think of it as a secure video conference with a trained official from a bank or financial institution. During this call, a bunch of security checks are happening in the background to make sure everything is completely locked down.

A standard V-CIP session involves:

- Live Interaction: You’ll have a real-time conversation with a trained official to confirm who you are.

- Document Capture: The official will ask you to hold up your original PAN card and might take screenshots of other official documents.

- Facial Recognition: Smart software matches your live video feed with the photo on your official ID.

- Geo-tagging: The system logs your location to confirm you’re physically in India during the call.

This approach blends human oversight with smart tech, creating a verification process that’s both tough on fraud and incredibly easy for the customer. It tears down geographical walls, letting someone in a remote village open a bank account with an institution in a big city, all from the comfort of their home.

Digital KYC methods like e-KYC and V-CIP are more than just tech upgrades; they’re engines for financial inclusion. By making verification simple and accessible, they’re bringing millions of Indians into the formal financial system.

The results speak for themselves. India’s swift move to these digital methods is a major step forward for financial compliance. By April 2023, the country had already seen over 14.95 billion Aadhaar-based e-KYC transactions—a clear sign of how widely it’s been adopted across banking, telecom, and insurance.

This digital-first mindset for KYC in India is a massive deal, especially for the booming fintech sector, where speed and security are paramount. By allowing for secure onboarding from anywhere, these technologies help innovative companies grow their customer base while sticking to strict regulatory rules.

Unlocking Convenience with the CKYC Registry

Imagine completing your KYC verification just once and then using that same approval for every financial service you ever need. No more repetitive paperwork. No more submitting the same documents over and over again. That’s the powerful idea behind the Central KYC Records Registry (CKYCR).

It’s a system designed to transform the entire KYC in India experience, turning a frustrating, recurring task into a simple, one-time event. Think of it as a secure, digital identity passport for all your financial needs.

Your Digital Identity Passport

Here’s how it works. When you complete your KYC with a CKYCR-registered institution, they upload your verified details—name, address, photo, and documents—to this central, secure repository. In return, you get a unique 14-digit KYC Identification Number (KIN).

This KIN is your master key. The next time a new bank or mutual fund asks for your KYC, you just give them your KIN. They can instantly access your already-verified records from the registry, ticking their compliance box in seconds. It’s a beautifully simple system that cuts out endless paperwork and saves everyone an incredible amount of time.

This centralised model is a win-win for everyone:

- For you, the customer: No more filling out the same forms or hunting down documents. Your data is also standardised, which means fewer errors and smoother onboarding.

- For financial institutions: They get immediate access to pre-verified, high-quality data. This not only speeds up customer onboarding but also slashes operational costs and strengthens compliance.

The Central KYC Registry is a perfect example of India’s push towards a seamless financial ecosystem. By standardising and centralising customer data, it creates a ‘do it once, use it everywhere’ model that boosts efficiency and security across the entire industry.

The Scale of Centralised KYC

The impact of this initiative is nothing short of massive. As highlighted in the 2025-26 budget speech, over 103 crore individuals—that’s more than 1.03 billion people—are now registered in the CKYCR. This staggering number makes it one of the largest centralised KYC databases in the world.

This huge registry allows banks, insurers, and other financial service providers to tap into a single, trusted source of information. It dramatically speeds up customer onboarding and eliminates redundant effort. You can read more about how this fits into India’s broader KYC simplification strategy.

But this unified system is about more than just convenience. It’s a critical piece of financial infrastructure. It harmonises data standards across different sectors, from banking to insurance to securities. By ensuring every regulated entity works from the same verified information, the CKYCR strengthens the integrity of India’s entire financial network. It’s a foundational step toward a truly integrated and efficient digital economy, making financial services more accessible and secure for every citizen.

Common Questions About KYC in India

The world of KYC in India can feel a bit like alphabet soup, full of acronyms and rules that leave you scratching your head. Whether you’re making your first investment or just trying to keep your bank account running smoothly, a few questions always seem to pop up. Let’s tackle them head-on.

Think of this as your practical guide to the most common KYC puzzles. We’ll clear up the confusion, from which documents you actually need to what happens if you forget to update your details.

