Bank KYC documents are the official papers—think your Aadhaar or PAN card—that banks use to confirm your identity and address. You can think of it as a formal introduction to your bank, proving you are who you say you are before you can open an account or use their financial services. This process isn’t optional; it’s a mandatory step to keep the whole financial system secure.

Table of Contents

What Are Bank KYC Documents Anyway?

At its heart, the KYC process is all about building trust between you and your bank. Before a financial institution can start looking after your money, it needs to be absolutely certain of who you are. This isn’t just some internal bank rule; it’s a critical security measure required by regulatory bodies like the Reserve Bank of India (RBI).

The whole point is to shut the door on illegal activities like money laundering, identity theft, and fraud. To do that, the entire process boils down to establishing two fundamental things about you.

The Two Core Pillars of KYC

Every single document a bank asks for is designed to satisfy one of two key purposes. Once you understand these categories, the entire KYC requirement list makes a lot more sense.

- Proof of Identity (POI): This confirms who you are. It’s about validating your name, photograph, and other personal details against an official, government-issued record.

- Proof of Address (POA): This confirms where you live. It verifies your current residential address, making sure the bank has a legitimate and physical way to contact you.

Some documents are particularly useful because they pull double duty. An Aadhaar card or a passport, for instance, can often serve as both POI and POA, which really simplifies the whole verification journey.

The KYC process is designed to protect banks from money laundering, terrorist financing, and other economic crimes. This mandatory process is integral to new client onboarding and extends throughout the entire client-bank relationship.

This dual requirement—proving who you are and where you live—forms the bedrock of every bank’s verification procedure. For anyone who wants to dig deeper into the bigger picture, it’s helpful to understand the general KYC principles and processes that shape these financial regulations.

Ultimately, when you provide these documents, you’re doing more than just ticking a box. You are actively participating in a system designed to protect your own finances and uphold the integrity of India’s entire banking sector.

The Essential Documents You Need for Bank KYC

Figuring out the paperwork for bank KYC can feel like trying to find the right key on a massive keyring. It seems confusing at first, but once you get the hang of how banks group these documents, it all starts to make sense.

At its core, every document a bank asks for is meant to confirm one of two things: who you are or where you live. Some handy documents can even do both. Think of it as building your financial identity. The bank needs a clear, verifiable picture of you before they can offer you their services. This isn’t just red tape; it’s the foundation of a secure banking relationship across India.

Proof of Identity (POI) Documents

Your Proof of Identity (POI) is how you officially tell the bank, “Yes, I am who I say I am.” These documents almost always have your full name and a photograph, making them a solid way to verify you.

Here are the most common POI documents banks ask for:

- PAN Card: This is pretty much non-negotiable for any major financial transaction in India.

- Aadhaar Card: With its unique number and biometric link, it’s a top choice for identity verification.

- Passport: As an internationally recognised document, it’s a very strong proof of who you are.

- Voter’s ID Card: Issued by the Election Commission of India, this is another widely accepted form of ID.

- Driving Licence: It has your photo and personal details, making it a valid POI.

