The boom in digital lending across India brought incredible speed and convenience, but it wasn’t all smooth sailing. This rapid, unchecked growth quickly created a bit of a ‘Wild West’ scenario. To bring order to the chaos and protect consumers, the Reserve Bank of India (RBI) stepped in with a comprehensive set of digital lending guidelines. These new rules are all about boosting transparency, reining in aggressive practices, and making it crystal clear who is accountable for what.

Table of Contents

Why New Digital lending Guidelines Were Necessary

Think about a city where thousands of super-fast roads suddenly appear overnight, but with no traffic lights, speed limits, or even road signs. That’s a pretty good picture of what digital lending in India looked like before the RBI laid down the law. Lending apps made credit more accessible than ever, which was great, but it also opened the door to chaos and put borrowers at serious risk.

This unregulated environment became a breeding ground for some truly troubling practices. Before long, countless consumers were falling prey to aggressive and unethical tactics, which started to erode trust in the entire fintech system.

The Surge in Borrower Complaints

It became obvious that something had to be done as complaints from users began to pour in. Borrowers from all corners of the country were reporting the same set of problems, pointing to major systemic failures.

The main issues were:

- Aggressive Recovery Tactics: Many unregulated apps resorted to harassment and intimidation to collect payments, causing immense stress for borrowers.

- Misuse of Personal Data: It was common for lending apps to demand excessive permissions, giving them access to a borrower’s contacts, photos, and files, which were often misused.

- Hidden Charges and Fees: Borrowers were often blindsided by undisclosed fees and ridiculously high interest rates that weren’t clearly communicated when they took the loan.

This flood of complaints was a clear signal that the fast-growing digital credit market needed some “traffic laws” to keep borrowers safe. The RBI’s move wasn’t about putting the brakes on innovation; it was about making the digital lending highway safe for everyone driving on it.

The core idea was to build a framework that encourages responsible innovation while shielding consumers from predatory behaviour. This ensures the long-term health and credibility of India’s fintech sector.

Establishing a Regulated Framework

To really get why these rules were needed, you have to look at the wide range of fast business funding options that popped up. Their speed was their biggest selling point, but it also created loopholes that could be exploited. In response, the Reserve Bank of India (RBI) issued the Digital Lending Directions, 2025 on May 8, 2025, which was a major regulatory milestone.

This directive pulls together earlier rules into one unified framework that puts the focus squarely on protecting borrowers and ensuring transparency and accountability for all Regulated Entities (REs) like banks and NBFCs. This was a deliberate move to swap ambiguity for clear, enforceable rules, making sure lenders operate within a structure that prioritises fairness and trust.

To help break this down, here’s a quick look at the main goals behind the RBI’s regulatory framework.

Core Pillars of the RBI Digital Lending Guidelines

| Pillar | Objective |

|---|---|

| Customer Protection | To shield borrowers from unethical practices like exorbitant interest rates, hidden fees, and aggressive recovery tactics. |

| Data Privacy | To ensure explicit consent is taken for data collection, define permissible data usage, and prevent misuse of personal information. |

| Transparency | To mandate clear, upfront communication about all loan terms, including interest rates, fees, and the Annual Percentage Rate (APR). |

| Accountability | To establish clear responsibility, ensuring that Regulated Entities (banks/NBFCs) are ultimately accountable for the actions of their lending partners. |

| Grievance Redressal | To require a robust and accessible system for borrowers to report issues and have them resolved in a timely manner. |

These pillars aren’t just suggestions; they form the foundation of a more stable and trustworthy digital lending ecosystem in India.

Who Must Follow the Digital Lending Rules

To really get a grip on the digital lending guidelines RBI has rolled out, you first need to understand exactly who’s on the hook. The rules establish a clear chain of command, making sure the buck stops somewhere, even when several companies are involved in a single loan.

