When a company decides to run a background check, they’re kicking off a systematic process to make sure a candidate’s story checks out and to keep potential risks at bay. It’s a multi-step dance that involves getting your consent, gathering the right data, and then working with specialised third-party services to verify everything from your identity to your criminal history. Frankly, in today’s business world, this has become a non-negotiable step.

Table of Contents

The Real Process Behind Employee Screening

To really get your head around how companies do background verification, you have to look past the idea of a simple checklist. It’s a carefully structured workflow built to protect the company, its current employees, and its customers.

With remote work becoming the norm and fraud getting more sophisticated by the day, confirming a candidate’s background is no longer just a formality—it’s a critical business function. A thorough check ensures that the person you’re hiring is exactly who they say they are and actually has the qualifications they’ve listed on their CV.

This isn’t about prying into someone’s personal life. It’s about validating professional and legal details that are directly relevant to the job. The depth of these checks is always tailored to the role’s responsibilities. For example, someone applying for a finance role will face much more detailed financial and criminal history checks than a junior person in a creative position.

What Is Typically Verified

At its heart, the verification process looks into several key areas to build a complete and accurate picture of a candidate. Most companies will examine the following:

- Identity Verification: This is the first hurdle. They’re confirming you are who you claim to be, usually with official documents like an Aadhaar or PAN card.

- Employment History: Time to check the CV. This involves contacting your previous employers to verify job titles, dates of employment, and the roles you held. It’s a known fact that fudging employment history is one of the most common things people do on their CVs.

- Educational Qualifications: Here, they’ll reach out to universities and colleges to confirm that your degrees, diplomas, and other academic credentials are all legitimate.

- Criminal Records: This involves searching court and police databases for any history of criminal activity that might be relevant to the job you’re applying for.

- Address Verification: A simple but important check. They’ll confirm, either physically or digitally, that you actually live at the address you’ve provided.

A robust verification process is the foundation of safe and reliable hiring. It’s an investment in organisational integrity, helping to prevent costly hiring mistakes before they happen by ensuring honesty and transparency from the start.

Ultimately, the entire point is to make a well-informed hiring decision based on verified facts, not just gut feelings. If you want to dive deeper into the nuts and bolts of it all, check out this complete guide to pre-employment screening. This structured approach helps build a workplace grounded in trust and safety from day one.

Establishing the Legal and Procedural Framework

Before you even think about running a single background check, you need to build a solid legal and procedural foundation. This initial phase isn’t about the investigation itself, but all about compliance, transparency, and setting the stage for everything that follows.

The entire process hinges on one absolute must-have: getting explicit, written consent from the candidate.

This isn’t just a courtesy; it’s a legal requirement under Indian privacy laws. In most modern workflows, this is handled smoothly with digital consent forms integrated directly into an Applicant Tracking System (ATS). When a candidate applies, they’re prompted to review and sign a disclosure form that clearly states the company’s intent to perform a background check, what information will be looked at, and what their rights are in the process.

Crafting a Transparent Verification Policy

A well-defined background verification policy is the backbone of any fair and legally sound screening programme. Think of this internal document as a guidebook for your HR teams, making sure every single candidate is treated consistently and fairly. A strong policy is much more than a list of rules; it’s a public commitment to transparency.

A robust policy should clearly outline:

- Which roles require checks: Not every position needs the same level of scrutiny. A good policy defines different tiers of verification based on job responsibilities. For example, a finance role will require a more in-depth check than an entry-level marketing position.

- The scope of checks for each role: Get specific. The policy must detail exactly what will be verified—from employment history and education credentials to criminal records and identity documents.

- How results are handled: It’s crucial to have a clear procedure for reviewing reports and managing any discrepancies that come up. This ensures fairness and consistency in decision-making.

This level of detail doesn’t just protect the company; it also informs candidates about exactly what’s being checked and why. It builds trust right from the start and dramatically cuts down the risk of legal headaches down the road. For anyone building their own framework, getting to grips with Indian privacy laws is non-negotiable. You can learn more about ensuring your background checks are compliant with local regulations.

