Financial scams in India are a serious and fast-growing problem. Cybercriminals are getting smarter, using technology to trick people and steal staggering amounts of money. These schemes are everywhere, from simple UPI frauds to complex “digital arrest” stories, and they cost Indians over ₹1,750 crore in the first four months of 2024 alone.

Table of Contents

The Growing Threat of Digital Fraud in India

The massive shift to digital payments and online services across India has, unfortunately, rolled out the red carpet for fraudsters. What used to be rare, isolated incidents have now snowballed into a sophisticated, nationwide issue affecting people from every walk of life.

Whether you’re a tech-savvy professional in a metro city or a senior citizen in a small town, nobody is completely safe. These aren’t just petty criminals sending misspelled emails anymore; they’re running organised operations built to exploit basic human psychology.

Think of this guide as your shield against this digital storm. We won’t just list out common financial scams in India. Our goal is to give you a real understanding of how these schemes actually work, the psychological triggers they pull, and the practical steps you can take to keep your hard-earned money safe.

Understanding the Scale of the Problem

The numbers paint a pretty grim picture. The sheer volume and financial damage from these scams are alarming, showing just how badly we need to raise public awareness. Scammers aren’t lone wolves; they’re often part of well-oiled criminal networks that are constantly sharpening their tactics.

Here’s a quick breakdown of why this is a critical issue for every Indian:

- Massive Financial Losses: The Indian Cyber Crime Coordination Centre (I4C) reports that the losses are huge and still climbing. This money often gets funnelled into larger criminal enterprises, making it nearly impossible to ever get back.

- Technological Sophistication: Scammers are using modern tools to look totally legitimate. They create convincing fake websites, use AI voice changers to impersonate officials, and send deceptive SMS messages that look exactly like the ones from your bank or a government agency.

- Emotional and Psychological Harm: The damage isn’t just financial. Victims often go through intense emotional distress, dealing with feelings of shame, anxiety, and helplessness long after the money is gone.

Scammers thrive on creating a sense of urgency, fear, or excitement. Their primary goal is to bypass your rational thinking and push you into making a quick, impulsive decision that benefits them.

This guide will arm you with the knowledge to spot these manipulative tactics from a mile away. We’ll break down everything from suspicious UPI payment requests to elaborate job offer frauds and investment schemes that promise the moon.

By understanding the scammer’s playbook, you can build a strong defence, making you and your family safer in an increasingly connected world.

Inside the Modern Scammer’s Playbook

To really protect yourself from financial scams in India, you first need to get inside a scammer’s head. They aren’t just tech geniuses hiding behind a screen; they are masters of manipulation. Think of them as digital puppeteers, expertly pulling our emotional strings to make us act against our own best interests.

This is the dark art of social engineering. Instead of trying to smash through digital firewalls with complicated code, scammers focus on the much easier target: the human on the other side. They simply bypass your antivirus software and target your brain directly.

They do this by tapping into universal human emotions. By spinning a compelling story, they can make even the most careful person question their own judgement.

The Emotional Triggers Scammers Exploit

Every successful scam is built on a foundation of emotional manipulation. Scammers know that when our emotions run high, rational thinking takes a backseat. They have a whole toolkit of triggers they use to push us into making decisions we’ll later regret.

The three most powerful weapons in their playbook are:

- Greed: The promise of a life-changing reward for almost no effort. This could be an unexpected lottery win, an unbelievable investment opportunity, or an exclusive job offer with a massive salary. The pull of easy money is incredibly hard to resist.

- Fear: Scammers create a sense of pure panic to force you to act immediately. They might pretend to be a police officer threatening arrest, a tax official demanding payment for an overdue bill, or a bank employee warning you that your account is compromised.

- Urgency: This is the secret sauce they add to either fear or greed. Scammers will always insist that you must “act now” before the amazing offer disappears or the terrible consequences kick in. This manufactured rush is designed to stop you from thinking clearly or checking their story.

“Social engineering is the art of manipulating people into performing actions or divulging confidential information. While it may sound complex, it’s often as simple as a scammer pretending to be someone you trust.”