At the very centre of this framework are the Regulated Entities (REs). Think of these as the institutions officially licensed by the RBI to lend money—commercial banks, cooperative banks, and Non-Banking Financial Companies (NBFCs). They are the primary audience for these regulations and are ultimately responsible for making sure everyone plays by the rules.

Imagine an RE is like a licensed restaurant owner. That owner holds the official permit to cook and sell food, making them directly accountable to the health department. In the same way, REs are directly answerable to the RBI for every single lending activity they undertake.

The Role of Lending Service Providers

But it’s not always that simple. REs don’t always deal with borrowers directly. More often than not, they team up with fintech companies known as Lending Service Providers (LSPs). These LSPs handle a lot of the customer-facing legwork, like finding new borrowers, running initial credit checks, or even managing loan collections for the RE.

Let’s stick with our restaurant analogy. An LSP is like a food delivery app. The app takes your order and brings the meal to your door, but it doesn’t actually prepare the food. The restaurant owner (the RE) is still the one in the kitchen.

The RBI’s guidelines are crystal clear: even with an LSP in the picture, the Regulated Entity (the bank or NBFC) cannot pass the buck. The RE must ensure its partners are operating by the book.

This means that while the RBI’s rules are aimed squarely at the REs, their impact ripples out to the LSPs. The RE is on the line to perform thorough due diligence on any LSP it partners with and is held accountable for any missteps made by that LSP.

Digital Lending Apps and Their Place

Finally, you have the Digital Lending Apps (DLAs). These are the mobile apps or websites we all use to apply for and manage our loans. A DLA might be run directly by an RE, or it could be operated by an LSP on behalf of an RE.

In our restaurant example, the DLA is the mobile app you used to order your food. It’s the digital storefront, the point of interaction. The RBI now requires REs to report every single DLA that they or their LSPs use.

So, the key takeaway from the digital lending guidelines RBI has put in place is this clear chain of accountability:

- Regulated Entities (REs) are directly regulated and hold the ultimate responsibility.

- Lending Service Providers (LSPs) are indirectly regulated through their agreements with REs.

- Digital Lending Apps (DLAs) are the platforms where lending happens, and they must comply with the rules enforced by the RE.

This structure ensures that no matter how many middlemen are involved, the borrower is always protected. A licensed financial institution is always in charge and ultimately accountable for the entire loan journey, from start to finish.

Understanding Your Rights as a Borrower

The whole point of the RBI’s digital lending guidelines is to put a protective shield around you, the borrower. The days of getting lost in confusing terms, being hit with surprise charges, and having your personal data scooped up without a second thought are over. These rules are here to arm you with clear information and give you back control, making sure your digital borrowing journey is safe and straightforward.

At the very centre of this borrower-first approach is a simple but powerful tool for transparency: the Key Fact Statement (KFS).

Think of it like a nutritional label on a food packet. Before you buy, that label tells you exactly what’s inside—calories, sugar, fat. The KFS does the same for a loan, breaking down every single cost and condition before you agree to anything. It’s not just a summary; it’s a standardised document designed to cut through the financial jargon and give you the complete, honest picture.

The Power of the Key Fact Statement

The KFS is a genuine game-changer because it forces lenders to be completely upfront. No more burying fees in the fine print.

Every KFS has to clearly lay out the following:

- Annual Percentage Rate (APR): This is the real cost of your loan over a year, shown as one single percentage. It rolls up the interest rate and all other charges, giving you the true measure of how expensive the loan is.

- All-Inclusive Costs: Every single fee has to be listed out. This includes processing charges, insurance premiums, and any other cost you can think of.

- Loan Details: You’ll see the exact loan amount, the tenure (how long you have to pay it back), and a clear repayment schedule.

- Penal Charges: It needs to spell out exactly what happens if you miss a payment, including any late fees or penalties.

- Contact Information: You’ll get the details of the nodal grievance redressal officer, so you know precisely who to call if things go wrong.

