KYC documents are simply the official papers, like your Aadhaar card, PAN card, or passport, that financial institutions ask for to verify who you are. Think of it as a digital handshake—an essential step to confirm your identity before you can open an account or carry out a transaction.

Understanding Your KYC Document Checklist

Whenever you sign up for a bank account, mutual fund, or even a digital wallet, the organisation is legally required to run a “Know Your Customer” check. This isn’t just a box-ticking exercise; it’s a critical safeguard that helps prevent financial fraud, identity theft, and money laundering. By making sure you are who you claim to be, these institutions create a more secure financial ecosystem for all of us.

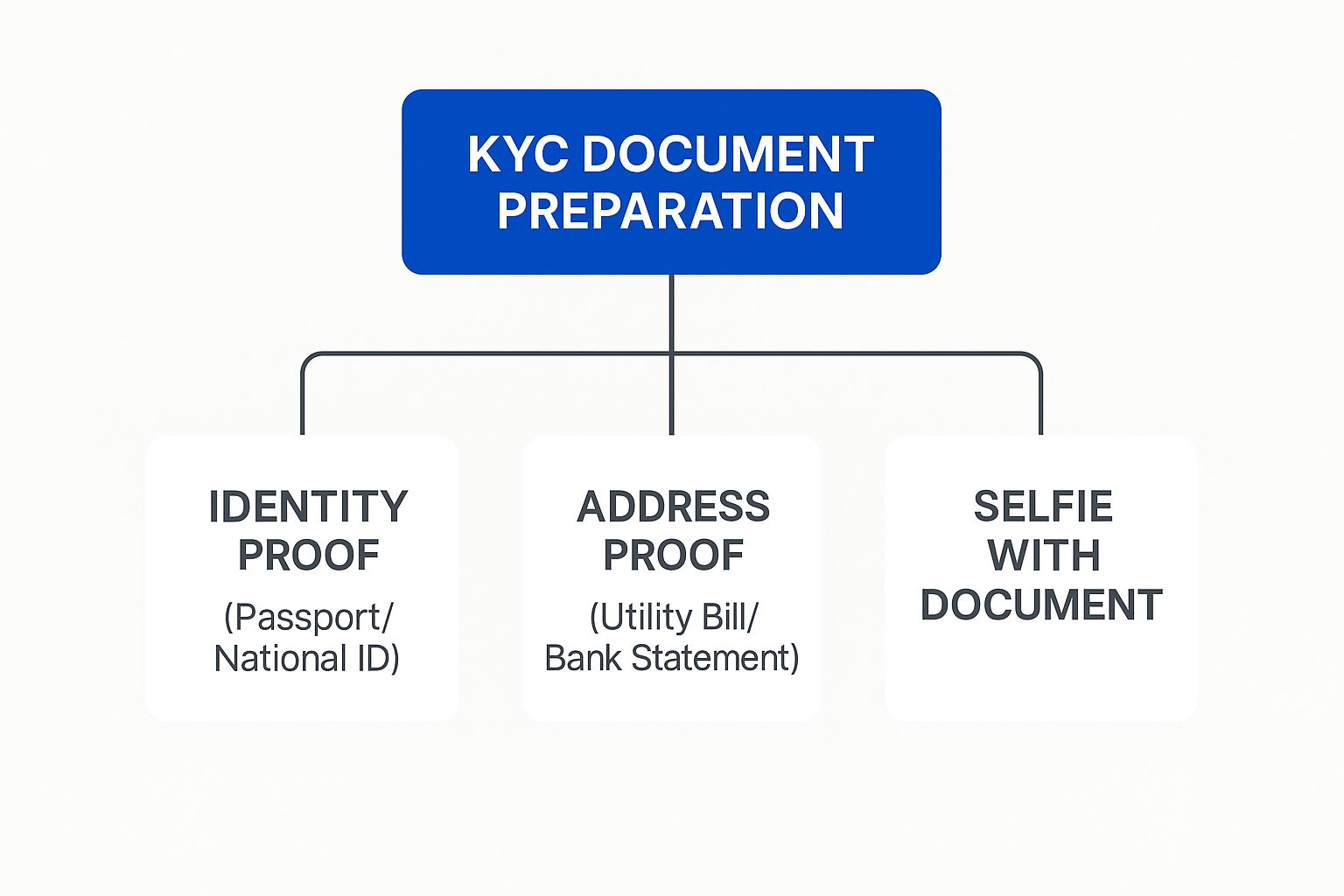

The entire process boils down to providing two key types of documents:

- Proof of Identity (PoI): This confirms your name, photograph, and signature.

- Proof of Address (PoA): This validates where you currently live.

In India, the Aadhaar card has become central to this process, largely thanks to its unique biometric link. The country’s rapid digital adoption is clear from the numbers—by April 2023, there were over 14.95 billion Aadhaar-based e-KYC transactions. This massive figure highlights just how accepted and efficient the system has become. You can find more insights on India’s digital verification trends on Trulioo’s blog.

To make things even clearer, let’s look at the documents most commonly used for KYC.