Once you understand these core tactics, you start to see the patterns everywhere. Whether it’s a text message, an email, or a phone call, the psychological game is almost always the same.

Deconstructing the Deception Methods

Scammers use different channels to deliver these emotional traps, each with its own fancy name. You don’t need to be a tech expert to understand them; just think of them as different ways of telling a convincing lie.

- Phishing: This is when scammers send deceptive emails that look like they’re from a trusted source, like your bank, an e-commerce site, or a government agency. The goal is to trick you into clicking a malicious link or giving up sensitive information.

- Vishing (Voice Phishing): Here, the scam happens over a phone call. Fraudsters might use AI voice changers or just be very convincing actors, impersonating officials to get money or personal details out of you.

- Smishing (SMS Phishing): This involves fraudulent text messages. These messages often contain urgent warnings or too-good-to-be-true offers, usually with a link that leads to a fake website designed to steal your login details.

It’s also crucial to know that scammers have tools to make their lies more believable. They often use services like rented SMS numbers and virtual phone numbers to hide their real identity and appear local or official.

At the end of the day, these methods are just the delivery systems for the real attack—the psychological one. Learning to spot the emotional manipulation is your first and most powerful line of defence.

Recognizing Common Financial Scams

To protect yourself from financial scams in India, you first need to know what you’re up against. Think of it as a field guide—a way to identify the different types of fraud you might encounter. Scammers are always finding new ways to operate, but their core tricks often fall into a few predictable categories. If you learn to spot these patterns, you can see the danger signs long before you’re at risk.

And the danger is very real. Cybercrime in India is growing at a frightening pace, with some projections suggesting losses could hit a staggering ₹20,000 crore by 2025. Just this year, India saw over 17 lakh cybercrime complaints, with financial fraud leading the pack. The banking and financial services sectors are taking the hardest hit, expected to face losses of around ₹8,200 crore, which is about 41% of the total projected cybercrime cost.

This section will walk you through the most common scams, breaking down exactly how they work with real-world examples.

The UPI and KYC Update Traps

The Unified Payments Interface (UPI) has made sending money incredibly simple, but that very simplicity is what scammers love to exploit. They prey on common user habits and our trust in official-sounding requests.

Here’s a classic example: you list an old table for sale online. A buyer gets in touch, seemingly very eager to buy it right away. They send you a UPI request, but it’s not a payment link—it’s a “collect” request. In a hurry to close the deal, you enter your PIN to “approve” the transaction, and just like that, money is taken from your account, not sent to it.

Another widespread tactic is the KYC (Know Your Customer) update scam. You’ll get an SMS or a call claiming to be from your bank, warning that your account will be frozen if you don’t update your KYC details now. The message includes a link to a fake website that’s a perfect copy of your bank’s real portal, designed purely to steal your login details. These kinds of scams are particularly common in the fintech space, which is why security is such a huge focus. For a deeper dive into this area, you can read our guide on the Indian fintech industry.

Remember, a legitimate company or bank will never ask you to enter your UPI PIN to receive money. A PIN is only ever used to send money. Banks also typically advise customers to visit a branch or use their official app for KYC updates—not to click on random links sent via SMS.

Fake Job Offers and Registration Fee Scams

In a competitive job market, the promise of a great job is a powerful bait. Scammers know this and post tempting job openings on popular portals and social media, often pretending to represent big, well-known companies.

Imagine you apply for a work-from-home role that promises a fantastic salary. A few days later, you get a professional-looking offer letter. But there’s a catch. Before you can “start,” they ask you to pay a small, supposedly refundable “registration fee,” “training cost,” or “document verification charge.”

Once that first payment is made, the requests might continue—for uniforms, software, or other fictional costs—or the “recruiter” might just disappear. These scams feed on people’s hopes and can turn a job search into an expensive nightmare.