By getting all this information neatly laid out beforehand, the KFS lets you properly compare different loan offers and pick the one that actually works for your finances.

The mandate for a Key Fact Statement is a direct response to widespread complaints about hidden charges that previously plagued the digital lending space. It shifts the power back to the borrower by ensuring full financial disclosure.

Your Right to Reconsider and Your Privacy

The guidelines don’t just stop at financial transparency. They also introduce other critical protections for you. One of the most important is the cooling-off period. This is basically a “no questions asked” window of time that lets you back out of a loan shortly after you’ve taken it, without getting hit by any prepayment penalties. While the lender’s board decides the exact duration, it gives you a crucial safety net in case you have second thoughts.

Another massive area of reform is data privacy. The new rules slam the brakes on the invasive data harvesting that used to be so common.

Here’s how your data is protected now:

- Minimal Data Collection: Lending apps can only collect data that is absolutely essential to process your loan. Nothing more.

- Explicit Consent: They must get your clear and specific permission for any data they collect, and you have the right to withdraw that consent at any time.

- No More Intrusive Access: Apps are now strictly banned from getting into your phone’s sensitive information, like your contact list, photo gallery, or call logs.

These measures make sure your personal information stays private and isn’t misused for aggressive collection tactics or sold off to third parties.

The RBI’s rules are a direct response to some alarming trends. Between 2020 and 2024, RBI records show over 50,000 consumer grievances were registered, mostly pointing to unscrupulous lending practices. These new guidelines directly attack those problems, creating a much safer environment for everyone. You can find more expert insights on borrower protection on expertpanel.org.

Ultimately, these rights change the game. You’re no longer just a passive recipient of credit but an informed consumer with the tools and protections to navigate the digital lending world with confidence.

How Lenders Must Change Their Operations

The RBI’s new framework isn’t just a list of suggestions; it’s a call for significant, practical changes to the very core of a lender’s daily business. These operational shifts are designed to pull apart risky practices, inject a heavy dose of transparency, and build a much stronger system of accountability. For lenders and their fintech partners, this means re-engineering their core processes to fall in line with the digital lending guidelines RBI has put in place.

The biggest shake-up revolves around the flow of money. In the past, it wasn’t uncommon for funds to snake through complex routes, often involving third-party pool accounts managed by Lending Service Providers (LSPs). This created a murky environment where tracking the money trail was a nightmare, dialling up the risk for everyone involved.

To cut through this fog, the RBI laid down a clear, non-negotiable rule.

Directing the Flow of Funds

The new guidelines are crystal clear: all loan disbursals and repayments must follow a direct path. This means money has to move straight from the lender’s (the Regulated Entity’s) bank account to the borrower’s bank account. When it’s time for repayment, the money travels directly back. No pit stops.

This direct fund-flow mechanism is the absolute cornerstone of the new operational model. It completely eliminates intermediary pool accounts, ensuring every rupee is accounted for and that the lender maintains full control and oversight from start to finish.

This single change forces lenders to completely overhaul their payment and reconciliation systems. They can no longer outsource the management of disbursals or collections to LSPs using pass-through accounts. Instead, they must build the internal infrastructure to handle these transactions directly, creating a transparent audit trail for every single loan.