Transparency isn’t just about avoiding legal trouble; it’s about building a foundation of trust with potential employees. When candidates understand the process, they are more likely to view it as a standard part of professional due diligence rather than an invasion of privacy.

A closer look at how companies perform background verification in India shows a multi-step process designed to protect workplace integrity. Checks typically involve validating identity documents like Aadhaar and PAN cards, contacting educational institutions to confirm degrees, verifying past employment details, and reviewing criminal and address records—all of which require the candidate’s written consent.

The timeline for these checks can vary. Identity verifications are usually quick, taking just 1-2 days, while criminal record checks might take up to 10 days because of decentralised records. To navigate these complexities and ensure compliance with ever-changing laws, businesses often team up with specialised verification vendors. This structured approach is what makes modern screening both effective and fair.

A Deep Dive into Core Verification Checks

Once you’ve got the legalities sorted and the candidate’s consent is in hand, the real work begins. This is where you move from paperwork to validation, digging into the details of a candidate’s background to make sure everything lines up. At its heart, each check is about answering one simple question: is the information they provided accurate?

The first stop is almost always identity. Here in India, this has become much easier thanks to official APIs for documents like Aadhaar and PAN cards. Instead of just looking at a photocopy, verification services can ping government databases directly. This gives you a real-time confirmation that the number is valid and that the name and details match what the candidate gave you. It’s a quick, tech-driven step that immediately flags any glaring identity issues from the get-go.