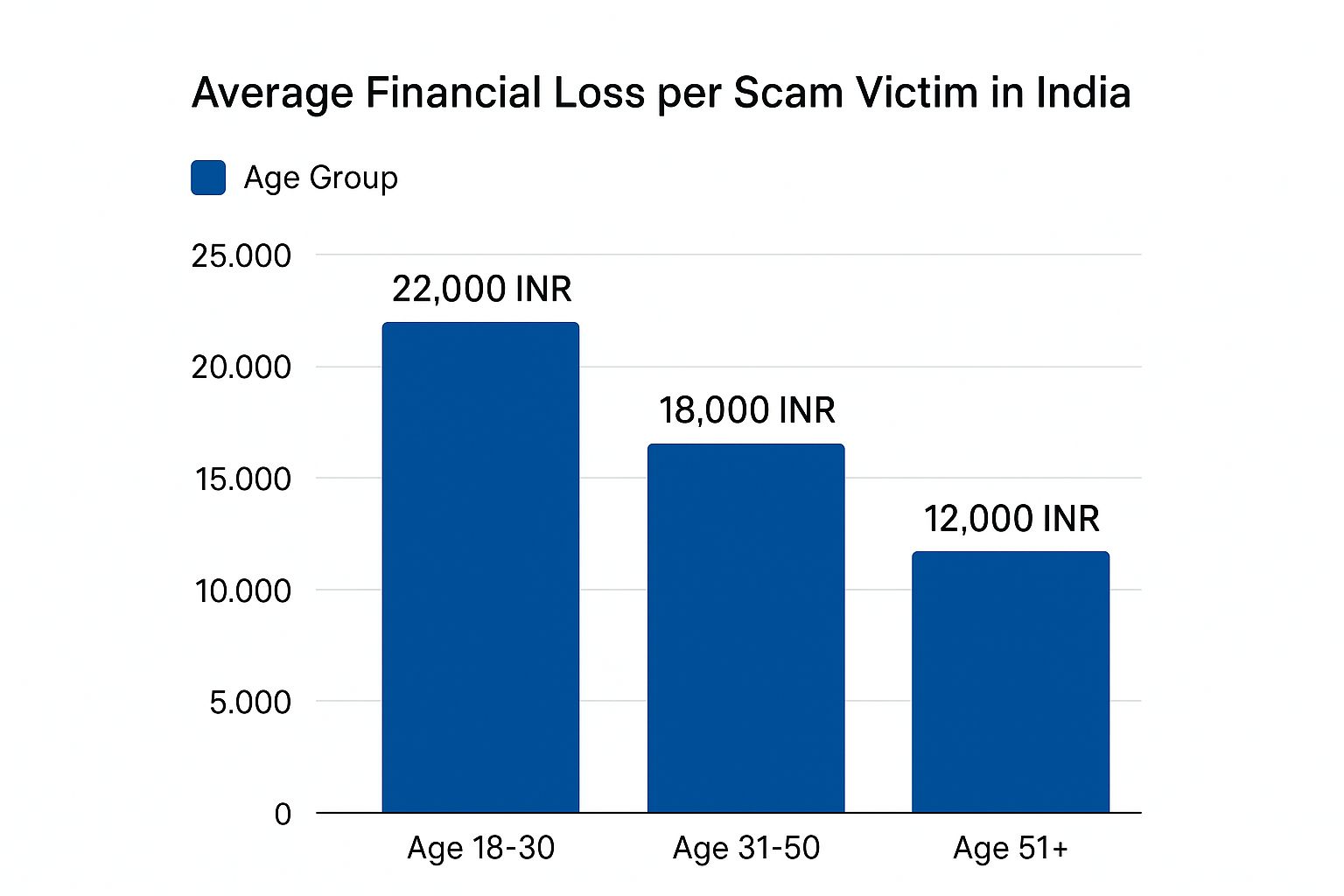

The image below illustrates the average financial loss per scam victim across different age groups in India, showing that younger people often bear the highest financial burden.

This data makes it clear: while everyone is a target, the 18-30 age group reports the highest average losses. This is likely due to their heavy reliance on online platforms for job hunting and making investments.

Predatory Loan Apps and Blackmail

The digital marketplace is flooded with instant loan apps promising quick cash with almost no paperwork. While some are legitimate, many are dangerous traps set by unregistered and predatory lenders.

The moment you download one of these apps and grant it permissions, you’re not just applying for a loan—you’re giving it full access to your phone’s contact list, photo gallery, and personal files. The app then disburses a small loan amount, but with an insanely high interest rate and a repayment window of just a few days.