Common KYC Documents for Individuals in India

This table gives a quick summary of the main documents accepted for both Proof of Identity (PoI) and Proof of Address (PoA) when completing your KYC.

| Document Type | Accepted As Proof of Identity (PoI) | Accepted As Proof of Address (PoA) |

|---|---|---|

| Aadhaar Card | ✔️ | ✔️ |

| PAN Card | ✔️ | ❌ |

| Passport | ✔️ | ✔️ |

| Voter’s ID Card | ✔️ | ✔️ |

| Driving Licence | ✔️ | ✔️ |

| Utility Bills (e.g., electricity, gas) | ❌ | ✔️ |

As you can see, some documents like the Aadhaar card pull double duty for both identity and address, while others like the PAN card are strictly for identity. Keeping these documents handy will make any KYC process much smoother.

Table of Contents

Why Financial Institutions Ask for Your Documents

It’s a familiar feeling. You’re opening a new bank account or starting a mutual fund, and suddenly you’re asked for a mountain of paperwork. It can feel like a bit of a chore, but there’s a crucial reason behind it: KYC is the financial system’s frontline defence against serious crime.

Think of it like the security check at an airport. It might feel like a delay, but its real job is to protect everyone on board. In the same way, when a financial institution verifies what KYC documents you provide, they are putting up a barrier against illegal activities. This process helps stop criminals from using fake identities to commit fraud or other unlawful acts.

The Regulatory Backbone of KYC

This isn’t just a case of individual company policy; it’s the law. In India, the entire KYC framework is built on robust regulations designed to protect the integrity of our financial sector. The two primary goals are crystal clear: prevent money laundering and cut off funding for terrorist activities.

A few key regulations and bodies are at the heart of this enforcement:

- Prevention of Money Laundering Act (PMLA), 2002: This is the cornerstone legislation that makes it mandatory for banks and other financial institutions to verify who their customers are.

- Reserve Bank of India (RBI): The RBI sets the specific KYC guidelines for all banks, ensuring there’s a consistent and secure approach across the entire industry.

- Securities and Exchange Board of India (SEBI): SEBI plays a similar role for the securities market, enforcing KYC norms to protect investors and maintain market stability.

These rules ensure every financial entity does its part to keep the system clean and transparent. To get a fuller sense of the landscape, you can learn more about the broader requirements of Indian compliance standards.

By verifying your identity, financial institutions are not just protecting themselves—they are safeguarding your money and the economic stability of the country. It turns a simple transaction into a secure and trusted interaction.

Ultimately, handing over your documents is a small action that plays into a much larger mission: creating a safer financial environment for everyone.

A Detailed List of KYC Documents for Individuals

To get through your KYC process without a hitch, you’ll need a couple of specific, officially valid documents. It’s a system that hinges on two core concepts: Proof of Identity (PoI) and Proof of Address (PoA).

Think of it this way: PoI is all about proving who you are, while PoA confirms where you live. Simple enough, right?

Some documents are multitaskers and can cover both bases, which definitely makes life easier. But knowing which document fits which category is crucial. Submitting the wrong type is one of the most common reasons applications get stuck in limbo, so getting this right from the start will save you a ton of time and frustration.

Essential Proof of Identity Documents

Your Proof of Identity document is your primary evidence of who you claim to be. The key ingredients? Your name and your photograph.

These are some of the most widely accepted PoI documents in India:

- Aadhaar Card: This is the big one. It’s the most common identifier and is accepted almost everywhere.

- PAN Card: A must-have for most financial transactions, it also serves as rock-solid proof of identity.

- Indian Passport: As an internationally recognised document, it’s a perfect fit for any KYC check.

- Voter’s ID Card: Issued by the Election Commission of India, this is another trusted and valid option.

- Driving Licence: A government-issued photo ID that’s also commonly accepted.

Remember to check that your name on the PoI document perfectly matches the name you used in your application. Even minor spelling differences can lead to a rejection.

If you’re curious about the tech that actually confirms these documents, you can get a better sense of the security measures by exploring how modern identity verification works.

Valid Proof of Address Documents

For your Proof of Address, the document must clearly show your current residential address. Consistency is everything here; the address has to be an exact match to what you’ve put in your application form.

Here are the documents most people use for PoA:

- Aadhaar Card: If your current address is on it, your Aadhaar can pull double duty for both PoI and PoA.

- Passport: Just like the Aadhaar, this can also serve as proof for both your identity and address.

- Recent Utility Bills: Bills for electricity, piped gas, or a landline telephone work well, but they can’t be older than two months.

- Bank Account Statement: A recent statement or a passbook from a scheduled commercial bank is also acceptable.

- Property Documents: You can also use a registered sale agreement or a recent property tax receipt.

A quick tip: always use the most recent documents you have, especially for things like utility bills and bank statements. It’s a small step that ensures a hassle-free verification process.

Getting Your Business KYC-Ready

When it comes to Know Your Customer, businesses have a few more hoops to jump through than individuals do. Think of it this way: just as you have a passport or an Aadhaar card to prove who you are, your company has its own set of official documents that prove it’s a real, legitimate entity with clear ownership. Financial institutions need to see this paperwork to be sure they’re not dealing with a ghost.