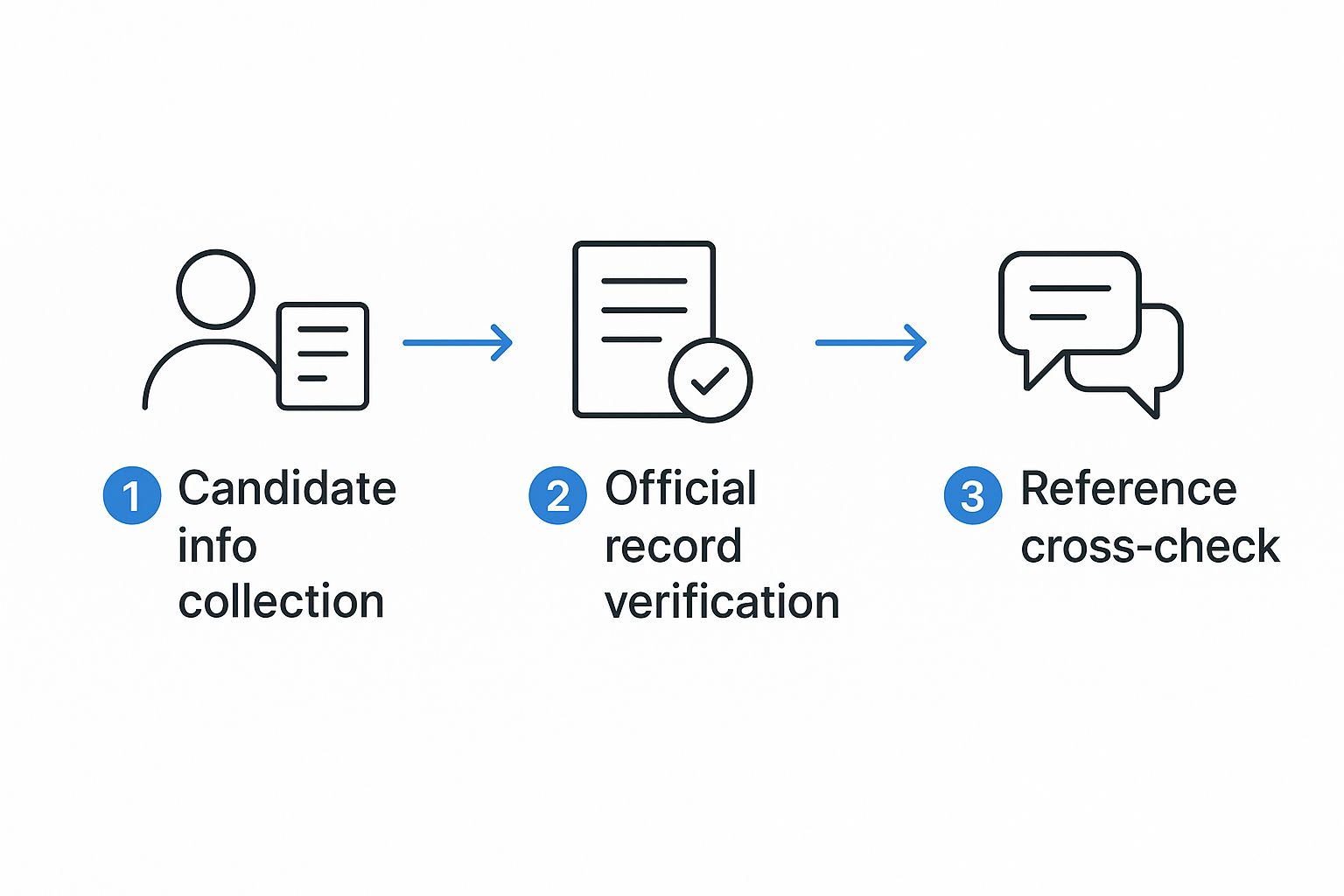

The typical background verification process follows a clear path, moving from collecting basic information to checking it against official records.

This flow shows how each stage builds on the last, from initial data collection to contacting human references for a complete picture.

Verifying Employment and Education History

Next up is what I often find to be the most revealing part of the process: employment history. It’s a well-known fact that a huge number of candidates—around 55%, in fact—tend to embellish their past roles and responsibilities on a CV. To get to the truth, verifiers go straight to the source and contact the HR departments of the previous employers a candidate has listed.

The standard approach is pretty straightforward. A formal request, usually an email, is sent to confirm a few key things:

- Dates of employment: Did they actually work there between the dates they claimed?

- Job title held: Was their designation what they said it was?

- Reason for leaving: This usually just confirms if they resigned or if their employment was terminated.

Things can get a bit tricky when you’re dealing with startups that have since shut down or companies that have been acquired or merged. This is where good investigators really show their worth. They might have to track down former managers on professional networks or piece the puzzle together using documents like relieving letters and payslips. If you want to dive deeper into these nuances, our guide on comprehensive employment verification has all the details.

Educational verification works in a similar way. Verifiers will contact the registrar’s office or the examinations department of the university or college the candidate attended. They’ll cross-reference the candidate’s name, roll number, and graduation year with the official academic records to confirm the degree is legitimate. Spotting fake degrees often comes down to recognising known degree mills or spotting tiny inconsistencies in a document’s design or seal.

Verifying past employment and education isn’t just about catching someone in a lie. It’s about building a foundation of trust. It ensures the skills and experience you’re hiring for are built on a genuine, verifiable history.

How Long Does All This Take?

One of the most common questions we get is about timelines. It’s important to have realistic expectations, as some checks are naturally quicker than others. The time it takes can influence your entire hiring schedule, so knowing the averages is a huge help.

Typical Timelines for Background Verification Checks in India

This table breaks down the average time needed for common verification checks in India, helping you plan your hiring process more effectively.

| Type of Verification Check | Average Completion Time (Working Days) |

|---|---|

| Identity Verification (Aadhaar, PAN) | 1-2 |

| Address Verification (Physical) | 3-7 |

| Employment Verification | 5-10 |

| Education Verification | 5-15 |

| Criminal Record Check | 7-20 |

| Court Record Check | 5-10 |

As you can see, simpler digital checks are fast, while those requiring manual intervention or coordination with third parties, like universities or police departments, take longer. Factoring these timelines into your recruitment process is key to keeping things moving smoothly and managing candidate expectations.

Navigating Criminal Record Checks

The criminal record check is, without a doubt, the most sensitive part of the process. In India, it’s also complicated by the fact that our judicial and police records are decentralised. There’s no single, national database you can just query in an instant.