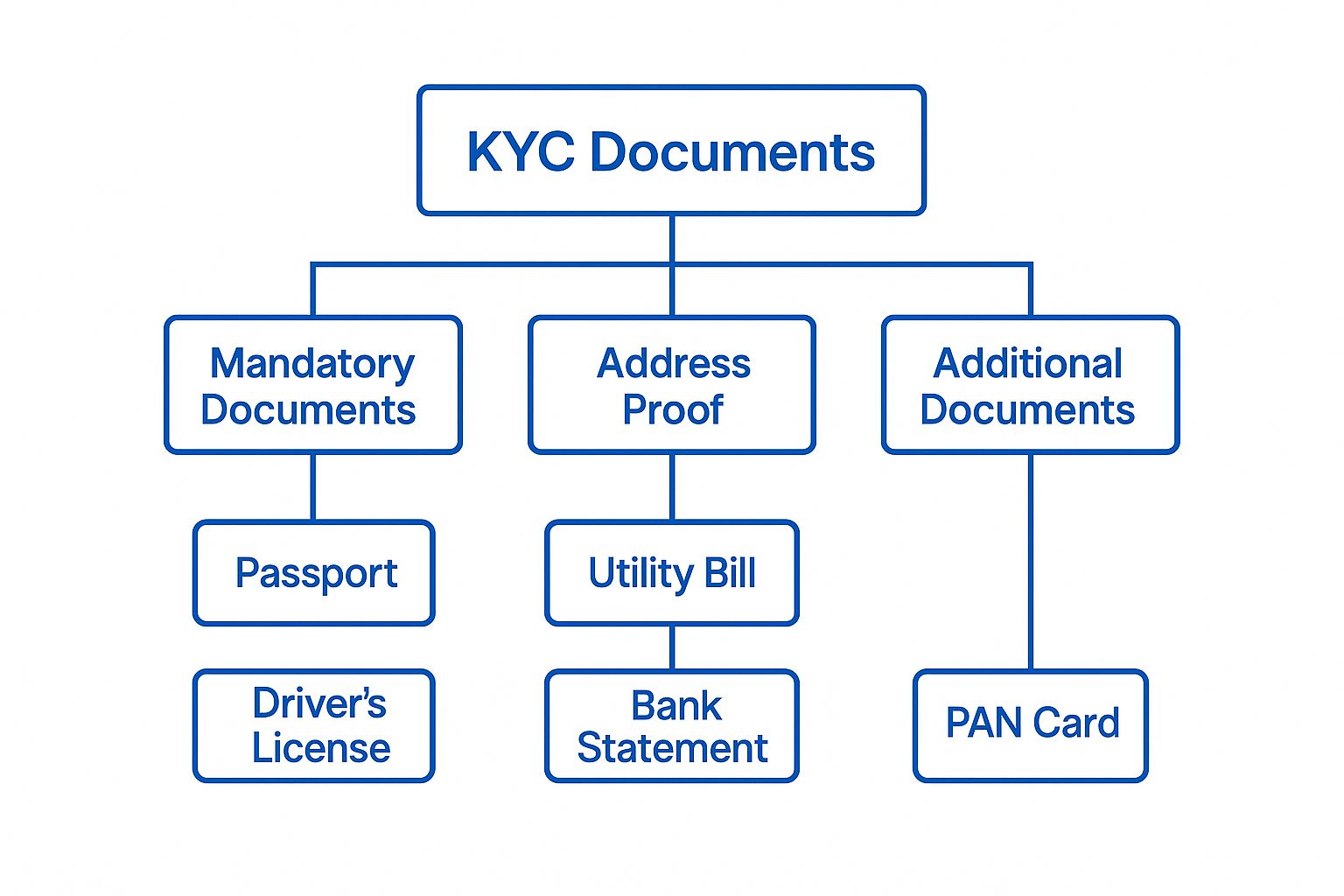

The infographic below breaks down how different documents fit into the KYC puzzle—some are mandatory, some prove your address, and others are supplementary.

This visual guide really helps clarify the specific roles that documents like your passport and utility bills play in the whole process.

Proof of Address (POA) Documents

While POI confirms who you are, your Proof of Address (POA) confirms where you live. It’s really important that the address on your POA document is current and exactly matches what you’ve told the bank. A simple mismatch here is one of the most common reasons KYC applications get held up. If this step seems tricky, understanding the official address verification process can save you a lot of hassle.

RBI mandates require banks to complete KYC verification before any account is activated. This is a crucial step to stop accounts from being used for illegal activities. These strict rules are clearly working—in 2022, it was reported that over 90% of Indian bank accounts were fully KYC-compliant.

Some of the key documents accepted as POA include:

- Aadhaar Card, Passport, or Voter’s ID (as long as they show your current address).

- Recent utility bills (like electricity, gas, or phone bills, but they can’t be more than two months old).

- The latest statement or passbook from another scheduled commercial bank.

- A property tax receipt or a registered rent agreement.

The need for a specific set of documents isn’t unique to India. For example, the list of documents required for opening a European bank account shows similar principles at play globally. Having all your core bank KYC documents ready to go will make your account opening experience much smoother.