This isn’t just red tape for the sake of it. This verification process is a critical defence against shell companies being used for shady activities like money laundering. So, when your business needs to open an account, understanding the specific documentation, like the RAK Bank business account opening requirements, is the key to a smooth process. What you’ll need depends entirely on how your business is structured.

This infographic breaks down the essential document categories you’ll need to get your ducks in a row.

As you can see, no matter what kind of business you run, proving your identity and address is always the starting point.

Key Documents by Business Type

Let’s dive into the specific requirements for common business structures in India.

- Sole Proprietorship: This is the most straightforward setup. The KYC process often looks a lot like an individual’s. You’ll generally need registration documents issued in the business’s name, along with the proprietor’s personal PAN card and address proof. Simple as that.

- Partnership Firm: For partnerships, the core documents are the Partnership Deed, the firm’s PAN card, and its registration certificate. On top of that, you’ll need to provide the KYC documents for all active partners involved.

- Private/Public Limited Company: These entities face the most rigorous checks. Expect to provide the company’s PAN card, Certificate of Incorporation, Memorandum of Association (MoA), Articles of Association (AoA), and a board resolution that authorises the transaction or account opening.

A common trip-up is forgetting the board resolution. This document is non-negotiable for corporate KYC, as it officially gives specific individuals the power to act on the company’s behalf.

This methodical approach is all part of India’s larger push for financial transparency. Regulators have been working to streamline these processes while strengthening the legal framework under the Prevention of Money Laundering Act (PMLA). The goal is to make compliance straightforward—and having the correct paperwork ready from the start is the best way to ensure it is.

The Shift to Digital KYC and CKYC

The days of submitting stacks of photocopies and waiting in endless queues are finally behind us. The entire KYC process has received a much-needed digital makeover, making identity verification faster, more convenient, and far more secure than ever before. This evolution changes the game for handling what KYC documents are required.

Two key innovations are spearheading this change: Aadhaar-based e-KYC and the Video-based Customer Identification Process (V-CIP). Instead of slow manual checks, these methods use technology to confirm who you are in just a few minutes.

- Aadhaar e-KYC: This method taps into your Aadhaar number to pull your details straight from the UIDAI database. Verification is almost instant, happening either through an OTP sent to your registered mobile number or with a quick biometric scan.

- V-CIP: Think of this as a face-to-face verification, but done over a live video call. An official from the financial institution will chat with you, capture a live photo, and verify your original documents in real-time, right on screen.

The Power of Central KYC

But perhaps the biggest leap forward is the Central KYC Registry (CKYCR). It’s a centralised, secure digital vault for all customer KYC records. Imagine a single digital locker that holds your verified information safely. Once you complete your CKYC process with any regulated financial institution, your details are stored here.

This means you only need to do it once. After your information is registered, you’re given a unique 14-digit KYC Identification Number (KIN). For any future accounts with other banks or financial companies, you can simply share your KIN instead of going through the whole document submission routine again.

This system is a massive time-saver for everyone. As of recent data, the CKYCR already holds over 82 crore (820 million) individual KYC records, with the banking sector accounting for 41% of its use. Regulations now state that once you have a KIN, you shouldn’t be asked for the same documents repeatedly. You can get more details on CKYC rules and how they’re being implemented in Shufti Pro’s comprehensive guide.

Modern businesses can simplify these digital checks even further with powerful tools. You can explore how to streamline your onboarding process through KYC API integrations. This shift towards a centralised and digital framework is making the entire KYC journey remarkably smooth and efficient.

Common Questions About KYC Documents Answered

Even after getting the hang of the basics, a few specific questions about KYC documents tend to trip people up. Let’s clear up some of the most common points of confusion so you’re fully prepared for your next verification.

Navigating the rules around document validity, address changes, and periodic updates is the key to a smooth experience. Getting these details right helps you avoid those frustrating delays or rejections.

Can I Use an Expired Passport or Driving Licence?

In short, no. All documents you submit for KYC must be valid and unexpired. Financial institutions and other regulated companies are legally required to reject any identification that has passed its expiry date. It’s a simple but critical step: always double-check the validity dates before you upload or present your documents.

What if My Current Address Has Changed?

This is a common one. If your current address doesn’t match the one on your official documents, you’ll need to get it updated first. The most straightforward approach is to update your Aadhaar card with your new address.

Once you have the updated card, you can submit it as your new Proof of Address. Some institutions might also accept a very recent utility bill (less than two months old) for the new address, but they’ll often ask for a signed self-declaration form to go along with it.

The golden rule of KYC is consistency. Your name and address must be identical across your application and the documents you provide. Even a small mismatch can flag your application for review.

Is a PAN Card Mandatory for KYC?

For most financial activities in India—especially anything related to banking, investments, or securities trading—a PAN card is mandatory. Government regulations require it for tracking significant transactions to help prevent tax evasion.

While some very low-risk products might offer alternatives, having a PAN card simplifies nearly every KYC process you’ll ever encounter. Think of it as a foundational document for your financial identity in the country.

Ready to make your own hiring and onboarding process faster and more secure? SpringVerify offers instant, reliable background checks and KYC verification. Discover how SpringVerify can help your business today!