Because of this, the process involves searching records at local, district, and national levels. This often means physically visiting court complexes or working with local police authorities in the areas where the candidate has lived. The search is looking for any First Information Reports (FIRs), chargesheets, or court convictions tied to the candidate. It’s a methodical, boots-on-the-ground approach, but it’s essential for uncovering red flags that would never show up in a simple online search.

Handling Discrepancies and Red Flags

Sooner or later, a background check is going to come back with something unexpected. It’s just part of the hiring process. When something doesn’t quite add up, it triggers a critical process for managing discrepancies and looking into potential red flags. These can be anything from a minor mix-up in employment dates to more serious issues like an unverified degree or even an undisclosed criminal record.

Understanding how often this happens is key. Take the recent data from OnGrid, a major Indian verification platform. During the 2024–25 fiscal year, they ran over 5 million checks. Out of those, a whopping 367,542 individuals had at least one failed verification.

That means about 7.22% of all candidates showed some kind of red flag. This figure really drives home why having a clear, consistent plan for these situations is non-negotiable. You can read more about the rising complexity of candidate verification in India.

Differentiating Minor Issues from Major Concerns

Not all discrepancies are deal-breakers, and a smart verification process knows how to tell the difference. The first step is to categorise the findings so you can figure out the right way to respond.

- Minor Discrepancies: These are often simple mistakes that can be sorted out quickly. Maybe a candidate was a few weeks off on their start date, or a previous employer had a slightly different job title on file. Usually, a quick chat with the candidate is all it takes to clear things up.

- Major Red Flags: These are far more serious and could point to dishonesty or a significant risk to your company. We’re talking about things like a completely fabricated employment history at a company that doesn’t exist, a fake degree certificate, or a criminal conviction that’s relevant to the job.

For example, being off by two weeks on an employment timeline is minor. But discovering a candidate claimed to work for a company that was never even registered? That’s a major red flag suggesting they intentionally tried to mislead you. Another serious issue could be a failed drug test, which has huge implications for workplace safety. You can dive deeper into what’s involved in setting up a reliable drug test verification process.

Implementing a Fair Adjudication Process

Once a serious red flag is identified, the company enters the adjudication phase. This isn’t about jumping to conclusions; it’s a structured process for deciding what to do next. The goal is to ensure every decision is fair, consistent, and legally sound. Rushing to a negative decision without due process is a recipe for bad hires and potential legal headaches.

The point of adjudication isn’t just to disqualify people. It’s about making an informed and fair decision based on the whole picture, assessing the risk in the context of the specific job role.

A solid adjudication process involves a few key steps:

- Review the Findings: First, the HR team or hiring manager needs to sit down and carefully go through the background check report, paying close attention to the specific details of the discrepancy.

- Consider Job Relevance: Next, they have to ask: is this issue directly relevant to the duties of the position? An undisclosed civil dispute might be a non-issue for a software developer, but it could be a deal-breaker for a chief financial officer.

- Provide an Opportunity to Explain: This is crucial. The candidate must always be given a chance to explain their side of the story. They should be notified of the adverse finding and have the opportunity to provide context or documents to dispute it.

- Make a Final Decision: Finally, based on everything—the report, the job requirements, and the candidate’s explanation—a final, well-documented hiring decision is made.

Using Technology for Smarter Verification

Manual checks are quickly becoming a relic of the past. Today, the way companies handle background verification is driven by a powerful tech stack that delivers accuracy and speed on a scale we couldn’t have imagined just a few years ago. This isn’t just about doing things faster; it’s about digging deeper and connecting the dots in ways a human verifier simply can’t.

At the heart of this modern approach is the Application Programming Interface (API). Think of an API as a secure messenger that lets a company’s Applicant Tracking System (ATS) talk directly to a verification platform. This integration creates a smooth, uninterrupted workflow. It means HR teams can kick off checks, track their progress, and get the final reports without ever having to switch between different software.

The Role of AI and Machine Learning

Beyond basic integration, artificial intelligence (AI) and machine learning have become central to spotting fraud. These systems are trained on massive datasets of documents and records, which allows them to perform incredibly sophisticated anomaly detection.

For instance, an AI can instantly flag tiny inconsistencies that a person might easily miss:

- A slight mismatch in the font used on a degree certificate.