Accepted KYC Documents for Indian Banks

To make things even clearer, here’s a quick-reference table that shows which documents are generally accepted by banks in India for both identity and address proof.

| Document Name | Accepted As POI | Accepted As POA | Key Considerations |

|---|---|---|---|

| Aadhaar Card | Yes | Yes | Must contain your current and correct address. |

| PAN Card | Yes | No | Primarily used for financial tracking, not address proof. |

| Passport | Yes | Yes | Address must be current; ensure it hasn’t expired. |

| Voter’s ID Card | Yes | Yes | The address listed must be your current residence. |

| Driving Licence | Yes | Yes | Only valid if the address is up-to-date. |

| Utility Bills | No | Yes | Must be recent (less than 2 months old) and in your name. |

| Bank Statement | No | Yes | Should be from another bank and show recent transactions. |

| Rent Agreement | No | Yes | Must be a registered agreement, not just an informal one. |

Having the right combination of these documents on hand before you start the application process can save you a ton of time and prevent any unnecessary delays.

How Digital KYC and CKYC Are Reshaping Banking

Gone are the days of carrying stacks of photocopied documents to the bank. The whole process is shifting to a much smarter, more secure method: Digital KYC. This lets you complete your identity verification from pretty much anywhere, using just your phone or computer.

Instead of someone manually checking your papers, banks now use tools like OTP-based Aadhaar verification and Video Customer Identification Process (V-CIP). This digital handshake is not only faster but also drastically cuts down the risk of document fraud, making the entire banking system more secure.

The Central KYC Registry (CKYCR): Verify Once, Use Everywhere

One of the biggest shifts in this area is the Central KYC Registry, or CKYCR. Think of it as a secure, centralised digital locker for your identity information, managed by the government. Once your KYC is done with one bank or financial institution, your verified details are safely stored in this central hub.

What does this mean for you? No more repeating the same tedious verification process every time you open a new account or invest in a mutual fund. When you complete your KYC, you get a unique 14-digit KYC Identification Number (KIN).

The KIN works like a master key. Just provide this number to any new bank or financial institution, and they can securely access your already verified bank KYC documents from the central registry. It’s a classic “do it once, use it everywhere” model.

This system saves a huge amount of time and effort for everyone involved—customers and banks alike. It also means all regulated companies are working from a single, verified source of truth, which boosts compliance and security across the board. If you want to dive deeper into how identity is verified securely, this guide on identity verification solutions offers some great insights.

The Real-World Impact of CKYC in India

The move to CKYCR isn’t a small one; it’s a massive overhaul of how financial data is managed in the country. As of 2025, India’s Central KYC Registry holds the records for over 103 crore (1.03 billion) individual customers. That number alone shows you the sheer scale of this initiative.

The Reserve Bank of India (RBI) is also keeping the pressure on, requiring banks to upload any customer data updates to the CKYCR within seven days. This keeps the registry fresh and reliable. You can read more about these CKYCR guidelines and their impact to get a better sense of the regulatory side.

So, what does this centralised system actually mean for the average person?

- Faster Onboarding: Opening an account used to take days. Now, it can often be done in minutes.

- Less Paperwork: You no longer need to carry multiple sets of physical documents for different services.

- Tighter Security: Centralised data is much better protected against identity theft and unauthorised access.

- More Convenience: It’s now easier to access a wider range of financial products without the usual friction.

Technologies like DigiLocker integration and OTP-based e-KYC are making this transition incredibly smooth. They allow you to share verified documents instantly with your consent, which is not just faster but also gives you more control over your personal information. It’s a fundamental change that’s truly improving the customer experience in Indian banking.

Why Your Bank Asks for Periodic KYC Updates

Just when you think you’ve ticked all the boxes, an email or SMS from your bank lands in your inbox asking you to update your KYC details. It’s easy to dismiss this as just another bit of administrative hassle, but it’s actually a crucial regulatory requirement designed to keep the financial system secure and your information up-to-date.