Is Aadhaar Absolutely Mandatory for KYC?

This is a big one, and the short answer is no, but it’s complicated. While Aadhaar isn’t legally required to open a bank account, it has become the go-to document for quick and easy e-KYC. Why? Because it’s fast and incredibly convenient for everyone involved.

However, the Supreme Court has been very clear: no essential service can be denied to you just because you don’t have an Aadhaar card. You always have the right to use other Officially Valid Documents (OVDs) to get your KYC done.

These alternatives include:

- Your Indian Passport

- A valid Driving Licence

- The Voter’s ID Card

- Your PAN Card (for Proof of Identity only)

- An NREGA Job Card

So, while Aadhaar certainly speeds things up, it’s not the only way. You’re well within your rights to use any of the other approved OVDs.

What Happens if I Don’t Update My KYC?

Ignoring those reminders to update your KYC can cause some serious headaches. Financial institutions are legally bound to keep customer records current. If you miss the deadline, they have to start restricting your account.

First, you’ll get a few warnings. If you don’t act on them, your bank or mutual fund might put a temporary freeze on your account.

A frozen account means you’re locked out of most transactions. You won’t be able to withdraw cash, transfer funds, or make new investments. Your account isn’t closed, but it’s basically unusable until you complete the update.

This isn’t meant to be a punishment. It’s a regulatory measure to prevent fraud and ensure the financial system isn’t running on outdated information. The good news is that lifting the freeze is usually quick—just submit the required documents, and you’ll be back in business.

How Can I Check My KYC Status Online?

Thankfully, this part is incredibly simple now, especially if your verification was handled by a KYC Registration Agency (KRA). SEBI has authorised several KRAs, and you can check your status on any of their websites.

The process is pretty much the same everywhere:

- Head over to the website of a KRA like CAMS, Karvy, or NDML.

- Look for a link that says “KYC Inquiry” or “Check KYC Status.”

- Enter your PAN card number—it’s the main key to unlock your KYC details.

- Solve the little security captcha and hit submit.

The portal will immediately show you where you stand: verified, pending, or if there’s an issue that needs your attention. If your details are in the Central KYC (CKYC) registry, you can check your status there, too. A “verified” status is what you’re aiming for; it means you’re good to go across different financial platforms.

Can KYC Be Done Entirely Online?

Yes, absolutely. For most services, the days of queueing up at a branch with a stack of photocopies are long gone. Digital methods have made remote KYC in India a secure and standard practice.

There are two main ways this happens online:

- Aadhaar-based e-KYC: This is the lightning-fast option. It uses an OTP sent to your Aadhaar-registered mobile number to pull and verify your details in a matter of seconds.

- Video-based Customer Identification Process (V-CIP): This feels a bit more personal. You’ll have a live video call with an official from the institution. They’ll verify you and your documents in real-time, right through your camera.

Both methods are fully approved by the RBI and are often more secure than the old paper-based way. They’ve been a massive help in bringing financial services to people in remote areas who can’t easily travel to a bank branch.

Why Do Different Institutions Ask for KYC Again?

It’s a valid frustration. You do your KYC with a bank, only to have a mutual fund platform ask you to do it all over again. This happens because, for a long time, different regulators like the RBI, SEBI, and IRDAI all had their own separate rules.

The Central KYC (CKYC) Registry was created to fix this exact problem. Once you complete CKYC, your information is stored in a central database, and you get a unique KYC Identification Number (KIN). Ideally, you’d just share this KIN with any new financial institution.

We’re getting there, but the system isn’t perfectly integrated yet. Some companies still rely on older systems that aren’t plugged into the CKYC registry, so they have to do their own check. The ultimate goal is a “one nation, one KYC” system, and while we’re still in that transition, the days of repeating this process are numbered.

At SpringVerify, we understand that fast, reliable, and compliant identity verification is crucial for your business. Our powerful API seamlessly integrates KYC checks into your workflow, automating the process and ensuring you can onboard customers and employees with confidence. Discover how you can streamline your verification process at https://in.springverify.com.