If you miss a single payment, the harassment begins. Agents will call, threaten, and abuse you. They often resort to blackmail, morphing your photos and sending them to every single person in your contact list. They use shame and fear to extort much more money than you ever borrowed.

Unbelievable Investment and Ponzi Schemes

“Double your money in 30 days!” We’ve all seen promises like this. It’s the classic calling card of a fraudulent investment scheme. Scammers set up slick websites and social media groups, complete with fake testimonials and profit charts, all to create an illusion of a can’t-miss opportunity.

They usually start by getting you to invest a small amount and then show you quick, impressive returns. This is just to build your trust. Once you’re convinced, they’ll persuade you to invest a much larger sum.

When enough people have put in their money, the whole thing collapses. The website goes dark, the social media groups are deleted, and the fraudsters vanish with everyone’s funds. This is a classic Ponzi scheme, where the “returns” paid to early investors come directly from the money put in by newer victims.

Identifying Common Financial Scams in India

To help you tell these scams apart at a glance, we’ve put together a quick comparison table. It breaks down how each scheme operates, who they usually target, and the key red flags to look out for.

| Scam Type | How It Works | Common Targets | Red Flag |

|---|---|---|---|

| UPI/KYC Fraud | Using “collect” requests or fake KYC update links to steal money or credentials. | Online sellers, less tech-savvy users, and bank customers. | Being asked for your UPI PIN to receive money or clicking unsolicited links. |

| Fake Job Offers | Luring applicants with attractive jobs and then demanding fees for registration or training. | Job seekers, recent graduates, and individuals looking for remote work. | Any job that requires you to pay money upfront before starting. |

| Loan App Traps | Offering quick loans via apps that access personal data for blackmail and extortion. | Individuals in urgent need of cash with poor credit scores. | Apps demanding excessive permissions (contacts, gallery) and unclear terms. |

| Investment Schemes | Promising guaranteed, high returns with little to no risk to lure investors into a Ponzi scheme. | People looking for quick profits and those new to investing. | Promises of returns that sound too good to be true and pressure to invest quickly. |

By familiarising yourself with these tactics, you’ll be much better equipped to spot a scam before it’s too late. The best defence is always awareness.

Building Your Digital Fortress with Proven Strategies

Knowing how financial scams in India work is the first step, but it’s the decisive action you take next that truly keeps you safe. It’s time to shift from awareness to active defence. Think of your digital life as a fortress; right now, you might have a few unguarded gates. This section is all about giving you the practical tools to build strong walls and secure every entry point.

These aren’t complex technical fixes. They are simple, powerful habits that create multiple layers of protection. By putting them into practice, you can dramatically reduce your vulnerability to even the most convincing fraudsters. The goal is to make yourself a much harder target.

Mastering Your First Line of Defence

Your passwords are the keys to your digital kingdom, yet so many of us use simple, easy-to-guess combinations for multiple accounts. That’s like leaving your front door wide open. Creating strong, unique passwords for every important account is your most fundamental security measure.

A strong password isn’t just a random jumble of letters; it’s a combination that’s tough for both people and computers to crack. Here’s what makes a password truly robust:

- Length is Strength: Aim for at least 12-15 characters. The longer a password is, the exponentially harder it becomes to break.

- Mix It Up: Use a combination of uppercase letters, lowercase letters, numbers, and symbols (like !, @, #, %).

- Avoid the Obvious: Never use personal information like your name, birthdate, or family members’ names. Steer clear of common words and sequential patterns like “123456” or “password.”

A simple trick for creating memorable yet strong passwords is to use a short, unusual phrase and then modify it. For example, “MyFirstDogWasAChowChow!” could become “M1stD0gW@sAChow!”—easy for you to remember, but a nightmare for anyone else to guess.

Activating Your Security Shield with 2FA

Even the strongest password can be stolen. That’s where Two-Factor Authentication (2FA) comes in. Think of it as a double-lock system for your accounts. After you enter your password (the first “factor”), you have to provide a second piece of information to prove it’s really you.