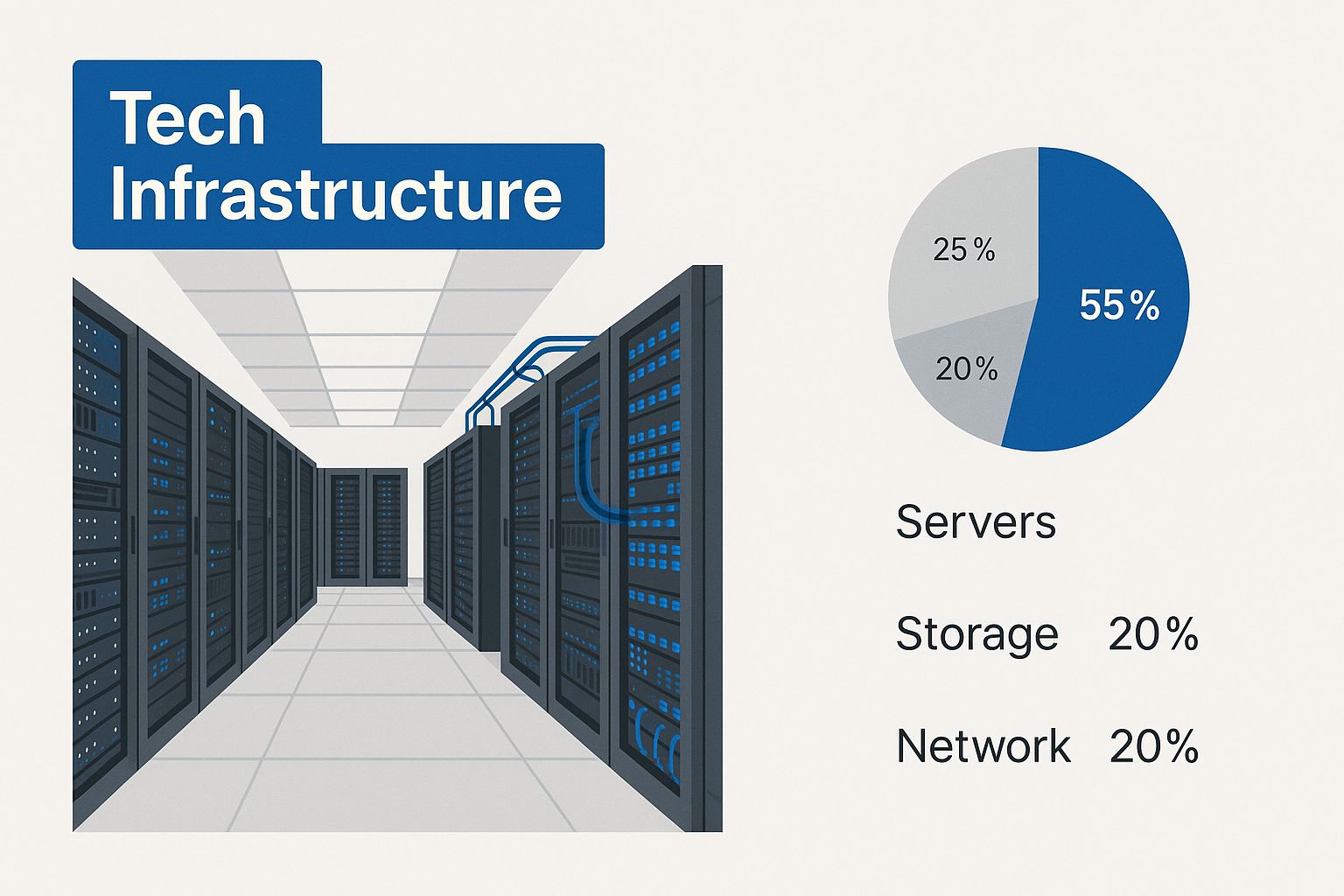

The infographic below gives you a sense of the kind of tech infrastructure needed to handle these new demands.

As you can see, a solid and secure technology backbone isn’t just a nice-to-have anymore. It’s essential for managing direct transactions, protecting data, and handling compliance reporting without a hitch.

To put these changes into perspective, let’s look at how things used to be versus how they must be now.