Think of your initial KYC submission as a snapshot in time. Life happens—you might move to a new city, change your phone number, or get a new passport. Periodic KYC updates ensure the bank’s records reflect your current reality, which is absolutely essential for managing risk and preventing fraud.

How Banks Assess Risk for Updates

You might notice that not everyone gets these update requests at the same time. That’s by design. The Reserve Bank of India (RBI) mandates that banks categorise customers based on their risk profile. This categorisation directly impacts how often you’ll need to refresh your bank KYC documents.

It’s a tiered system that works like this:

- Low-Risk Customers: These are typically individuals with stable financial profiles and predictable transaction histories. They are usually asked to update their KYC details once every 10 years.

- Medium-Risk Customers: This group might include people with more varied or complex financial activities. For them, a KYC update is required every 8 years.

- High-Risk Customers: This category often covers Politically Exposed Persons (PEPs) or individuals involved in high-value, complex financial dealings. They need to update their KYC far more frequently—once every 2 years.

This risk-based approach is smart. It allows banks to focus their compliance efforts where they’re needed most, keeping a closer eye on higher-risk accounts while making the process less of a burden for the average customer.

A periodic KYC update isn’t a one-and-done check; it’s an ongoing process. It ensures your bank always has the most accurate information, protecting both you and the institution from potential financial crimes. This continuous relationship helps maintain the integrity of the entire banking ecosystem.

Simplifying the KYC Updation Process

Thankfully, the RBI recognises that this can be a pain. They’ve introduced measures to make these periodic updates much smoother. For instance, if none of your details—like your address or identity information—have changed, you can now simply submit a self-declaration to the bank confirming this. In many cases, this can be done right from your phone through mobile banking, saving you a trip to the branch.

The process is getting even more accessible. Recent reforms announced by the Reserve Bank of India are set to make a big difference. The amendments from June 2025 allow banking correspondents—even local kirana shop owners acting as bank agents—to help customers complete their periodic KYC updates. You can learn more about how the RBI is empowering banking correspondents to streamline KYC and improve financial inclusion. These changes are making compliance more straightforward and convenient for everyone involved.

Common KYC Mistakes and How to Avoid Them

Submitting your bank KYC documents can feel pretty straightforward, but a few simple slip-ups can easily lead to frustrating delays. Let’s be honest, nobody wants their verification rejected. It almost always comes down to small, preventable errors.

Knowing what these pitfalls are ahead of time is half the battle. The goal is to get it right on the first try, because a rejected application means going back to square one, wasting both time and effort. Let’s walk through the most common mistakes people make and, more importantly, how to sidestep them.

Mismatched and Outdated Information

This is probably the number one reason for rejection: submitting documents where the information just doesn’t line up. When details are inconsistent or expired, it immediately raises a red flag for the bank and casts doubt on your identity.

- Expired Documents: This one’s a classic. Always check the validity date on your passport, driving licence, or any other ID with an expiry date. Handing over an expired document is an automatic fail.

- Name Mismatches: If you’ve changed your name, especially after marriage, this can trip you up. Imagine your PAN card has your maiden name but your Aadhaar has your married name—that’s a conflict. Every single document you submit must have the exact same name.

- Old Addresses: Just moved? Make sure your Proof of Address (POA) document actually shows your current residence. That old utility bill with your previous address simply won’t cut it.

Pro Tip: Before you even think about starting your application, physically lay out all your documents. Go through them one by one. Check that your name, date of birth, and address are identical across the board. If you spot a discrepancy, get it updated before you submit anything.

Poor Document Quality and Submission Errors

How your documents look matters just as much as what they say. Whether you’re submitting them online or in person, poor quality can make your documents unreadable and, therefore, useless. A blurry photo is no better than no photo at all.

- Blurry or Unclear Scans: Make sure any scanned copies or photos of your documents are sharp and well-lit. Avoid glare, and ensure all four corners of the document are clearly visible in the frame.

- Incorrect Document Type: Don’t submit a PAN card when the bank specifically asks for a Proof of Address. Pay close attention to whether they need a Proof of Identity (POI) or a Proof of Address (POA), as they serve different purposes.