This second factor is usually a temporary code sent to your phone via SMS, generated by an authenticator app, or even a physical security key. So, even if a scammer manages to steal your password, they can’t get into your account without that second piece of the puzzle. You should enable 2FA on every account that offers it, especially for banking, email, and social media.

The Pause and Verify Technique

Scammers thrive on creating a sense of urgency. They want you to act immediately, without thinking. Your most powerful counter-tactic is incredibly simple: pause.

When you receive an unexpected message demanding urgent action—whether it’s a text about a blocked account or an email about a surprise lottery win—just stop. Take a deep breath and ask yourself a few critical questions:

- Does this make sense? Was I expecting this message?

- Is the sender legitimate? Check the email address or phone number carefully for tiny, suspicious changes.

- How can I verify this on my own? Never click links or call numbers provided in the message. Instead, go directly to the official website or use the phone number on the back of your bank card to check the claim.

This simple act of pausing breaks the scammer’s spell of urgency and gives your rational mind time to catch up. A key component of building a strong defence is empowering individuals through comprehensive IT security awareness training.

This proactive mindset is also vital for organisations handling sensitive customer information. Ensuring robust internal security protocols and maintaining regulatory standards are non-negotiable. Businesses can learn more about these requirements by exploring the various aspects of Indian compliance frameworks to protect both themselves and their customers. Adopting these proven strategies will help you build a formidable digital fortress, securing your financial life against the persistent threat of scams.

Understanding the Global Networks Behind Local Scams

That unsolicited message or urgent call might feel like a local nuisance, but it’s often just the tip of the iceberg—the final move in a massive global operation. Many financial scams hitting Indians aren’t the work of some lone wolf in a basement. We’re talking about highly organised, international criminal syndicates. This isn’t one person trying to trick you; it’s a well-funded, corporate-style criminal machine.

These groups are structured just like multinational companies, complete with hierarchies, performance targets, and sophisticated tech. They operate huge call centres, sometimes called “scam compounds,” where thousands of employees work around the clock to defraud people all over the world. Once you grasp this international angle, you start to see the true scale of the problem.

The Southeast Asian Connection

A huge chunk of the criminal networks targeting Indian citizens are actually based in Southeast Asian countries. This geographical distance is a massive headache for Indian law enforcement, creating jurisdictional nightmares that make it incredibly difficult to track down and prosecute the masterminds pulling the strings.

The sheer size of these operations is staggering, and the financial damage they cause speaks volumes about their reach. In the first half of 2025 alone, India lost an estimated ₹8,500 crore to online financial fraud. More than half of these scams were traced back to countries like Myanmar, Cambodia, and Thailand, often with Chinese operators at the helm. You can dig deeper into this data in the full government report.

This isn’t a small-time con. You’re up against a global criminal industry that invests heavily in technology, training, and evasion techniques. Realising this helps shift the perspective from personal blame to cautious vigilance.

This organised structure allows scammers to run thousands of attacks every single day, constantly tweaking their scripts and tactics for maximum impact. They don’t just stick to one sector, either. Their methods can ripple out and affect legitimate businesses, especially online. We’ve actually covered some related issues in our article on the challenges in the e-commerce industry.

Why This Global Context Matters

Knowing you’re not just dealing with a single scammer but a vast, resourceful network changes everything. It reinforces just how critical personal security is. These criminal groups have the money and know-how to build incredibly convincing fake websites, use advanced voice-altering software, and exploit legal loopholes to shuffle money across borders in the blink of an eye.

Their whole strategy is built on operating with impunity, staying far away from the reach of the authorities in the countries they target. This global setup is exactly why the fight against financial scams is so complex—and why your awareness is the single most powerful first line of defence.

An Action Plan for Scam Victims

Realising you’ve fallen victim to a financial scam is a gut-wrenching experience. It can leave you feeling shocked, violated, and utterly helpless. But in those first few moments, what you do next can make all the difference. Quick, decisive action is your most powerful weapon.

There’s something law enforcement calls the ‘golden hour’—that critical window right after a scam hits. Reporting the crime immediately gives authorities their best shot at tracing and blocking the transaction before your money vanishes into a maze of accounts. Your speed is everything.