- An Aadhaar number that doesn’t follow the correct checksum algorithm.

- Employment dates that impossibly overlap between two different jobs.

This automated first pass frees up human experts to concentrate on the truly complex cases that need real investigative work.

Technology transforms background verification from a reactive checklist into a proactive risk management strategy. It empowers companies to not only verify claims but to uncover hidden patterns and potential threats with far greater precision.

Tackling Modern Hiring Challenges

Technology also gives us powerful tools to handle newer, more complex issues like dual employment—often called moonlighting. By cross-referencing a candidate’s PAN with official GST and Provident Fund (PF) records, systems can automatically detect if someone has active registrations or contributions tied to another employer. This is a critical check for protecting company data and making sure an employee is fully committed.

A recent Ernst & Young study really drove home the urgency here. It found that a shocking 85% of verification failures were due to employment discrepancies, and a staggering 45% of candidates were caught moonlighting. The report also pointed out that 32% submitted documents from companies that didn’t even exist—a type of fraud that demands robust, tech-enabled vigilance to uncover. You can dig into the full findings on how technology is essential for managing modern hiring risks.

Ultimately, using tech for smarter verification isn’t just about speeding things up. It’s about fundamentally boosting the depth, accuracy, and integrity of every single hire you make, helping you build a more trustworthy workforce from the ground up.

Frequently Asked Questions

Even with a solid grasp of the background verification workflow, plenty of specific questions still pop up. Let’s tackle some of the most common ones we hear to give you that extra bit of clarity and help you navigate the process with confidence.

How Long Does a Background Verification Process Typically Take in India?

There’s no single answer here—the timeline for a background check in India really depends on what you’re verifying. Simple, digital checks are lightning-fast. Think Aadhaar or PAN card verifications, which are often wrapped up within 1-2 working days.

Things slow down when manual work or outside parties get involved. For instance, confirming past employment or educational degrees usually takes somewhere between 3 to 7 days. The timing is all down to how quickly a previous HR department or university registrar responds to the request.

Criminal record checks often take the longest. Because they require coordination with different local and regional authorities, these can stretch out to 10 working days or sometimes even more. All in all, a comprehensive check on a candidate could take anywhere from a couple of days to two full weeks.

Can a Company Conduct a Background Check Without My Consent?

Absolutely not. In India, a company cannot legally run a formal background check on you without getting your explicit, written consent first. This is a hard-and-fast rule, especially under privacy laws like the Digital Personal Data Protection (DPDP) Act.

Before any screening begins, an employer has to tell you exactly what they plan to check and get your permission. This is almost always done through a consent form, either digital or on paper, that you’ll see during the application process.

Performing formal checks on a candidate’s employment, education, or criminal history without their prior consent is a direct violation of their privacy rights. While employers can review publicly available information, they cannot engage a third-party agency to investigate your background without your approval.

This legal protection makes sure the whole process is transparent and that you, the candidate, are always in the loop and have agreed to the verification.

What Are the Most Common Reasons for a Failed Background Check?

Hands down, the number one reason for a failed background check is a discrepancy in employment history. It’s a broad category, but it covers a lot of the issues we see crop up.

Some of the most frequent problems include:

- Inaccurate Employment Dates: The dates a candidate lists don’t match what their former employer has on file. It happens more than you’d think.

- Inflated Job Titles: Someone claims a more senior title than the one they actually held.

- Unverifiable Companies: The candidate lists a company that has since closed down or, in some sketchy cases, never even existed.

Right after employment issues, problems with educational qualifications are the next biggest culprit, including fake degrees from unaccredited “degree mills.” Other common reasons for a red flag are undisclosed criminal records and addresses that can’t be verified. We’re also seeing a rise in checks designed to uncover dual employment (or “moonlighting”), which has become a major concern for many companies.

Ready to build a trustworthy team with confidence? SpringVerify provides fast, reliable, and compliant background verification services designed for Indian companies. Our powerful API integrates seamlessly with your existing HR systems, automating the screening process so you can make informed hiring decisions faster. Learn more and get started today.