- Ignoring Update Notifications: Banks will periodically send you reminders to update your KYC details. Ignoring these messages is a bad idea. It can lead to restrictions on your account or, in some cases, get it frozen entirely. Act on these notifications as soon as you get them.

By steering clear of these common blunders, you can ensure your bank KYC documents are processed without a hitch, saving you the headache of having to do it all over again.

KYC Rules for Minors, NRIs, and Senior Citizens

The standard KYC process works beautifully for the average customer, but it’s not a one-size-fits-all solution. Life isn’t that simple. To account for different life stages and circumstances, there are specific rules for minors, Non-Resident Indians (NRIs), and senior citizens. Knowing these differences is key to a hassle-free verification for everyone.

Think about opening an account for a child. Since a minor can’t legally sign a contract, the account has to be opened and managed by a parent or legal guardian. This means the guardian goes through their own full KYC process first, submitting their identity and address proofs.

Then, the minor’s identity proof, like a birth certificate or Aadhaar card, is collected to officially link them to the account. This two-step approach keeps the account secure while letting families plan for their child’s financial future.

Documentation for NRIs

Non-Resident Indians play by a slightly different set of rules. While they still need to provide proof of identity and address, their international status means the documents themselves are different. For an NRI, a valid passport is the non-negotiable, primary identity document.

For proof of address, banks will need to see documents connected to their foreign residence. A valid visa or work permit is crucial here, as it confirms their legal right to be in another country. It’s also incredibly important that all documents are properly attested. If you’re navigating this, getting familiar with the ins and outs of passport verification can be a huge help.

Relaxations for Senior Citizens

The RBI recognises that senior citizens can sometimes struggle to produce standard documents. To make banking more accessible, they’ve introduced a few relaxations. If a senior citizen doesn’t have a valid Officially Valid Document (OVD), they can often provide a self-certified document that declares their identity and address, accompanied by a recent photograph.

For joint accounts, the KYC process is required for all account holders, not just the primary one. Each individual on the account must submit their own set of bank KYC documents to be fully compliant.

This small change makes a big difference. Additionally, for low-risk customers over 60 years old who just need to update their KYC details, banks might accept a simple self-declaration of their address. This takes a lot of the headache out of the periodic update process. These tailored rules ensure that financial services are truly for everyone, regardless of age or location.

Frequently Asked Questions About Bank KYC

Let’s be honest, navigating the world of bank KYC can bring up a lot of questions. To help you stay informed and keep your accounts running smoothly, here are some clear, straightforward answers to the queries we hear most often.

What Happens if I Neglect My KYC Update?

Ignoring a request to complete or update your KYC is a mistake you don’t want to make. At first, your bank will send you a few reminders, but if you disregard them, they are legally required to put partial restrictions on your account.

This could mean you’re blocked from making certain transactions. If your KYC remains incomplete for too long, the bank might have to temporarily freeze your account altogether, stopping all debits until you get it sorted.

Can I Complete the Entire KYC Process Online?

Yes, absolutely. Thanks to the Video-based Customer Identification Process (V-CIP), you can now get your entire KYC done right from the comfort of your home. The process involves a live video call with a bank official who verifies your PAN card and captures your photograph and location in real-time.

This digital method is just as valid as showing up in person. It’s a secure, RBI-approved alternative that saves a ton of time and makes the whole process much more convenient for everyone involved.

How Often Must I Update My KYC Documents?

This really depends on the risk profile your bank has assigned to you. It’s not a one-size-fits-all situation.

- High-Risk Customers: You’ll need to update your KYC every two years.

- Medium-Risk Customers: The requirement is once every eight years.

- Low-Risk Customers: You only need to provide updates every ten years.

And if none of your personal details have changed? It’s even simpler. You can just submit a self-declaration confirming your information is still current. Most banks let you do this right through their app or website, keeping your records accurate with minimal fuss.

Hiring should be simple and secure. With SpringVerify, you can streamline your background verification with instant KYC checks on WhatsApp, ensuring your team grows with trusted individuals. Get started at https://in.springverify.com.