Old Practices vs New RBI Mandates

This table breaks down the key operational shifts, showing a clear before-and-after picture of the digital lending space.

| Operational Area | Previous Practice (Pre-Guidelines) | New Mandate (Post-Guidelines) |

|---|---|---|

| Loan Disbursal & Repayment | Funds often routed through LSP-managed pool or pass-through accounts, creating an opaque money trail. | All funds must move directly between the lender’s bank account and the borrower’s bank account. No intermediaries. |

| Credit Limit Increases | Lenders could automatically increase credit limits without specific, fresh consent from the borrower for each increase. | Explicit consent from the borrower is mandatory for every single increase in the credit limit. |

| Fee Collection | LSPs could deduct their fees directly from the loan amount before it reached the borrower. | Lenders must pay fees to LSPs directly. All fees and charges must be paid by the borrower to the lender, not the LSP. |

| Grievance Redressal | Often an informal or poorly structured process with no dedicated officer or fixed resolution timelines. | A formal system is required, with a dedicated Nodal Grievance Redressal Officer and a 30-day resolution timeline. |

| Data Collection | Broad data collection permissions were often taken, with little clarity on data storage or usage. | Data collection must be need-based with clear, explicit consent. Data cannot be stored by LSPs, except for basic info. |

These aren’t minor tweaks; they represent a fundamental rethinking of how digital lending should operate, prioritising customer protection and transparency above all else.

Putting Borrowers in Control of Their Credit

Another critical operational shift is about credit limits. Previously, some lenders would automatically bump up a borrower’s credit limit without asking for permission. It was a practice that could easily push people into taking on more debt than they could handle. The RBI has slammed the brakes on this.

Under the new rules, any increase in a credit limit requires the borrower’s explicit consent every single time. This isn’t a one-and-done approval given at the start. For each proposed increase, the lender has to go back to the borrower and get a fresh, specific “yes.”

This simple but powerful change puts borrowers firmly back in the driver’s seat. For lenders, it means building a new workflow to formally request and record this consent before touching a credit line. On top of that, accurately reporting credit history to bureaus is essential, making a solid understanding of a credit check for individuals a must-have for compliance.

Establishing a Robust Grievance Redressal System

Finally, the guidelines demand a far more structured and responsive system for handling customer complaints. Lenders can no longer treat grievance redressal as an afterthought.

The new requirements are specific:

- Appoint a Nodal Officer: Both the lender and each of its LSPs must appoint a dedicated nodal grievance redressal officer just for digital lending complaints.

- Clear Communication: The contact details for this officer must be easy to find—on the lender’s website, the LSP’s app, and in the Key Fact Statement (KFS).

- Defined Timelines: A complaint has to be resolved within a strict 30-day period. If the lender misses this deadline, the borrower can take their complaint straight to the RBI’s Ombudsman.

This forces lenders to create a formal, trackable, and time-bound process for sorting out customer issues, making them directly accountable for the service they provide. Together, these operational changes are building a much safer and more trustworthy lending environment.

A Practical Guide to Compliance and Reporting

Staying on the right side of the RBI’s digital lending guidelines is more than just a box-ticking exercise for lenders (Regulated Entities or REs) and their partners. It’s about building a business that’s trustworthy and built to last. To do that, you need a clear game plan for reporting, due diligence, and how you govern your operations.

One of the biggest shifts is the absolute requirement to report every single loan that comes through a digital channel—whether you originate it yourself or through a Lending Service Provider (LSP)—to the Credit Information Companies (CICs). This isn’t a “nice-to-have”; it’s a fundamental duty.

This rule ensures a borrower’s credit history is always accurate and complete, which helps prevent people from getting buried in debt and encourages healthier lending practices across the board. For lenders, this means putting solid, automated reporting systems in place that don’t miss a single transaction.

Onboarding and Vetting Lending Service Providers

The RBI has made one thing crystal clear: the buck stops with the Regulated Entity. This completely changes how you should think about onboarding an LSP. It’s no longer a simple partnership agreement; it’s now a serious due diligence mission. You can’t just sign a contract and cross your fingers.

Before bringing any LSP on board, REs must do their homework with thorough background checks. This means getting answers to some tough questions about their:

- Technological Capabilities: Are their systems robust enough to handle the strict rules on data privacy, security, and direct-to-borrower fund transfers?