Your Immediate Emergency Checklist

If you think you’ve been scammed, the key is not to panic. Instead, follow these steps methodically to secure what’s left and start the recovery process. Every second counts.

- Report to the National Cyber Crime Helpline: Your very first call should be to the helpline number 1930. You can also file a complaint directly on the official National Cyber Crime Reporting Portal. This triggers an alert to try and freeze the funds.

- Contact Your Bank or Wallet Provider: Immediately get in touch with your bank’s fraud department. They can block your card or freeze the account to prevent any more losses while they kick off their own investigation.

- Gather All Your Evidence: Collect every single piece of information you have. This means screenshots of messages, transaction IDs, the scammer’s phone numbers, and any fake websites you might have visited. This proof is absolutely vital for your official complaint.

The scale of this problem in India is staggering. In the first ten months of the 2024–25 fiscal year, losses hit ₹4,245 crore from about 2.4 million separate incidents. We’re seeing a frightening rise in social engineering scams, with over 100,000 cases of ‘digital arrests’ reported in 2024 alone, where scammers coerce people into sending them money. You can read more about the latest digital fraud trends in India on marketbrew.in.

Moving Beyond the Financial Impact

Falling for one of these schemes isn’t a reflection of your intelligence; it’s a testament to just how sophisticated and manipulative these criminals have become. It is so important to remember that you are not to blame.

“Victims of financial scams often feel a sense of shame or embarrassment, which can prevent them from reporting the crime. Sharing your experience is a courageous step that not only helps your own case but also raises awareness to protect others in your community.”

By taking these steps, you’re not just fighting to get your own money back. You’re also doing your part to help dismantle the vast criminal networks behind these financial scams in India.

Frequently Asked Questions About Financial Scams

When you’re dealing with the fallout of a financial scam in India, you’re bound to have a lot of pressing questions. This section cuts through the noise to give you direct, clear answers to the most common concerns, so you can feel more in control and better prepared.

Can I Get My Money Back After Being Scammed in India?

Getting your money back is tough, but it’s not impossible—especially if you act lightning-fast. Your absolute best shot is to report the fraud within the ‘golden hour’.

The first thing you should do is call the National Cyber Crime Helpline at 1930 or immediately file a report on their official portal. This triggers an alert that gives authorities a chance to freeze the transaction before the scammer can whisk the money away. The success of a recovery really hinges on how quickly you report the crime. For certain digital payment scams, knowing the platform’s specific process is key. For instance, it’s worth learning about effective Zelle scam refund strategies to understand how different systems handle these disputes.

Are Banks Responsible for Refunding Scammed Money?

A bank’s liability really comes down to how the fraud happened. If the loss was a result of a security lapse on the bank’s side, like a system breach, they are typically on the hook for the full amount.

However, the tables turn if you were tricked into sharing your sensitive details. If a fraudster convinced you to give up your OTP, PIN, or password through some clever social engineering, the bank will likely argue that they aren’t responsible for the loss. This is exactly why the golden rule is to never share these details with anyone, ever.

A bank’s responsibility often ends where a customer’s voluntary action begins. Think of it as a security partnership—protecting your credentials is your non-negotiable part of the deal.

How Can I Verify if a Call Is Genuinely from My Bank?

Always approach any unsolicited call or message with a healthy dose of scepticism. The single most reliable way to handle these situations is to just end the conversation or ignore the message entirely.

Then, you take control. Find the official customer care number on the back of your debit card, on the bank’s official website, or within their mobile app, and contact them yourself.

Remember, a legitimate bank will never:

- Try to create a sense of panic or extreme urgency.

- Ask for your full password, OTP, or card PIN.

- Threaten to block your account if you don’t comply immediately over the phone.

By making the call yourself, you guarantee you’re speaking to a real representative and not a scammer trying to play on your fears.

At SpringVerify, we believe that a secure hiring process is the first step towards building a trustworthy organisation. Our comprehensive background verification services help you make informed decisions with confidence, protecting your company from internal and external threats. Learn how you can create a safer workplace at https://in.springverify.com.