- Internal Governance: Do they actually have clear, enforceable policies for handling customer data, interactions, and complaints?

- Financial Stability: Is the LSP a solid, viable business that can be relied upon for the long haul?

Think of it this way: the RE is the landlord, and the LSP is the tenant. The landlord is ultimately responsible for what the tenant does on their property. This means constant oversight isn’t just a good idea—it’s essential. For a closer look at what goes into building these kinds of checks, exploring comprehensive compliance checks for businesses can offer some valuable insights.

The guidelines effectively make the RE the chief compliance officer for its entire digital lending ecosystem. Every action taken by an LSP is considered an action of the RE itself.

This new level of responsibility means REs need to draft detailed agreements that spell out an LSP’s duties, liabilities, and commitment to RBI rules in no uncertain terms. Regular audits and performance reviews of your LSPs have gone from being best practices to being critical parts of managing your risk.

Creating a Culture of Regulatory Adherence

Beyond the paperwork and processes, real compliance comes from your company’s culture. The RBI’s guidelines are a nudge for organisations to weave regulatory discipline right into their DNA. This has to start at the top, with leaders who genuinely champion transparency and ethical conduct.

For compliance officers, the job is to turn these dense guidelines into practical internal policies and training sessions. Everyone involved in the digital lending journey, from the software developers to the customer support team, needs to understand their role in keeping the organisation on the straight and narrow.

The timelines the RBI has laid out are tight, so lenders need to move quickly but carefully. The main focus should be on:

- System Upgrades: Tweaking loan management systems to handle direct fund transfers and flawless CIC reporting.

- Process Re-engineering: Redesigning how you generate the Key Fact Statement (KFS), get explicit consent for credit limit changes, and manage grievances.

- Partner Audits: Setting up a system to continuously monitor all your LSPs to make sure they’re staying compliant.

By getting ahead of these changes, lenders can do more than just meet regulatory demands. They can build a stronger, more resilient business that earns borrowers’ trust and contributes to the healthy growth of India’s digital credit market.

The Future of India’s Fintech Ecosystem

It’s easy to see the RBI’s digital lending guidelines as just another rulebook, but that would be missing the point. Think of them more as a blueprint for the future of India’s entire fintech space.

Rather than holding the industry back, these regulations are carefully pruning it. They’re designed to snip away the unsustainable, sometimes harmful, practices to let healthier and more robust business models grow strong.

This new framework is pushing fintechs to shift their focus. The days of hunting for regulatory loopholes or building a business on confusing fee structures are numbered. Instead, a new wave of responsible innovation is taking root, where success is built on transparency and genuine customer trust, not just on how fast you can acquire users.

This is a critical step towards building a mature market. By setting clear guardrails, the RBI is creating a more predictable environment where legitimate players can invest confidently. The guidelines are redefining how things work, and advanced tech like AI in Banking and Finance Law will undoubtedly play a big part in navigating this new terrain.

Fostering Trust and Financial Inclusion

One of the biggest long-term wins from these guidelines will be in financial inclusion. Digital lending always had the promise of bringing credit to underserved communities, but let’s be honest—unethical practices created a lot of distrust. Many potential borrowers who needed these services the most were scared away.

By cleaning house, the RBI is making digital credit a much safer and more approachable option for millions. When a borrower sees that an app is backed by a regulated bank, gives them a clear Key Fact Statement, and respects their data, their confidence goes way up.

That trust is the real foundation for financial inclusion, encouraging more people to step into the formal credit system. You can get a broader view of how the industry is adapting in our overview of the Fintech landscape.

These guidelines are not a barrier to growth but a foundation for it. They are constructing a stable, globally respected digital lending market in India—one that balances rapid innovation with the crucial need for consumer protection.

Building a Mature Digital Lending Market

Ultimately, the RBI’s framework is an investment in the long-term health of India’s digital economy. It’s a clear signal to move away from the ‘growth-at-all-costs’ mindset towards a more sustainable model built on solid ethics and governance.

We can already see how this will shape the future:

- Higher Quality Partnerships: Banks and NBFCs will be much pickier, choosing to partner only with LSPs that can prove they have strong compliance and ethical standards.

- Focus on Customer Experience: With transparency now a must-have, fintechs will have to compete on the quality of their service, how easy their app is to use, and how fair their products are.

- Increased Investor Confidence: A well-regulated market is far more attractive to investors, both at home and abroad. This could bring more stable, long-term capital into the sector.

The road ahead will require some adjustments, there’s no doubt about that. But the destination is a fintech ecosystem that isn’t just innovative and dynamic, but also safe, fair, and inclusive for every Indian.

Frequently Asked Questions

It’s natural to have questions when new regulations like the RBI’s digital lending guidelines come into play. Whether you’re a borrower, a lender, or a fintech partner, navigating the specifics can be tricky. We’ve tackled some of the most common queries to give you direct, clear answers about your rights and responsibilities.

Let’s break down the complex topics into simple explanations to clear up any confusion.

What Is the Key Fact Statement and Why Is It Important?

Think of the Key Fact Statement (KFS) as a complete, standardised price tag for your loan. It’s a document your lender must give you before you sign anything, and it’s designed to be simple and easy to understand.

Its entire purpose is to create total transparency. By putting all the costs out in the open, it gets rid of nasty surprises like hidden charges or unexpected fees that might pop up down the line.

The KFS is a big deal because it has to include:

- The Annual Percentage Rate (APR), which shows you the total cost of the loan for a year.

- A clear breakdown of all fees, from processing charges to late payment penalties.

- A full repayment schedule so you know exactly how much is due and when.

This single document gives you the power to properly compare loan offers from different lenders, helping you make a financial decision that’s truly right for you.

Do These Guidelines Apply to Buy Now Pay Later Services?

Yes, for the most part, they do. If a ‘Buy Now, Pay Later’ (BNPL) service is effectively a credit line provided by an RBI-Regulated Entity (RE)—like a bank or an NBFC—then it absolutely has to follow these guidelines.

This means BNPL providers who are tied to a regulated institution must provide a Key Fact Statement, ensure funds are transferred directly, and stick to the strict data privacy rules. The key thing to look for is whether the BNPL arrangement is structured as a loan from an institution under the RBI’s watch.

What Is the Cooling-Off Period for a Digital Loan?

The cooling-off period is a fantastic pro-borrower feature. It gives you a set amount of time to back out of a loan after the money has been sent to you, without having to pay any prepayment penalties.

The exact length of this period is decided by the lender’s own board-approved policy. During this window, you can simply repay the principal amount plus the proportionate Annual Percentage Rate (APR) for the few days you had the money and cancel the loan.

This acts as a critical safety net, preventing “borrower’s remorse.” It protects you from getting stuck in a loan agreement you quickly realise doesn’t fit your financial situation.

What Should I Do If a Lending App Violates These Rules?

If you suspect a digital lending app is breaking the RBI’s rules—maybe they’re using misleading ads, snooping on your phone’s contacts, or haven’t given you a KFS—there’s a clear process to follow.

Your first move should always be to file a formal complaint with the lender’s own grievance redressal officer. By law, the lender has 30 days to sort out your issue.

If they don’t resolve it in time, or if you’re not happy with their answer, you have the right to escalate. You can take your complaint straight to the RBI’s Ombudsman using its centralised Complaint Management System (CMS) portal, where it will get an impartial review.

At SpringVerify, we know that trust and compliance are the bedrock of any successful business. Our thorough background verification services help you build a team you can count on, letting you hire with confidence and security. Find out more about our fast, accurate screening solutions at https://in.springverify.com.